The FOMC Meeting Minutes published yesterday weighed heavily on stock markets, the Canadian loonie and bond valuations, as many committee members suggested that the pace of bond purchases would be slowed by year end. Additional comments from several Fed members are also expected today, within the framework of the Fed’s annual summer retreat at Jackson Hole, Wyoming.

Meanwhile, the situation of emerging markets remains worrisome, as investment funds are withdrawing capital at an alarming pace! During the last week, data released by Morgan Stanley showed that more than $750 million had been pulled out of emerging market funds. These outflows have a considerable impact on the currencies of said countries (in the last three months, the currencies of Brazil, India and Indonesia have fallen 17%, 13% and 9% respectively), and are very difficult to manage for many countries, who are forced to use last-ditch measures such as raising their key rate or limiting corporate and individual outflows.

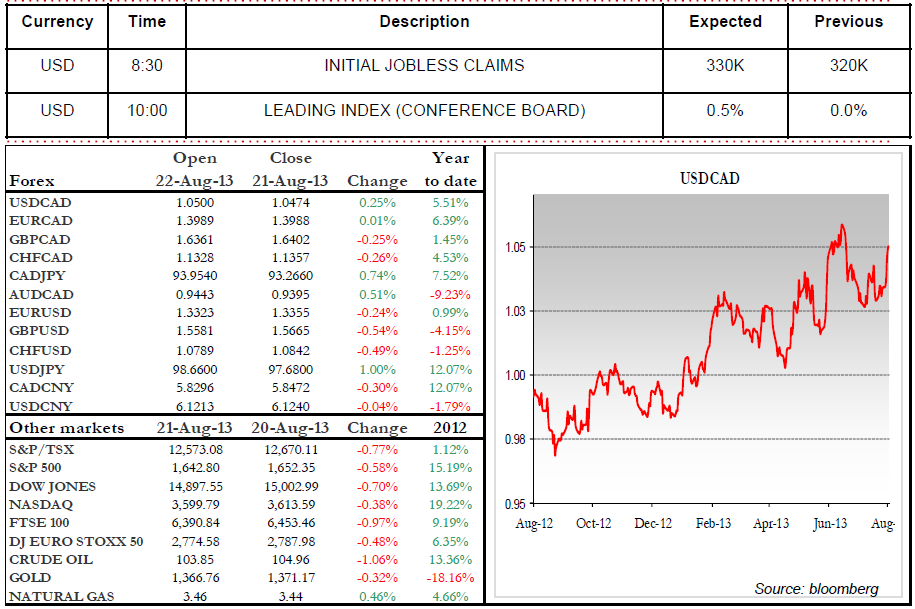

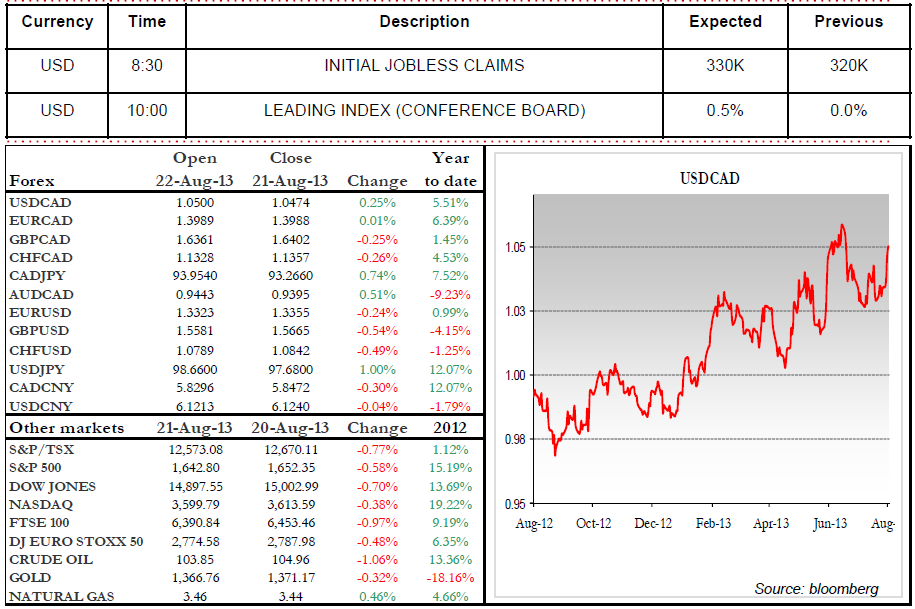

Today’s economic news includes Initial Jobless Claims, as well as the Conference Board Leading Indicator at 10 a.m. The loonie continues its downward glide, while HSBC China Manufacturing data are boosting stocks and punishing bonds. Wishing you a great day! Emmanuel Tessier-Fleury

Range of the day: 1.0455 – 1.0540

Meanwhile, the situation of emerging markets remains worrisome, as investment funds are withdrawing capital at an alarming pace! During the last week, data released by Morgan Stanley showed that more than $750 million had been pulled out of emerging market funds. These outflows have a considerable impact on the currencies of said countries (in the last three months, the currencies of Brazil, India and Indonesia have fallen 17%, 13% and 9% respectively), and are very difficult to manage for many countries, who are forced to use last-ditch measures such as raising their key rate or limiting corporate and individual outflows.

Today’s economic news includes Initial Jobless Claims, as well as the Conference Board Leading Indicator at 10 a.m. The loonie continues its downward glide, while HSBC China Manufacturing data are boosting stocks and punishing bonds. Wishing you a great day! Emmanuel Tessier-Fleury

Range of the day: 1.0455 – 1.0540