The China Balance of Trade figures released overnight greatly surpassed economists’ expectations. Exports for July (YoY) were 5.1% compared to the 2% forecast, while imports reached 10.9% versus the expected 1%. The Australian dollar, which had been down during the Asian session because of the country’s low employment figures (-10,000 jobs compared to +5,000 jobs that had been forecast), benefited from the apparent stabilization of the world’s second largest economy to return to positive territory.

The Bank of Japan announced that it was maintaining its monetary policy a few hours ago. The yen is up slightly.

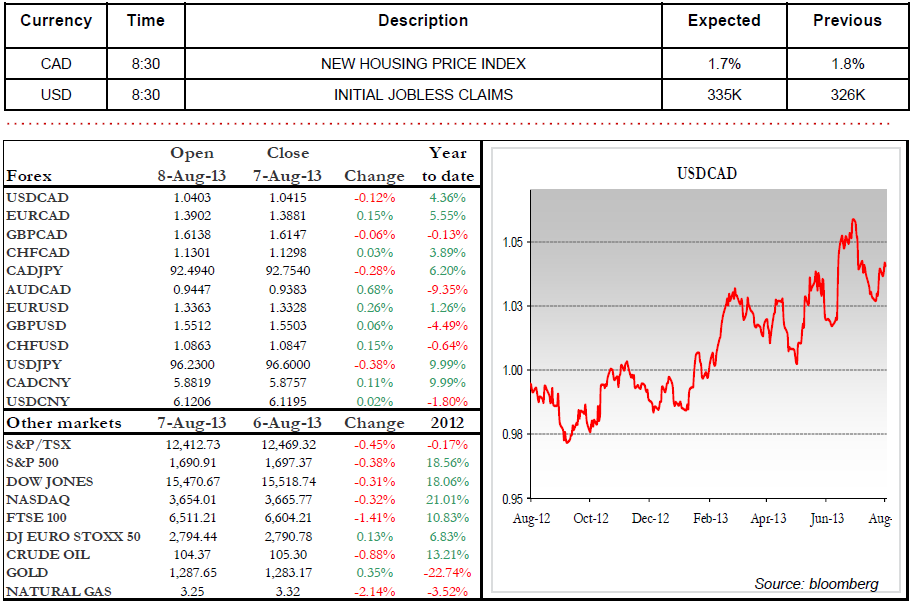

Meanwhile, the USD/CAD pairing remains very stable, having fluctuated within a narrow range of 30 points. The most significant day this week for this pairing will be tomorrow, with the release of Canada’s employment data. With the low volume of transactions observed in the market, any figure not in line with the expectation of 10,000 jobs created could result in exaggerated movements.

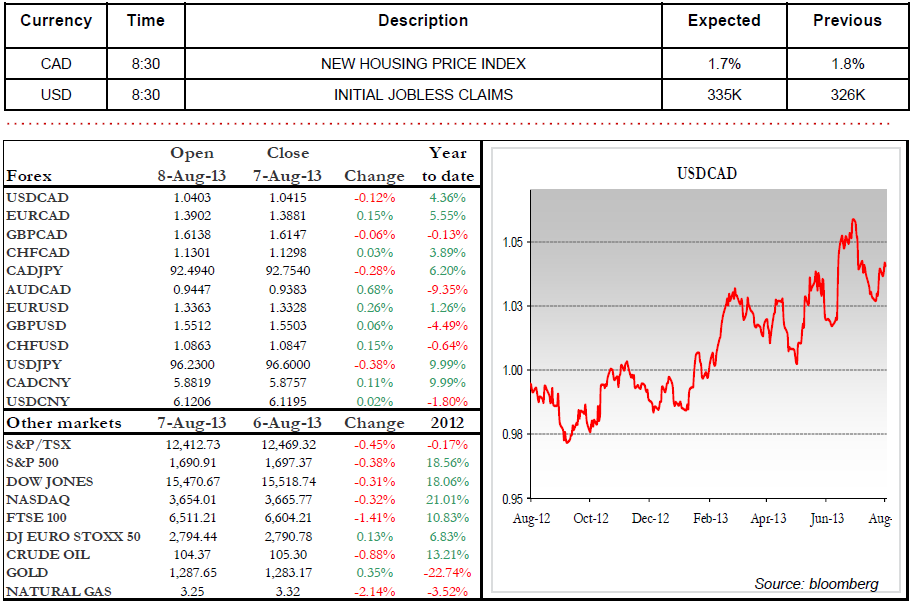

In the meantime, we are watching for Canadian Housing Starts and U.S. Initial Jobless Claims data. Wishing you a great day! Gardy Pharel

Range of the day: 1.0370-1.0445

The Bank of Japan announced that it was maintaining its monetary policy a few hours ago. The yen is up slightly.

Meanwhile, the USD/CAD pairing remains very stable, having fluctuated within a narrow range of 30 points. The most significant day this week for this pairing will be tomorrow, with the release of Canada’s employment data. With the low volume of transactions observed in the market, any figure not in line with the expectation of 10,000 jobs created could result in exaggerated movements.

In the meantime, we are watching for Canadian Housing Starts and U.S. Initial Jobless Claims data. Wishing you a great day! Gardy Pharel

Range of the day: 1.0370-1.0445