Street Calls of the Week

Yesterday, the Reserve Bank of New Zealand increased its key rate by 0.25% to 2.75%. New Zealand is the first developed nation to increase its rate since international banks have been offering record borrowing rates. The New Zealand dollar, also known as the kiwi, jumped nearly 1% against the greenback in reaction to the news.

In full electoral campaign mode, Quebec Premier Pauline Marois announced that her province would be keeping the loonie as its currency in the event that the province votes to separate. She compares a sovereign Quebec’s use of the Canadian currency to the eurozone countries’ use of the euro. She added that the Bank of Canada would remain responsible for monetary policy. A great deal will need to happen before this becomes a reality. Nonetheless, we can be reassured regarding our FX strategies.

Chinese securities closed up by 1% last night, due to the fact that regulators will now allow this country’s companies to issue preferred shares for the first time in history.

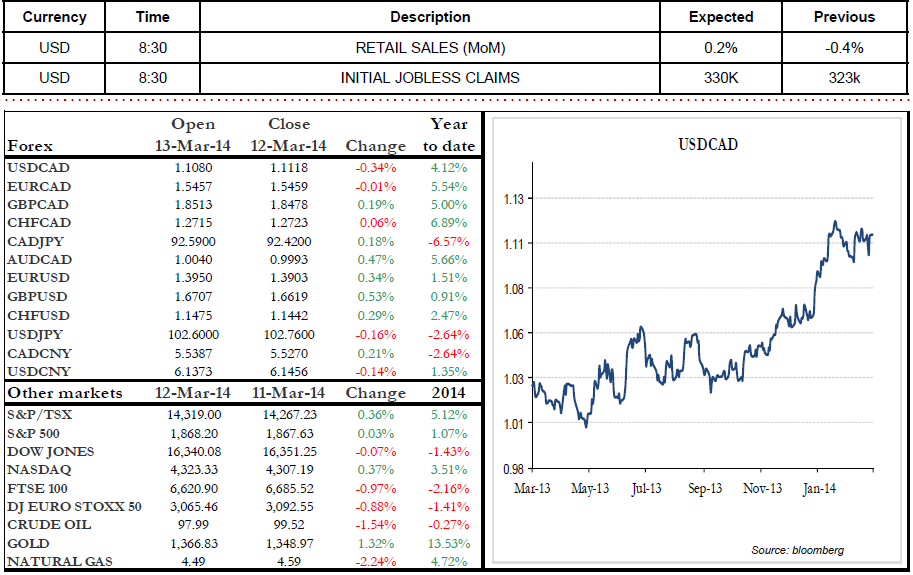

Canada’s New Housing Price Index figures will be released today. South of the border, we are expecting Retail Sales, Initial Jobless Claims and Import Price Index data.