Investing.com’s stocks of the week

Yesterday was relatively quiet on currency and stock markets. Little volatility is to be expected today either, with U.S. markets closing at 1 p.m.

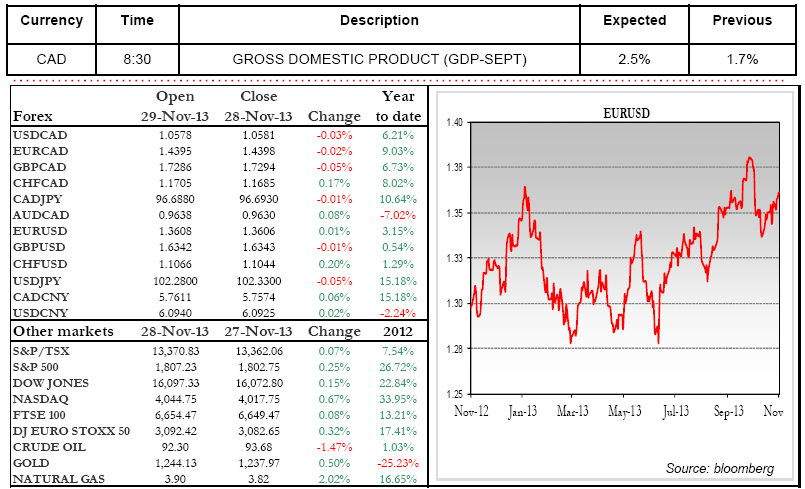

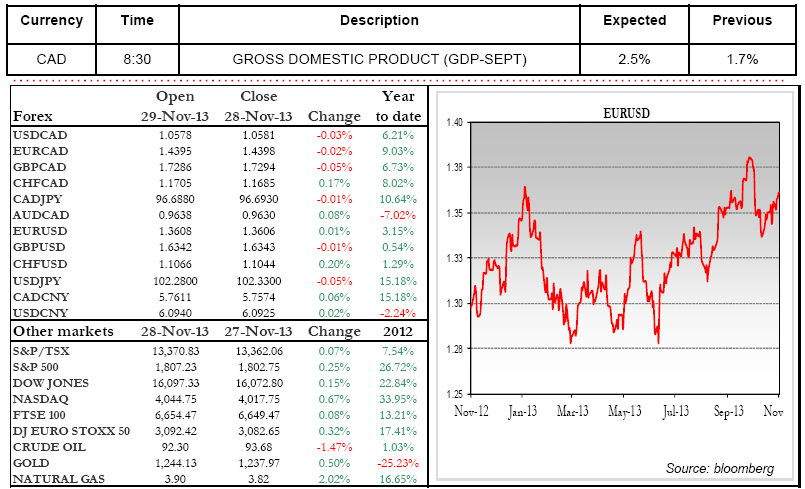

In the meantime, rising German inflation is bolstering the euro, which is trading at a four-year high against the yen. European economic data are encouraging, in large part thanks to the extraordinary actions taken in the past by the ECB. However, indicators pointing to higher-than-expected inflation in the eurozone are reducing the likelihood of another rate cut by the ECB. Confidence is at its highest level since August 2011 and stock markets on the Old Continent are up close to 30% in 2013. On October 25, the euro hit a high of 1.3802 against the USD. Despite a downturn in early November, the trend remains bullish for the single currency.

Closer to home, the loonie remains vulnerable and it seems like nothing will reverse the downward trend. GDP Growth data to be released at 8:30 will no doubt have an impact on our dollar. Have a great day and a great weekend. Emmanuel Tessier-Fleury

Range of the day: 1.0535 – 1.0635

In the meantime, rising German inflation is bolstering the euro, which is trading at a four-year high against the yen. European economic data are encouraging, in large part thanks to the extraordinary actions taken in the past by the ECB. However, indicators pointing to higher-than-expected inflation in the eurozone are reducing the likelihood of another rate cut by the ECB. Confidence is at its highest level since August 2011 and stock markets on the Old Continent are up close to 30% in 2013. On October 25, the euro hit a high of 1.3802 against the USD. Despite a downturn in early November, the trend remains bullish for the single currency.

Closer to home, the loonie remains vulnerable and it seems like nothing will reverse the downward trend. GDP Growth data to be released at 8:30 will no doubt have an impact on our dollar. Have a great day and a great weekend. Emmanuel Tessier-Fleury

Range of the day: 1.0535 – 1.0635