- We think QE will be extended through the first quarter of 2013 and the size of the purchase program is likely to be brought to $85 billion a month as Operation Twist comes to an end.

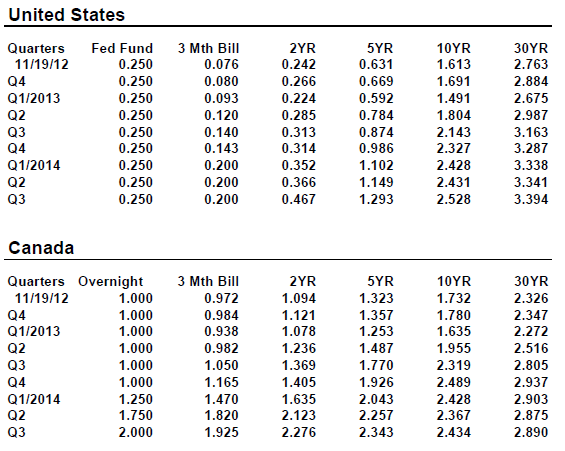

- With economic growth and political developments unfolding largely in line with our projections for both the U.S. and Canada, we are once more sticking with our previous interest-rate forecast. We are adding to our provincial exposure.

Unconventional policies: How far should the Fed go?

Before February 1994 the FOMC did not explicitly announce changes to its policy stance, although its view of the future path of its target rate was put to a vote by FOMC members as early as 1983. Even after 1994, the movement toward full and timely disclosure of policy decisions was gradual.

The FOMC at first issued a press release only if there was a significant change in the policy stance, and even then the policy changes were described vaguely with no target rate specified. In the release of March 1994, for example: … Chairman Alan Greenspan announced today that the Federal Open Market Committee decided to increase slightly the degree of pressure on reserve positions. This action is expected to be associated with a small increase in short-term money market interest rates …

Another milestone in Fed communication came in the press release of May 1999, the first to include some rate guidance in the form of a policy bias. It said:

The Committee was concerned about the potential for a build up of inflationary imbalances that could undermine the favorable performance of the economy and therefore adopted a directive that tilted toward the possibility of a firming in the stance of monetary policy.

From the 39 words of the March 1994 press release to the 548 words of October 2012, the FOMC effort to shape expectations through its communications has evolved quite significantly. Not only has the press release become longer but what was initially a vague policy bias has evolved to much more specific forward guidance. In the October 2012 statement the FOMC:

… currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

The theoretical literature on central bank transparency and the use of forward guidance dates from well before the 2007 financial crisis. Thus some potential avenues had already been explored before the current episode, in which the Fed, having pushed its policy rate to the zero lower bound, has had to turn to less traditional policy instruments.

To Read the Entire Report Please Click on the pdf File Below.