Stock markets decided to shrug off the poor January U.S. Retail Sales numbers released yesterday. Although sales dropped by 0.4%, compared to the analysts’ consensus of 0%, the S&P 500 still gained 0.58% in yesterday’s trading. It appears that the recent bullish trend in stocks was strong enough to override the disappointing economic news.

European national GDP figures for the final quarter of 2013 were released early this morning. France, Germany and the eurozone as a whole all saw slightly higher growth than anticipated.

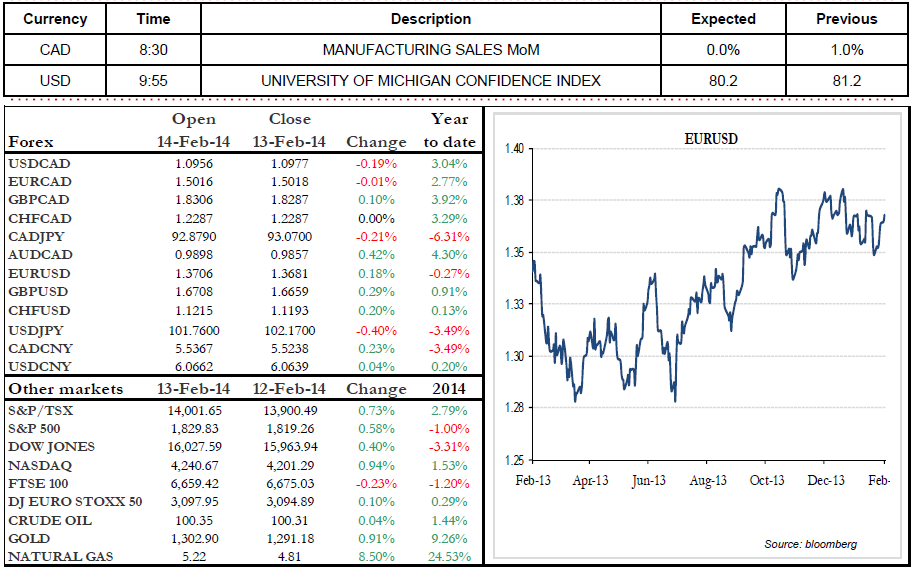

The past five days have seen impressive performances by several G10 currencies against the greenback, including the pound sterling, the loonie and the euro, which gained 2%, 1% and 0.7% respectively over the period.

This morning, a number of economic indicators will be published to close out the week. In Canada, Manufacturing Sales and CREA Existing Home Sales will be announced. South of the border, the Import Price Index, Industrial Production, Capacity Utilization and the University of Michigan Consumer Sentiment Index will be released. Have a great weekend!