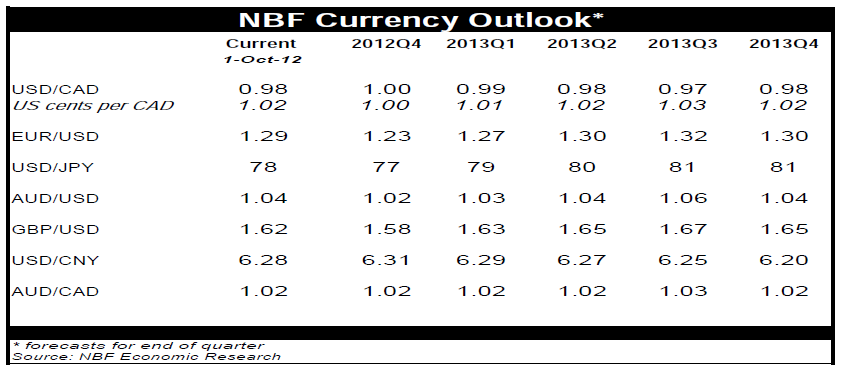

- Central bankers, the world’s best hope at a time of political inertia, have delivered in a big way. By agreeing to buy unlimited amounts of short-term sovereign bonds, the European Central Bank has finally accepted its responsibility of lender of last resort, significantly reducing the tail risks of the eurozone’s implosion. On the other side of the Atlantic, observing new signs of economic weakness and little progress in the labour market, the Fed decided to adopt a more aggressive approach with a new unsterilized bond purchase program, i.e. QE3. The Fed’s money printing exercise contrasts with the ECB’s “fully sterilized” purchases, and that combination is negative for USD. We have accordingly brought forward our forecasts of US dollar weakness, raising in the process our targets for other currencies, including the euro and the Canadian dollar.

- But the euro drama isn’t over just yet. Untimely austere policies will extend the eurozone recession, making it even harder for governments to achieve their deficit targets. The Greek situation hasn’t been resolved and an exit is more than just a possibility. And the zone’s internal competitiveness/trade imbalances won’t be solved overnight, more so with an apparent stall in labour market and pension reforms. Moreover, in the US, politicians distracted by upcoming elections are seemingly not in a rush to address a fiscal cliff that threatens to take the world’s largest economy into recession. The related uncertainty is hurting US growth already. All told, risk aversion could make an unwelcome return to markets sooner rather than later. Under that scenario, the US dollar could show some temporary resilience despite the headwinds generated by the Fed’s printing press.

ECB reduces tail risks …

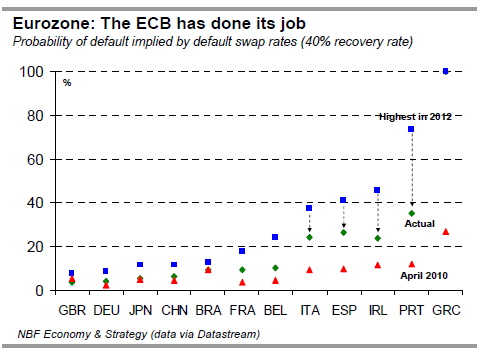

Some significant tail risks to the global economy were reduced in September with favourable outcomes to the German Constitutional Court ruling on the European Stability Mechanism, the Dutch elections, and more importantly the European Central Bank’s decision to finally accept its responsibility as lender of last resort. Sovereigns in the eurozone periphery were indeed given a lifeline by the ECB’s pledge to purchase their short-term bonds in unlimited amounts under the Outright Monetary Transaction program (OMT).

Of course, the OMT comes with some major strings attached, and hence those countries would only want to tap that facility as a last resort. But even with no OMT money disbursed yet, the ECB’s pledge has already worked wonders by chasing away bond vigilantes and bringing down short yields to more manageable levels, hence reducing default probabilities significantly.

And with the Fed’s decision, a week after the ECB’s intervention, to embark on a third round of asset purchases, many would have expected risk aversion to subside through global markets. But after an initial rally, markets seem to be struggling to maintain those gains. A look at the euro-yen cross confirms that the twin central bank interventions have failed to spur a “risk on” environment.

While the euro has rallied in response to reduced tail risks of default and a eurozone breakup, the yen, a currency that tends to do well in periods of risk aversion, has remained strong. With so much liquidity injection by the world two major central banks, just what is preventing markets to take off in a sustainable fashion? Investors may be realizing that the same old problems that had prompted those central banks to come to the rescue in the first place, are not going away so soon.

To Read the Entire Report Please Click on the pdf File Below.