The Canadian smart phone manufacturer BlackBerry, formerly known as RIM, has hired advisors to evaluate its strategic options. Several analysts are forecasting the sale of the company to a private firm, which would mean it would no longer be listed on stock markets. Some believe that Microsoft would be interested in what once was a Canadian technological crown jewel, while other anticipate that Fairfax Financial, which already owns 10% of the company would be in a good position to privatize the company. BlackBerry stock, which has traded as high as $140 a share, is currently trading around $10. A sale to foreign interests could have repercussions on the Canadian currency.

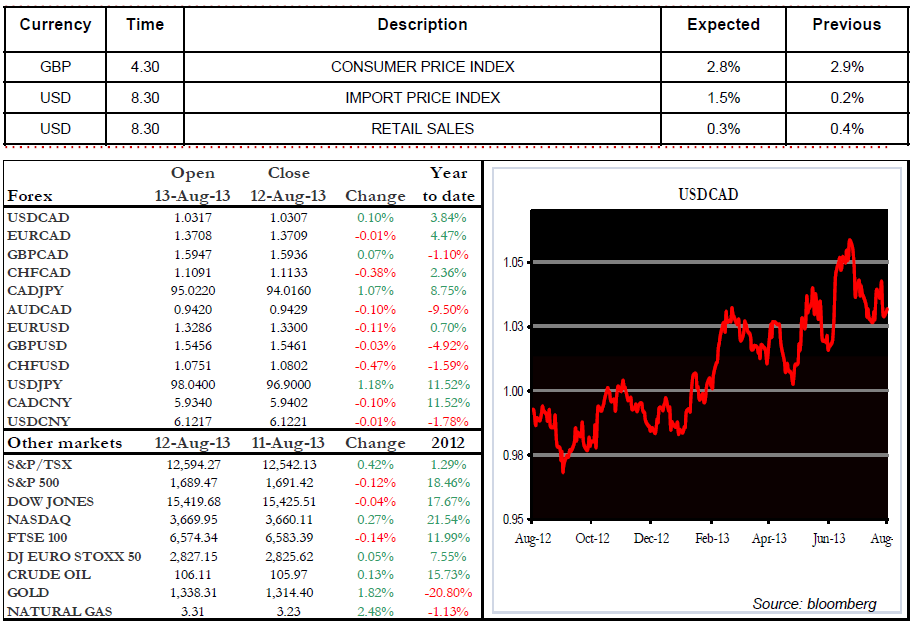

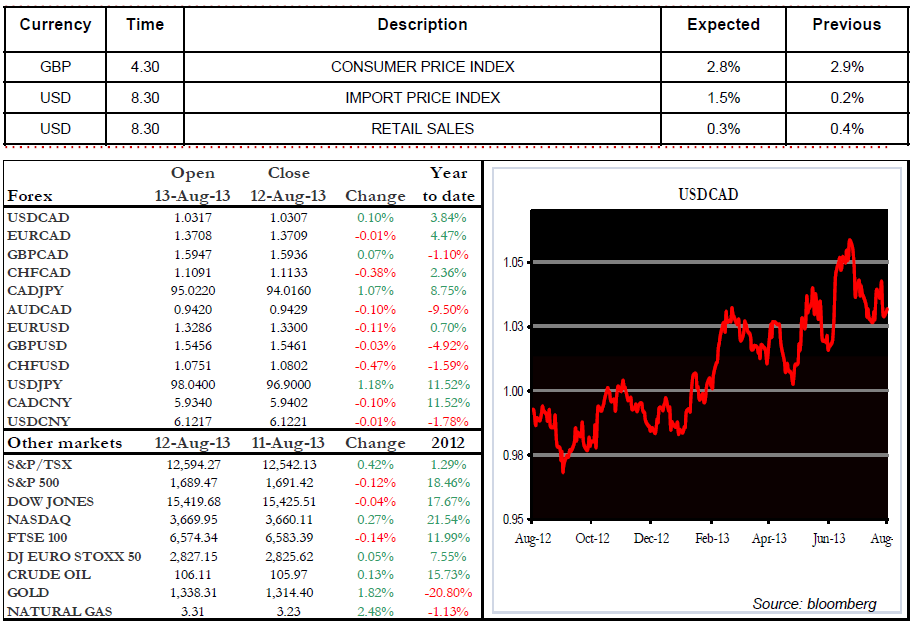

U.S. Retail Sales figures for July are expected at 8:30 this morning. Markets are anticipating them to be up 0.3 %, compared to the 0.4% increase in June. This index is closely followed by analysts, because it is an indicator of American consumer behaviour on which a significant portion of the U.S. economy depends. Higher-than-expected figures would be bad news for the CAD, which would lose a few points against the greenback, in turn carried by expectations that the Fed will be tightening its monetary policy imminently. Have a great Tuesday! Xavier Villemaire

Range of the day: 1.0280-1.0380

U.S. Retail Sales figures for July are expected at 8:30 this morning. Markets are anticipating them to be up 0.3 %, compared to the 0.4% increase in June. This index is closely followed by analysts, because it is an indicator of American consumer behaviour on which a significant portion of the U.S. economy depends. Higher-than-expected figures would be bad news for the CAD, which would lose a few points against the greenback, in turn carried by expectations that the Fed will be tightening its monetary policy imminently. Have a great Tuesday! Xavier Villemaire

Range of the day: 1.0280-1.0380