Investing.com’s stocks of the week

New York Fed President William Dudley stated yesterday that the pace of the rate hikes will be relatively slow, and this news weighed on U.S. interest rates. He expects economic growth to accelerate in the second quarter of the year and gradually push inflation closer to the 2% target. The minutes of the latest FOMC meeting will be released at 2 p.m. today and will have a significant impact on the currency market. Fed voting members’ inflation concerns could hinder risk-taking and cause interest rates to rise.

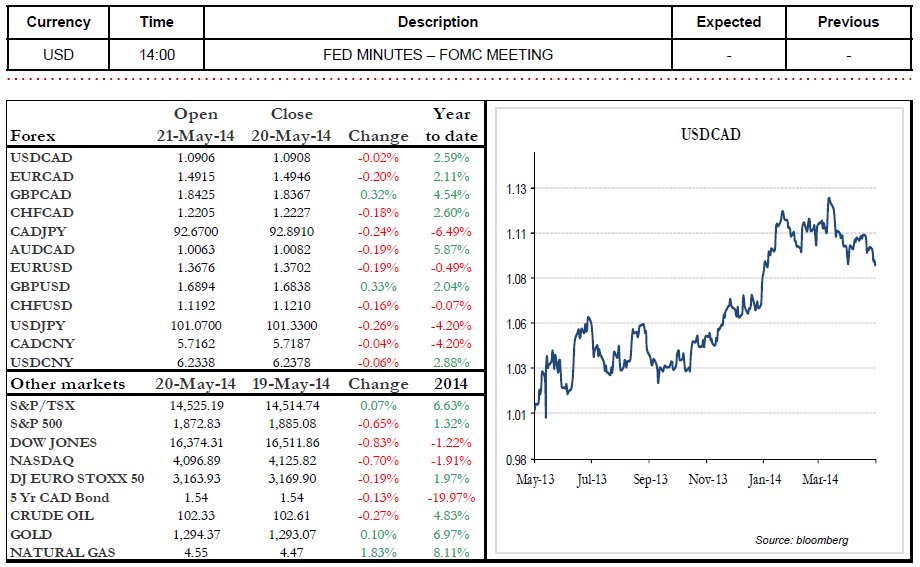

The statements of the New York and Philadelphia Fed presidents, as well as U.S. retailers’ disappointing corporate earnings weighed on markets and the loonie, which was down yesterday. The Canadian dollar is stable this morning and energy prices are up.

The Bank of Japan’s meeting, which started yesterday, is helping to support the yen, which is trading at its highest level in nearly three months. The BoJ issued a positive statement on the economy and is keeping its monetary policy unchanged. BoJ Governor Haruhiko Kuroda stated that quantitative easing measures have been effective, and that he is confident that inflation will reach its target of 2% within a year. Have a good day! Emmanuel Tessier-Fleury

Range of the day: 1.0845 – 1.0955