Investing.com’s stocks of the week

We were expecting some major news yesterday and we were not disappointed! The Fed announced that it would start tapering its bond purchases starting in January. It will decrease its Treasury and agency mortgage-backed securities purchases by $5 billion each. Bond purchases will be trimmed to $75 billion next month. The FOMC also indicated that it intends to continue withdrawing support as the employment sector bounces back and consumer prices continue to improve. The Federal Reserve also stated that it would be appropriate to maintain the key interest rate at 0.25% even if the unemployment rate drops below 6.5%, and particularly if inflation stays below the target rate.

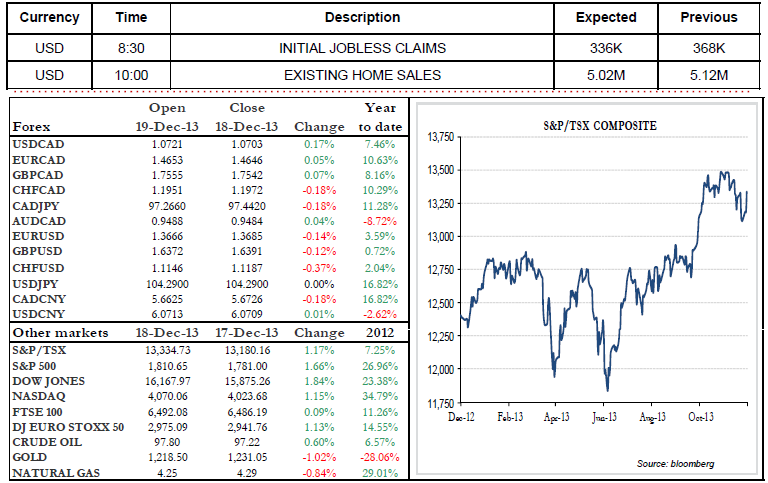

It took a few long minutes for the market to absorb the news. The reaction was definitely impressive! The S&P 500, the bellwether index in the U.S., jumped further to the news and closed the session up by nearly 2%. Could this news be the flame that will ignite the Santa Claus Rally?

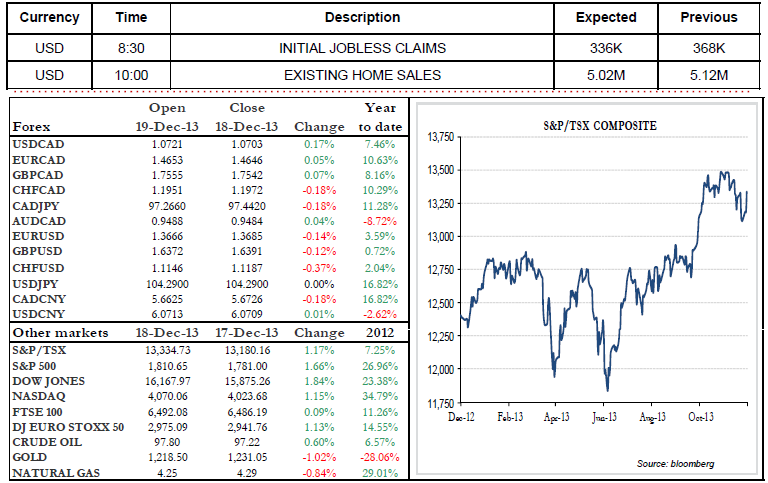

On the currency markets, the FOMC statement resulted in the greenback being up against most of its peers. The DXY, the U.S. dollar index, closed the session up by more than 0.5%.

We are keeping an eye on economic indicators that will be released south of the border today: Initial Jobless Claims and Existing Home Sales. Have a great day! Philippe Shebib

Range of the day: 1.0680-1.0770

It took a few long minutes for the market to absorb the news. The reaction was definitely impressive! The S&P 500, the bellwether index in the U.S., jumped further to the news and closed the session up by nearly 2%. Could this news be the flame that will ignite the Santa Claus Rally?

On the currency markets, the FOMC statement resulted in the greenback being up against most of its peers. The DXY, the U.S. dollar index, closed the session up by more than 0.5%.

We are keeping an eye on economic indicators that will be released south of the border today: Initial Jobless Claims and Existing Home Sales. Have a great day! Philippe Shebib

Range of the day: 1.0680-1.0770