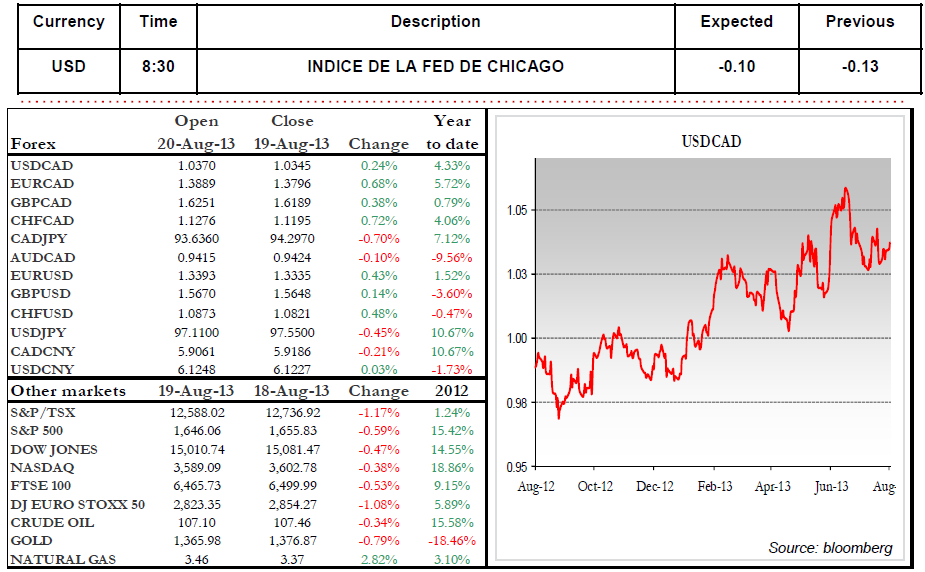

Fears that interest rate hikes could affect the recovery weighed heavily on U.S. stock markets yesterday, as they lost ground for a fourth consecutive session. Despite this losing streak, U.S. equities have generated an excellent performance since the beginning of the year, with substantial gains being recorded for the S&P500 and the DJIA.

While the initial reaction will be negative due to the possibility of diminished bond buybacks by the Fed, this is unlikely to prove a concern in reality and Chairman Ben Bernanke will also hold steady on the Fed's highly accommodating monetary policy. The context therefore remains favourable for financial markets.

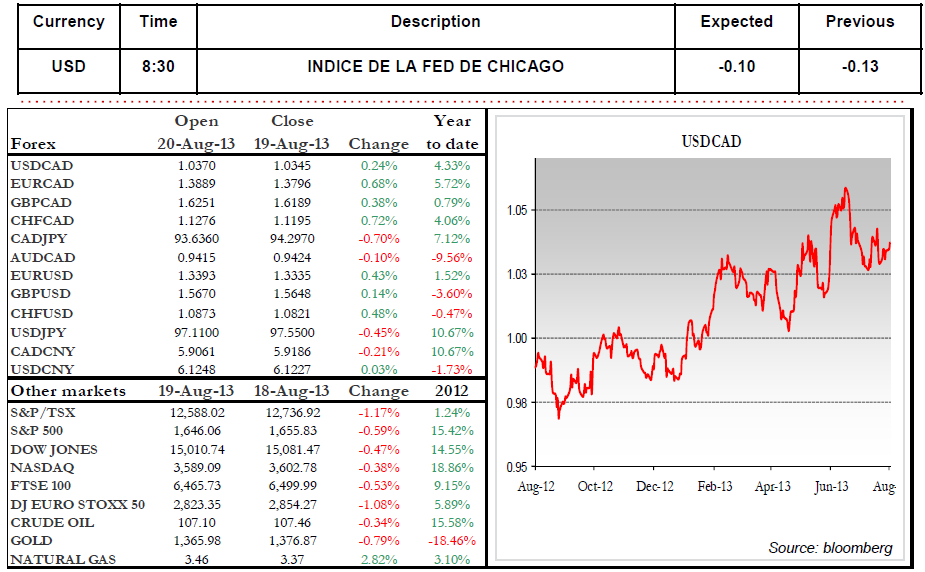

Corporate earnings from some major American retailers will be announced today and will serve as a good bellwether of how U.S. households are faring. Until the FOMC minutes are released tomorrow, the trend remains bearish for stocks and commodities, with the loonie losing ground against the greenback. Asian and European stock markets are also down today. Wishing you a great day! Emmanuel Tessier-Fleury

Range of the day: 1.0325 -1.0415

While the initial reaction will be negative due to the possibility of diminished bond buybacks by the Fed, this is unlikely to prove a concern in reality and Chairman Ben Bernanke will also hold steady on the Fed's highly accommodating monetary policy. The context therefore remains favourable for financial markets.

Corporate earnings from some major American retailers will be announced today and will serve as a good bellwether of how U.S. households are faring. Until the FOMC minutes are released tomorrow, the trend remains bearish for stocks and commodities, with the loonie losing ground against the greenback. Asian and European stock markets are also down today. Wishing you a great day! Emmanuel Tessier-Fleury

Range of the day: 1.0325 -1.0415