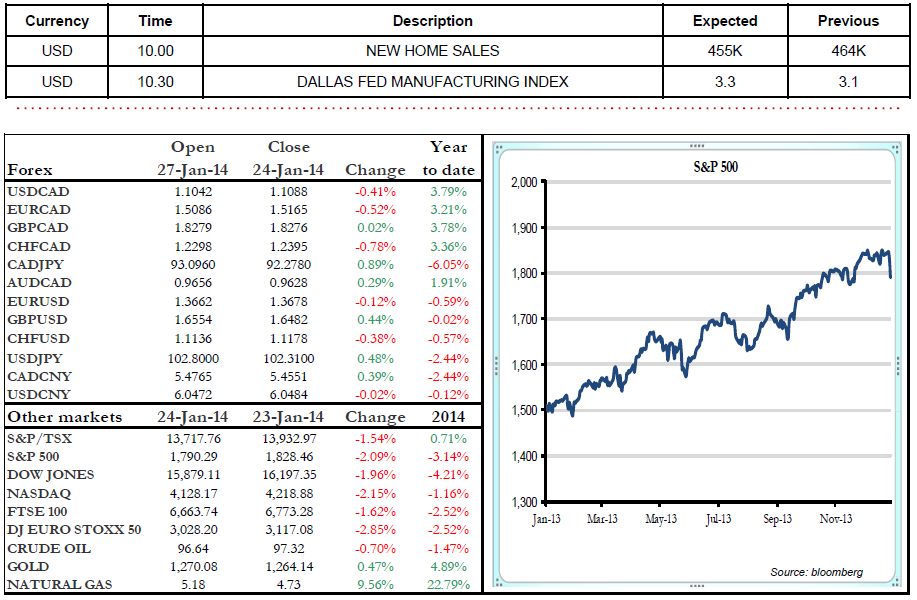

The rough start to 2014 for emerging market equities and currencies continues this morning. The MSCI Emerging Markets Index is down 1.6% at this time, bringing its year-to-date slump to -6.8%. The same story holds true on the currency front; the Argentine peso, the Turkish lira and a range of other currencies have suffered dramatic setbacks against the greenback. The main causes for these developments are reduced economic activity due to slower Chinese growth, and diminished liquidity on markets resulting from the tapering of the Federal Reserve’s quantitative easing program, which will be addressed at the FOMC meeting on January 28 and 29. The FOMC’s post-meeting statement will be closely monitored when it is released on Wednesday afternoon.

This morning, U.S. New Home Sales figures for December will be released. Markets anticipate a slight dip: from 464,000 in November to 455,000 in December. Given Friday’s 2.1% drop in the S&P 500, a nasty surprise could throw a monkey wrench into a market that already does not appear to be firing on all cylinders. Have a great Monday! Xavier Villemaire

Range of the day: 1.1020-1.1140