Investing.com’s stocks of the week

Markets are skittish, resulting in a great deal of volatility for most asset classes. After an excellent start to the session yesterday, North American markets nosedived by mid-day! Over the lunch hour, a major player bought over $200 million in put options on the S&P 500. Given the leverage of this transaction, this move is equal to a $2.8 billion short! Though the motives behind this transaction remain unknown, the impact was immediate.

The International Monetary Fund (IMF) finally announced a bailout plan for Ukraine for as much as $18 billion. In order to receive this aid, Ukraine will be required to increase natural gas prices by 50% for its population, freeze the salaries and pensions of state employees and allow its currency to devaluate. Since the beginning of 2014, the Ukrainian currency has lost 23% against the greenback.

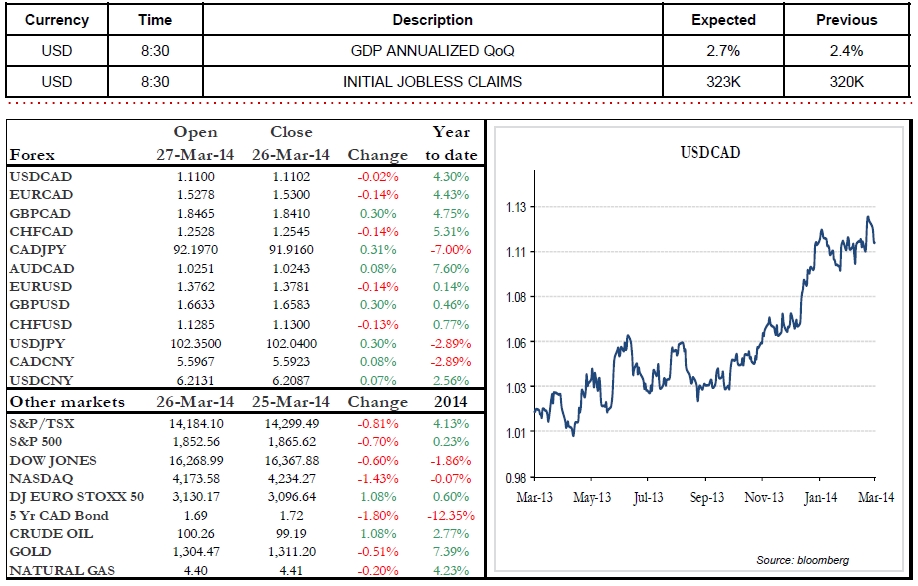

The volatility of the last few days is benefiting the CAD, which is up 1.2% against the American dollar for the week. The euro remains under pressure, in anticipation of the ECB meeting on April 3. In economic news south of the border, we are expecting GDP and Personal Spending figures as well as Initial Jobless Claims.