Indices moved little yesterday with U.S. Industrial Production figures released–in line with analysts' forecasts–coupled with lower than expected Pending Home Sales. It was a quiet day for stocks, bond yields as well as for the currency markets, in anticipation of the next FOMC meeting that will begin today.

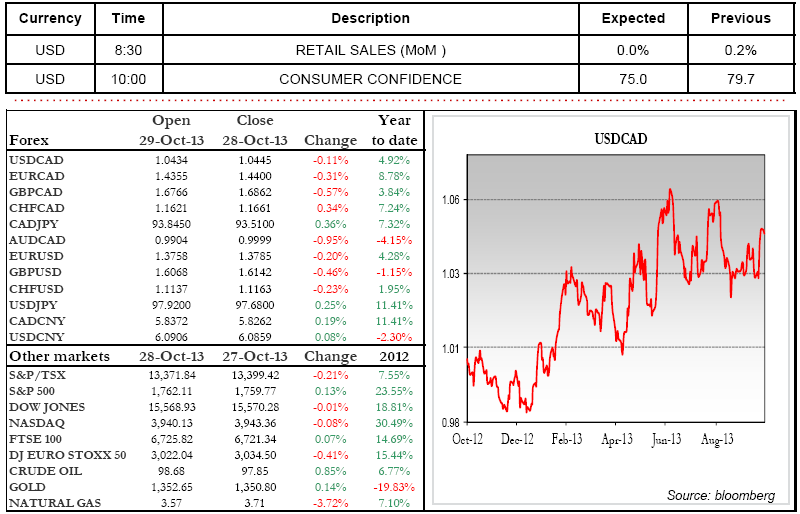

Retail Sales and CB Consumer Confidence data are the main U.S. indicators to keep an eye on today. These figures will help gauge the impact of the higher bond yields and consumer sentiment right before the U.S. government shutdown. Given the weak numbers posted by recently released indicators, analysts anticipate that the Fed will continue its measures to support the economy. Remember that, during September's meeting, Ben Bernanke had surprised investors by not tapering the pace of the bond-buying program.

More than half of the companies that make up the S&P500 have already released their corporate earnings. The numbers show sales in line with forecasts and profits 5% over expectations. Sales and profits have increased by 4% and 4.5%, respectively.

Markets are calm today with moderate gains for the European markets and Canadian dollar. The euro and oil prices are down slightly. Wishing you a great day! Emmanuel Tessier-Fleury

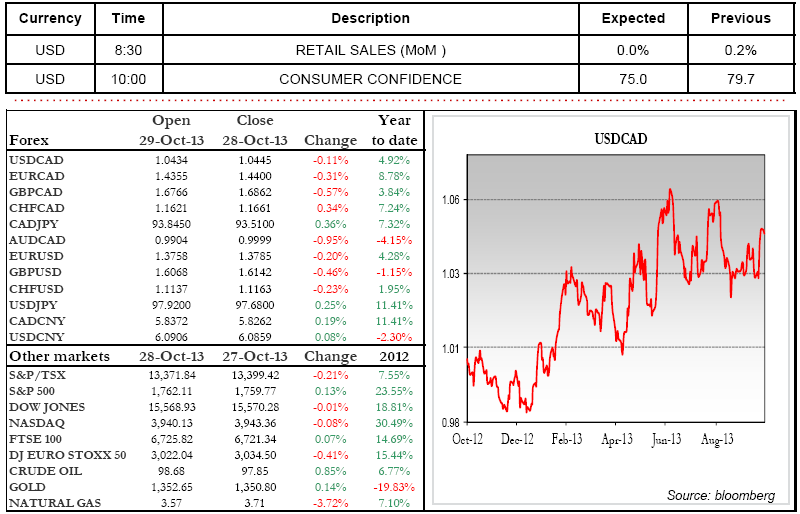

Range of the day: 1.0395 – 1.0475

Retail Sales and CB Consumer Confidence data are the main U.S. indicators to keep an eye on today. These figures will help gauge the impact of the higher bond yields and consumer sentiment right before the U.S. government shutdown. Given the weak numbers posted by recently released indicators, analysts anticipate that the Fed will continue its measures to support the economy. Remember that, during September's meeting, Ben Bernanke had surprised investors by not tapering the pace of the bond-buying program.

More than half of the companies that make up the S&P500 have already released their corporate earnings. The numbers show sales in line with forecasts and profits 5% over expectations. Sales and profits have increased by 4% and 4.5%, respectively.

Markets are calm today with moderate gains for the European markets and Canadian dollar. The euro and oil prices are down slightly. Wishing you a great day! Emmanuel Tessier-Fleury

Range of the day: 1.0395 – 1.0475