U.S. stock markets nose-dived yesterday afternoon when investment firm BlackRock. stated that the job market was improving and that signs of rising inflation will force the Fed to raise its key rate. The U.S.’s flagship S&P 500 Index lost 0.65% in trading yesterday. This type of reaction from financial markets is a sign that investors are on tenterhooks for the next FOMC meeting slated for next week.

Volatility in the greenback compared to its peers is at its highest since February, due in large part to recent slides by the pound sterling, the euro and the yen against the USD. Last night, Australian Consumer Confidence dropped from 98.5 to 94, driving down the Australian dollar, which has shed close to 2% since the start of the week.

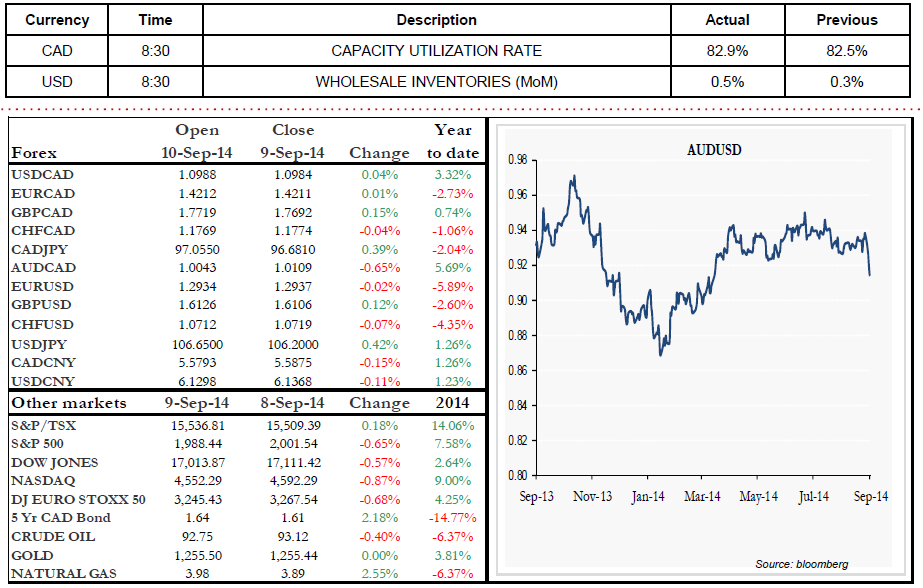

South of the border today, we’ll be keeping an eye on Mortgage Applications and Wholesale Inventories. In Canada, Capacity Utilization and a two-year government bond auction are on deck. Have a great day!