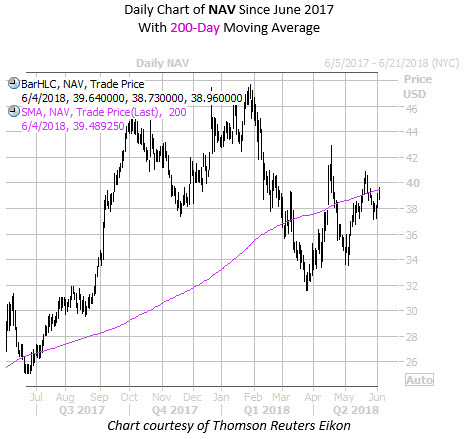

Truck and machinery manufacturer Navistar International Corporation (NYSE:NAV) is slated to report fiscal second-quarter earnings before the market opens tomorrow, June 5. Navistar stock is down 0.4% at $38.77 at last check, and has seen choppy trading since its late-March lows. More recently, NAV has struggled to break above the 200-day moving average, and is down 9% year-to-date.

Digging into the stock's earnings history, NAV has closed higher in the session following three of the company's last four reports, including a 7.4% jump in December. Widening the scope, the stock has averaged a one-day post-earnings swing of 5.6% over the past two years, regardless of direction. However, the options market is pricing in bigger 11.6% move for tomorrow's trading, per data from Trade-Alert.

Options traders appear to be betting on a rare post-earnings retreat, albeit amid relatively low absolute volume. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity's 10-day put/call volume ratio comes in at 2.80, and ranks in the 82nd annual percentile. This lofty ratio suggests that puts have been purchased over calls at a faster-than-usual clip during the past two weeks.

Outside of the options pits, though, traders have been reducing their bearish exposure to the stock. Short interest on NAV fell nearly 19% during the past two reporting periods to 3.40 million shares -- the fewest since since mid-2012. Nevertheless, this still represents a healthy 7% of the stock's total available float, or 7.4 times the equity's average daily pace of trading.