Investing.com’s stocks of the week

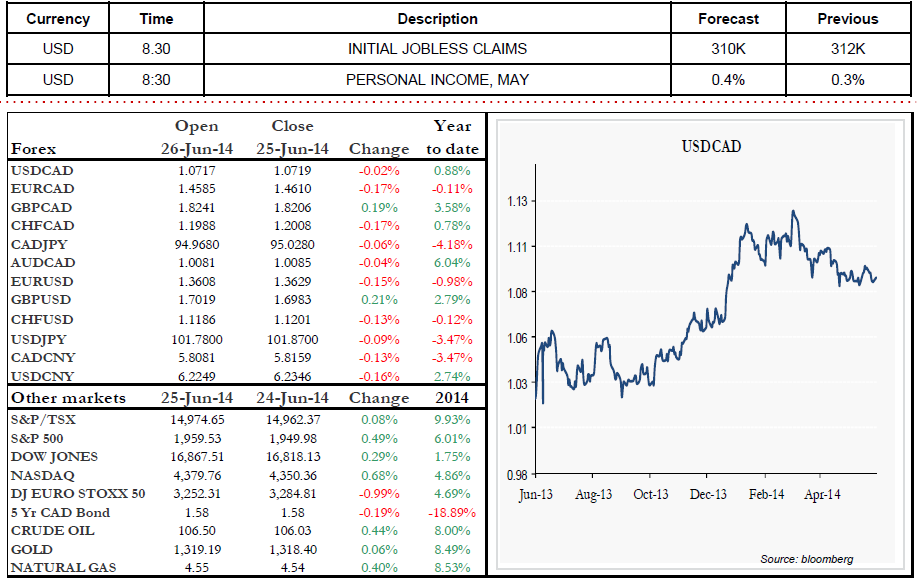

Several disappointing economic indicators were released yesterday in the U.S., including GDP data for Q1 2014. Once more, the weather was to blame. Economic growth dropped 2.9% compared to an expected contraction of 1.8%. Second quarter results are expected to be back around normal levels. Forecast to have stabilized in May, Durable Goods Orders figures also disappointed, dropping by 1%. The impact on the USD/CAD was very mixed.

Despite these disappointing results, U.S. stock market indices ended a two-day skid yesterday. Currently, the futures market is pointing to a neutral opening on the New York stock market.

Our attention is still focused on the situation in Iraq. As of yesterday, Sunni insurgents are presumed to have control over several oil fields. WTI and Brent prices have increased by 3.2% and 3.7% respectively since the beginning of the crisis.

Few economic indicators are expected today. Just like every Thursday, we are keeping an eye on Initial Jobless Claims data. Have a good day! Rana Karim

Range of the day: 1.0670-1.0750