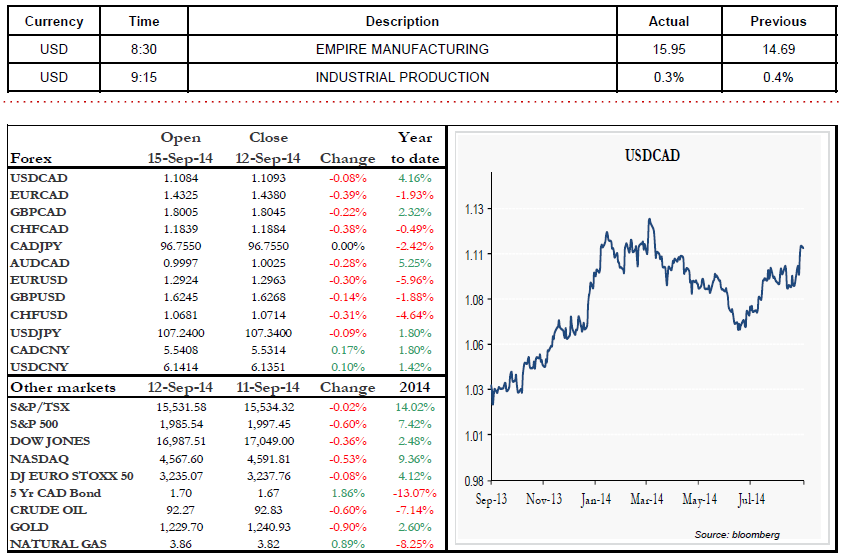

The greenback is doing great these days. In the past three months, the USD has risen against all other G10 currencies, with increases ranging from 2.08%, 4.56% and 4.87% against the loonie, the euro and the yen, respectively. Investors are expecting a more hawkish tone from the FED statement that will follow the next FOMC meeting, slated for September 16 and 17. This explains what is driving the greenback upwards, and also why the bond market is doing poorly right now.

After having reached a trough of 2.34% last August 28, U.S. 10-year bond yields have risen by 0.27%. The situation is similar in Canada, where we have experienced a 0.24% increase.

The key rate outlook has given investors a reason to take some profits on emerging and commodities markets. In terms of economic indicators today, we are looking to the U.S. where Empire State Manufacturing Survey and Industrial Production figures will be released. Wishing you a good start to the week.