Thursday was much calmer on financial markets than the previous day, when the Fed made headlines around the world. Nevertheless, some economic indicators of note were released yesterday south of the border. Existing Home Sales and the CB Leading Indicator both came in close to analysts’ expectations. Initial Jobless Claims for last week were disappointing, with a reading of 379,000 or 43,000 more than expected.

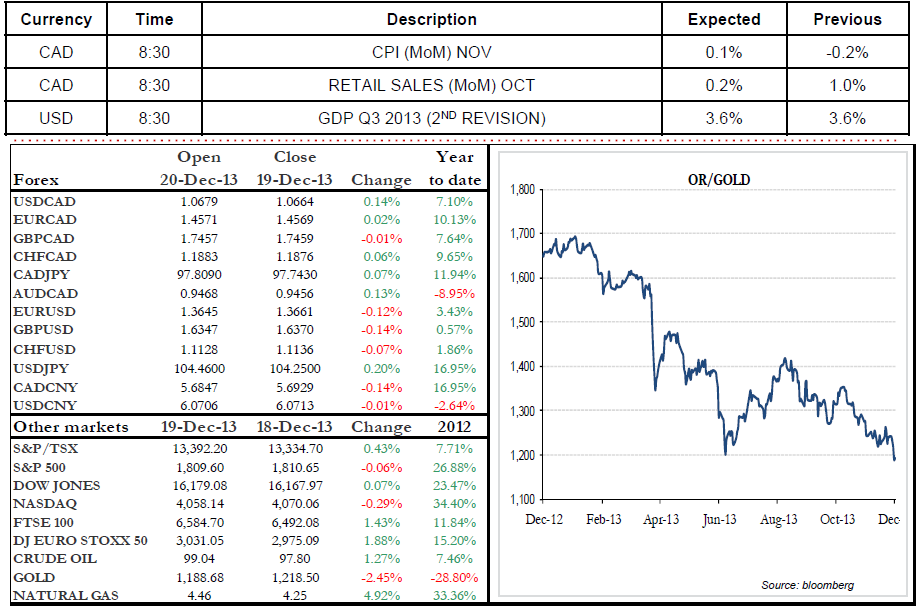

Investors appear to be moving away from gold, which fell to $1,188, its lowest level since 2010, and resulting in an annual return of -29%, the worst since 1981. Goldman Sachs also announced that it did not believe the correction on gold was over yet. The main reason for the recent drop is anticipation surrounding the Fed’s tapering of bond purchases, which is spurring interest in the greenback and leading investors to shun gold.

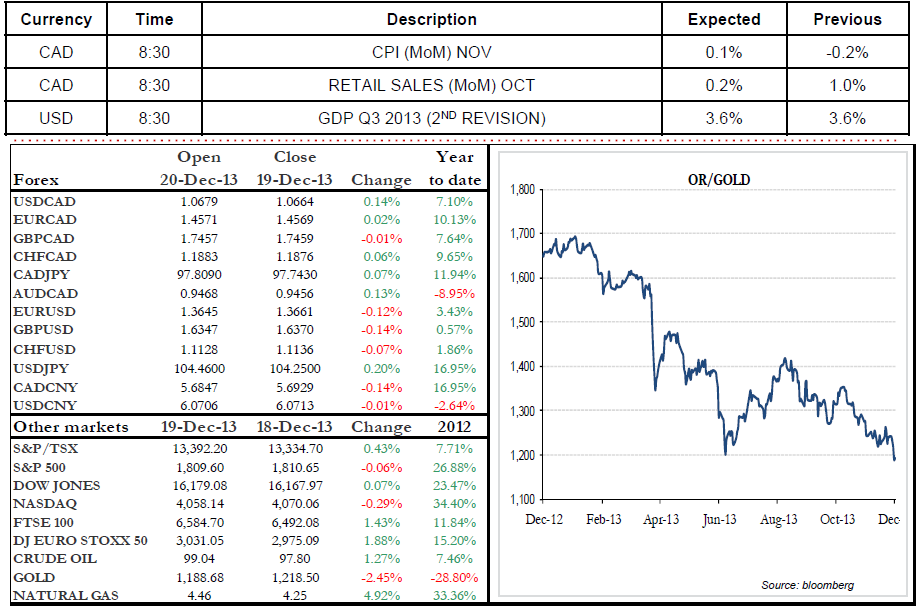

We wrap up the week with inflation figures and Canadian Retail Sales, as well as the final revision of U.S. third quarter GDP. Happy Holidays! Philippe Shebib

Range of the day: 1.0650-1.0740

Investors appear to be moving away from gold, which fell to $1,188, its lowest level since 2010, and resulting in an annual return of -29%, the worst since 1981. Goldman Sachs also announced that it did not believe the correction on gold was over yet. The main reason for the recent drop is anticipation surrounding the Fed’s tapering of bond purchases, which is spurring interest in the greenback and leading investors to shun gold.

We wrap up the week with inflation figures and Canadian Retail Sales, as well as the final revision of U.S. third quarter GDP. Happy Holidays! Philippe Shebib

Range of the day: 1.0650-1.0740