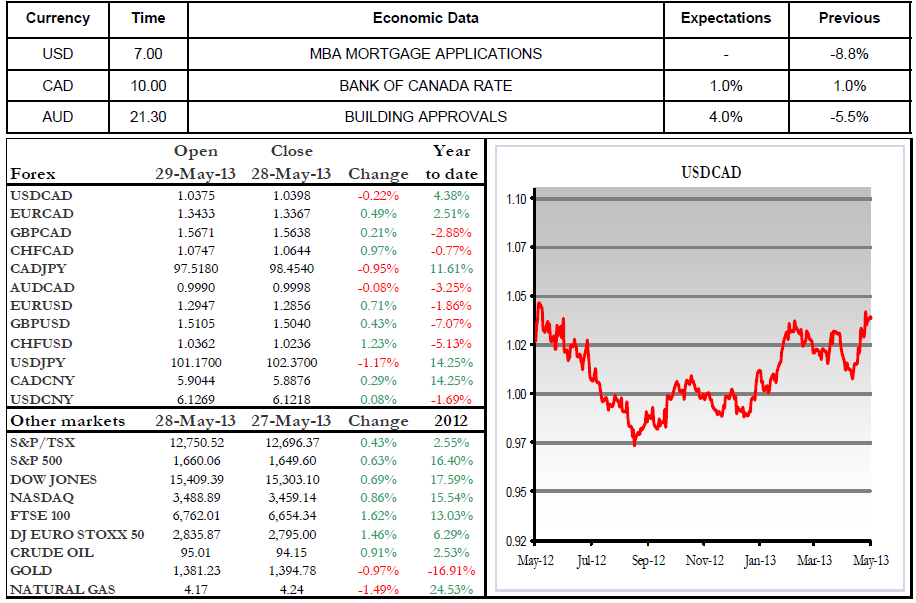

Currency markets saw renewed activity yesterday. Take for example the EUR/USD pairing, which fluctuated by some 100 points in favour of the greenback over the course of the day, only to then correct by as much overnight. The loonie has not been spared from the wave of support bolstering the U.S. dollar, with the USD/CAD pairing reaching levels not seen since June 2012. It's not just FX markets that have returned with a vengeance from the long weekend south of the border, the S&P500 opened the day up sharply and eventually closed with a 0.65% gain. Meanwhile gold lost close to 1%. In a word, the current order of things appears to be called into question.

This morning, the Bank of Canada will be announcing its decision regarding the country's key rate. Although the market expects the rate to remain unchanged at 1.00%, this will still be an important press conference, as it will mark the Bank's last official communication with Mark Carney at the helm. Given the heightened volatility in recent days, we are keeping a watchful eye on the statement that will accompany the BoC's decision. Most analysts expect Mr. Carney to stay the course before turning over the controls to his successor, Stephen Poloz. However, Carney may be tempted to tweak the wording of the statement to give more leeway to Mr. Poloz and leave his mark one last time on Canadian monetary policy. No doubt a situation that will be watched with great interest today. Wishing you a great day! Xavier Villemaire

Range of the day: 1.0325 - 1.0425

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NBC Daily Forex : May 29, 2013

Published 05/29/2013, 04:03 AM

Updated 05/14/2017, 06:45 AM

NBC Daily Forex : May 29, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.