Investing.com’s stocks of the week

The Dow Jones Industrial Average ended the day in the red for a fifth consecutive day yesterday. Once again, encouraging growth perspectives in the U.S., specifically with respect to employment and GDP, are increasing the likelihood that the Fed will begin tapering its quantitative easing measure as soon as this month. The next FOMC meeting is slated for December 17 and 18, and it will be interesting to see the resulting monetary policy statement.

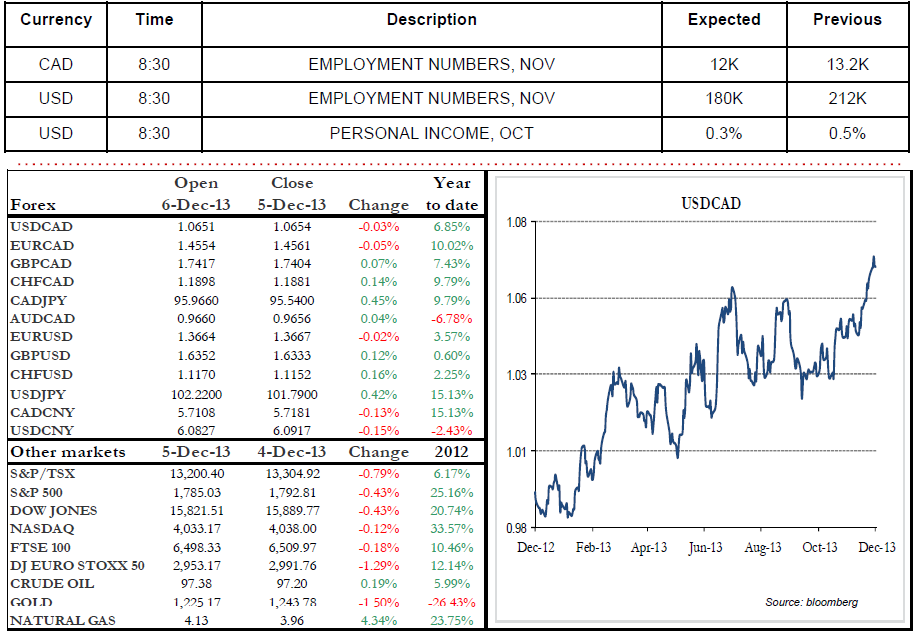

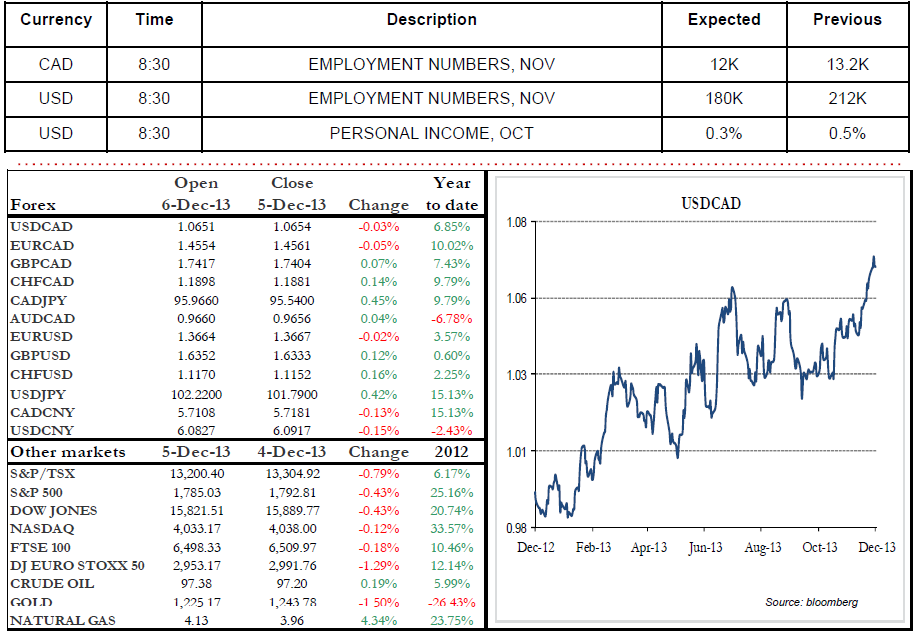

Employment figures will be released on both sides of the 49th parallel this morning. Higher figures than the forecast (12,500 for Canada) would allow the loonie to catch its breath against the greenback. As for the U.S., the recently released ADP Employment Change data and Initial Jobless Claims numbers both beat expectations, leaving pundits to believe that markets will be bullish this morning when the new employment data will be released. The direction of the USD/CAD pair, as well as U.S. stock and bond markets, will depend heavily on these figures.

The U.S. futures market is currently pointing to a positive opening, while the Canadian dollar is trading at the same level as yesterday’s close against the U.S. dollar. Wishing you a great weekend! Rana Karim

Range of the day: 1.0610-1.0710

Employment figures will be released on both sides of the 49th parallel this morning. Higher figures than the forecast (12,500 for Canada) would allow the loonie to catch its breath against the greenback. As for the U.S., the recently released ADP Employment Change data and Initial Jobless Claims numbers both beat expectations, leaving pundits to believe that markets will be bullish this morning when the new employment data will be released. The direction of the USD/CAD pair, as well as U.S. stock and bond markets, will depend heavily on these figures.

The U.S. futures market is currently pointing to a positive opening, while the Canadian dollar is trading at the same level as yesterday’s close against the U.S. dollar. Wishing you a great weekend! Rana Karim

Range of the day: 1.0610-1.0710