Wednesday was an action-packed day in Canada, with the Montreal Canadiens winning their first playoff game, and Governor Stephen Poloz releasing the Bank of Canada’s Monetary Policy Report. It came as no surprise that the BoC is maintaining its key rate at 1%. The report notes that “the fundamental determinants of growth and inflation continue to strengthen gradually in Canada.” According to Mr. Poloz, “the timing and direction of any change in monetary policy will depend on how new information influences the balance of risks.” The report states that the BoC will remain neutral with regard to its next rate change. The loonie immediately lost nearly 0.4% in reaction to the Bank’s announcement.

Fed Chair Janet Yellen gave a speech before the Economic Club of New York yesterday. She stated that the inflation and unemployment rates remain too far off their objectives for the Fed to raise its key rate. The U.S. unemployment rate is currently at 6.7% and the maximum employment goal is 5.5%. Inflation is at 1.5%, well below the target of 2%.

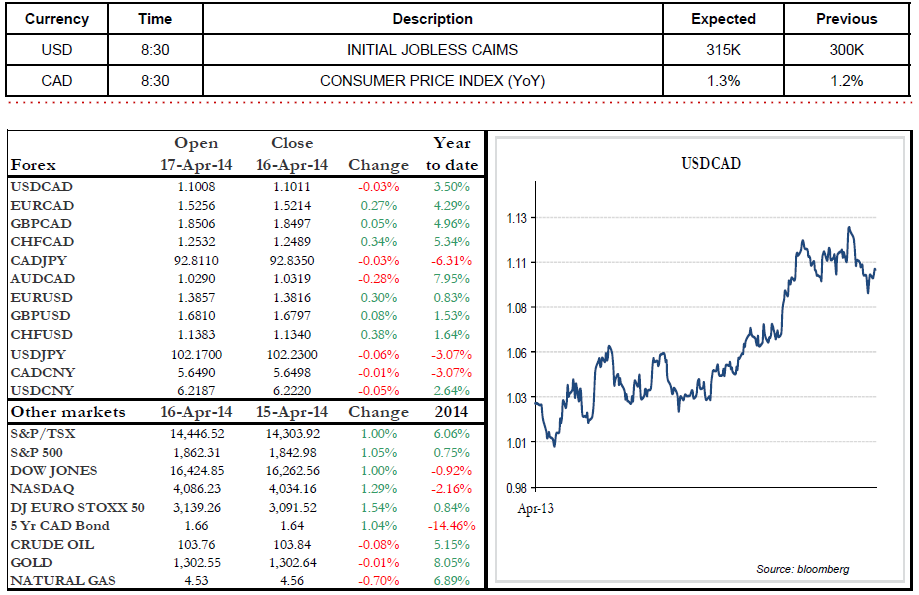

This morning, we are expecting Canadian inflation data. Initial Jobless Claims and the Philadelphia Fed Manufacturing Index figures will be released south of the border. Happy Easter and Passover!

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI