On Jun 15, 2016, we issued an updated research report on Navistar International Corporation (NYSE:NAV) . The company continues to gain from its cost-saving initiatives and new product launches. However, economic uncertainties prevailing in Brazil are likely to impact its profits.

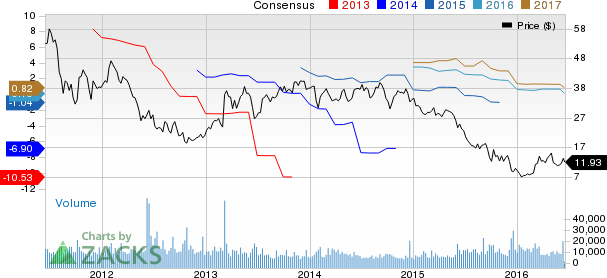

Navistar reported second-quarter fiscal 2016 (ended Apr 30, 2016) earnings of 5 cents per share, as against adjusted net loss of 57 cents per share recorded in the year-ago quarter. The Zacks Consensus Estimate for the reported quarter was of a loss of 18 cents per share. Results benefited from continued progress in business operations and initiatives to effectively manage costs, partially offset by lower Class 8 truck volumes.

Navistar’s revenues fell 18% year over year to $2.19 billion in the quarter, missing the Zacks Consensus Estimate of $2.24 billion. The decline in the top line can be attributed to lower volumes in the company's Core U.S. and Canadian markets, and lower engine volumes in Brazil.

Navistar expects adjusted EBITDA (earnings before interest, tax, depreciation and amortization), excluding pre-existing warranty and one-time items, for fiscal 2016 in the band of $550–$600 million, higher than $494 million recorded in fiscal 2015. Further, sales volume of the medium-duty trucks, school bus and severe service segments are expected to improve. Navistar is also poised to benefit from cost-saving initiatives like engine restructuring and reductions in discretionary spending and employee headcount. In fiscal 2016, the company targets $200 million reduction in structural and product costs.

Additionally, Navistar is benefiting from the launch of new products, which boast improved quality and performance, together with its expansion strategies. In Jun 2016, Navistar signed an agreement with General Motors Company (NYSE:GM) per which it will produce the cutaway model of the latter’s G Van at the Springfield, OH plant from the first half of 2017. It will also recommission its second line at the plant.

However, Navistar projects Class 6–8 retail deliveries in the U.S. and Canada in the range of 330,000–360,000 units for fiscal 2016, down from the previous forecast of 350,000–380,000 units as well as 388,600 units recorded in fiscal 2015. Class 8 deliveries should be in the range of 220,000–250,000 units, down from the previous estimate of 240,000–270,000 units, and 279,000 units in fiscal 2015. As a result, revenues are expected in the band of $8.2–$8.6 billion for fiscal 2016, lower than both the previous projection of $9–$9.25 billion and the fiscal 2015 level of $10.1 billion. Given the current market conditions, the company no longer expects to be profitable for the full year. In addition, Navistar’s results are being adversely affected by lower volumes in Brazil, resulting from economic uncertainties.

Zacks Rank

Currently, the company carries a Zacks Rank #3 (Hold).

Some better-ranked automobile stocks include Lear Corp. (NYSE:LEA) and Superior Industries International, Inc. (NYSE:SUP) . Both the stocks sport a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

NAVISTAR INTL (NAV): Free Stock Analysis Report

SUPERIOR INDS (SUP): Free Stock Analysis Report

LEAR CORPORATN (LEA): Free Stock Analysis Report

GENERAL MOTORS (GM): Free Stock Analysis Report

Original post