Investing.com’s stocks of the week

The ECB just announced that it is keeping its key rate unchanged at 0.25%, a decision justified by gradually improving economic conditions. However, ECB President Mario Draghi remains concerned about the 0.7% inflation rate. The euro lost ground against the greenback further to the news. Earlier this morning, the Bank of England announced that it was also keeping its key rate unchanged at 0.5%. Since its lowest level on July 10, the GBP is up by 10% against the U.S. dollar.

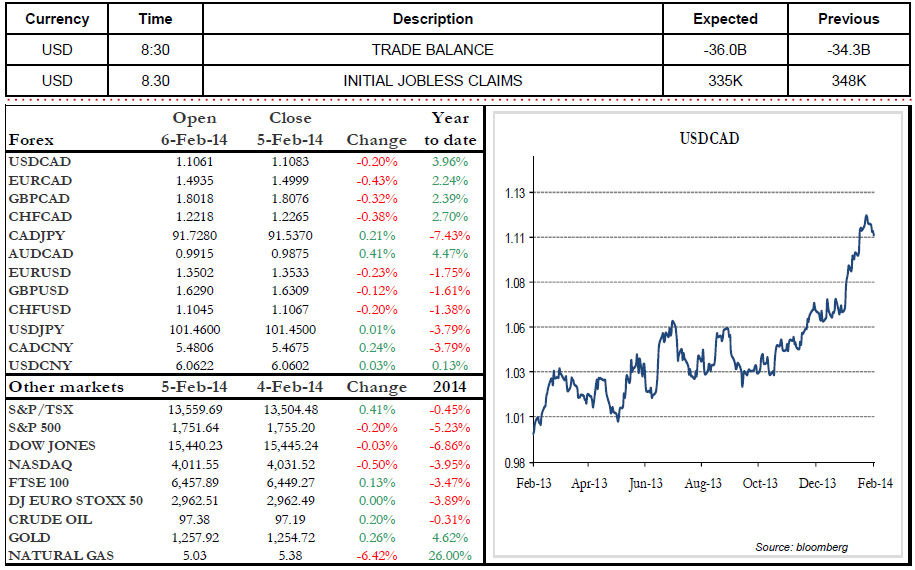

As stated by Stéfane Marion, our Chief Economist and Strategist, in the Forex February review, the Fed ending cash injections is having a significant impact on emerging economies, which represent over 50% of the international GDP. Though the central bank is staying the course with regard to its quantitative easing program, it will need to be more cautious in its actions and comments to avoid making the situation worse. Stéfane Marion is forecasting that the loonie will stabilize near current levels.

Markets are awaiting Friday’s employment figures. Numbers below analyst forecasts for a second month in a row could hardly be interpreted as a market anomaly, and would point instead to difficult times for the remainder of 2014. In economic news, we are keeping an eye on Balance of Trade and Initial Jobless Claims data expected today.