An event-filled fall is on the way with several key events worth monitoring in the coming weeks. The possible tapering in Fed bond buybacks, German elections and turmoil in emerging nations could serve as a pretext for profit-taking.

We will be keeping a close eye on emerging nations again this week, as the Indian rupee drops again versus the greenback. The current situation calls to mind the Asian crisis that began in 1997 in Thailand, and then spread across the region. India appears to be in the toughest bind, with the rupee trading at historic lows. Rating agencies are discussing a downgrade, although they've also pointed out that the situation is less risky than in 1997.

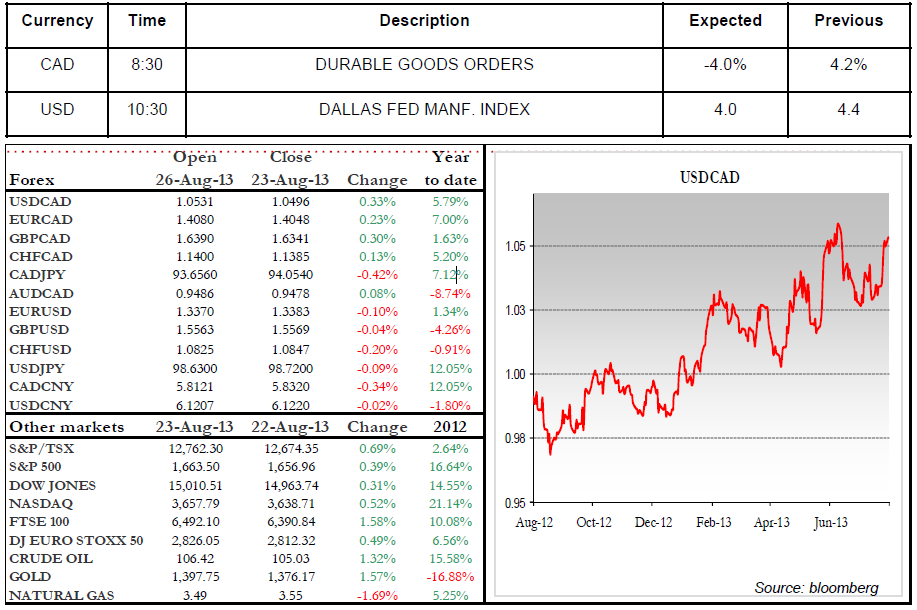

On the economic front, we will be watching for the release of Durable Goods Orders and the Dallas Fed Manufacturing Business Index. At press time, the Canadian dollar is down slightly and bond yields have remained stable compared to their levels at Friday's closing bell. Wishing you a great day! Emmanuel Tessier-Fleury

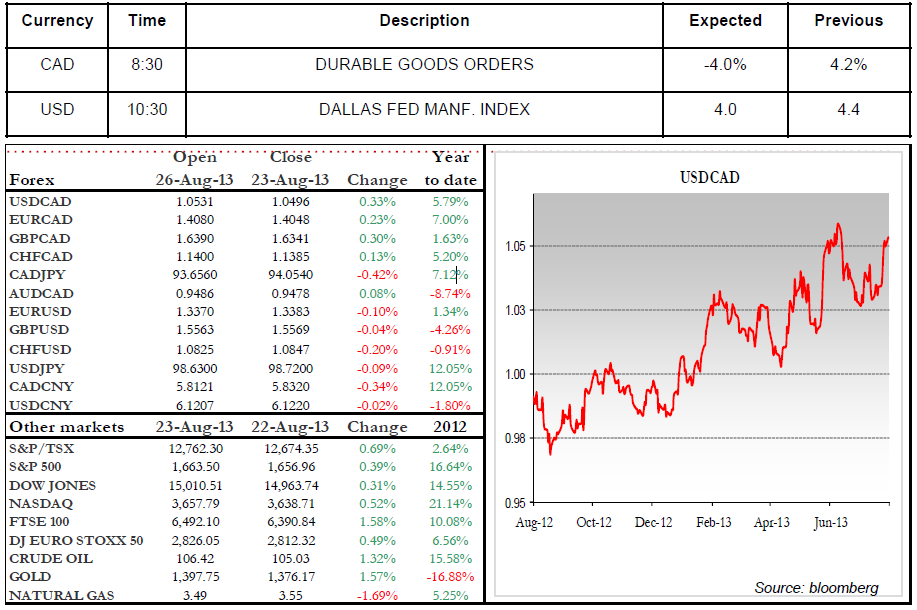

Range of the day: 1.0510-1.0625

We will be keeping a close eye on emerging nations again this week, as the Indian rupee drops again versus the greenback. The current situation calls to mind the Asian crisis that began in 1997 in Thailand, and then spread across the region. India appears to be in the toughest bind, with the rupee trading at historic lows. Rating agencies are discussing a downgrade, although they've also pointed out that the situation is less risky than in 1997.

On the economic front, we will be watching for the release of Durable Goods Orders and the Dallas Fed Manufacturing Business Index. At press time, the Canadian dollar is down slightly and bond yields have remained stable compared to their levels at Friday's closing bell. Wishing you a great day! Emmanuel Tessier-Fleury

Range of the day: 1.0510-1.0625