Investing.com’s stocks of the week

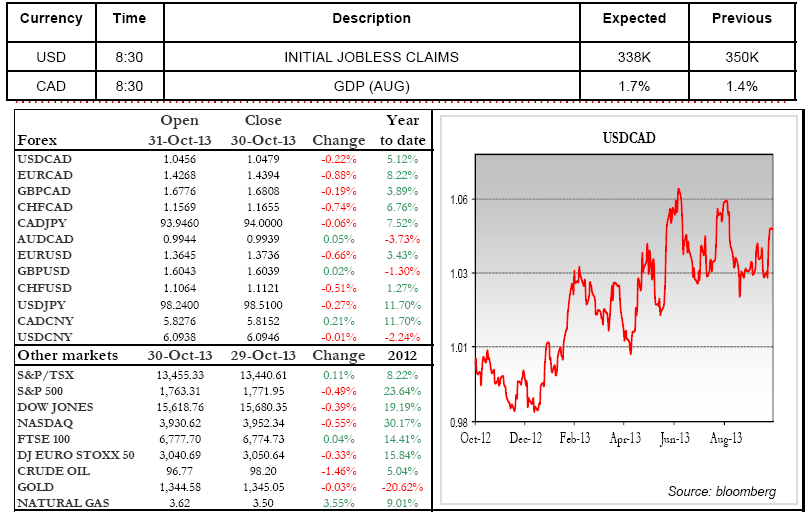

As expected, the Fed announced yesterday that it will continue buying $85 billion in bonds per month. The drop in consumer confidence, the difficult employment market and the concerns over the U.S. government shutdown are cited as the main factors supporting the Fed's decision. The press release also states that the Fed intends to maintain its key interest rate near zero as long as the unemployment rate remains over 6.5% and inflation is under 2.5%. Remember that Janet Yellen will replace Bernanke as Chair on January 31.

The announcement was slightly less accommodating that analysts expected, and this resulted in profit-taking on both the bond and stock markets. Given the 30.3% and 25.6% increases posted by the S&P500 and Dow Jones since the beginning of the year, it would appear that investors are nervous.

European figures show a drop in inflation, which is weighing on the euro; the ECB could therefore opt for a more accommodating approach over the coming months.

Asian markets are down this morning while the DXY Index continues to climb against the main currencies. A great opportunity is looming on the horizon for USD sellers. Wishing you a great day! Emmanuel Tessier-Fleury

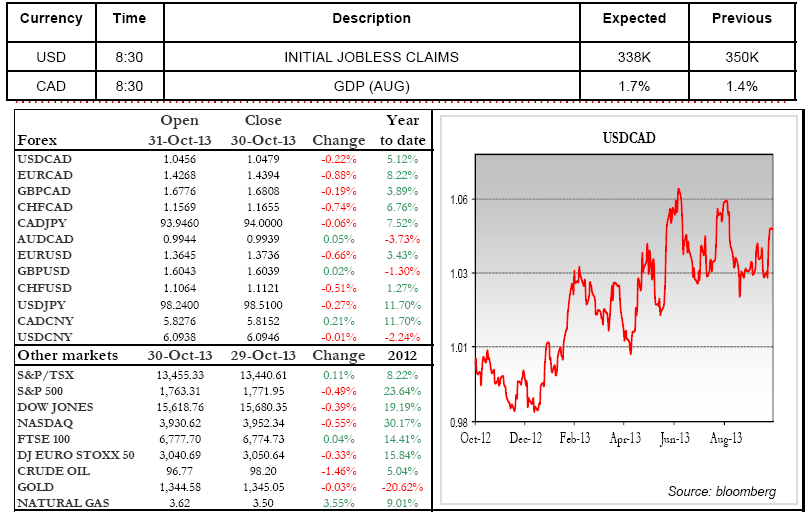

Range of the day: 1.0415-1.0495

The announcement was slightly less accommodating that analysts expected, and this resulted in profit-taking on both the bond and stock markets. Given the 30.3% and 25.6% increases posted by the S&P500 and Dow Jones since the beginning of the year, it would appear that investors are nervous.

European figures show a drop in inflation, which is weighing on the euro; the ECB could therefore opt for a more accommodating approach over the coming months.

Asian markets are down this morning while the DXY Index continues to climb against the main currencies. A great opportunity is looming on the horizon for USD sellers. Wishing you a great day! Emmanuel Tessier-Fleury

Range of the day: 1.0415-1.0495