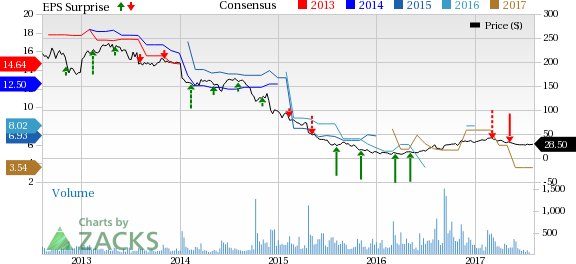

Natural Resource Partners LP (NYSE:NRP) reported second-quarter 2017 adjusted earnings of $1.13 per unit, missing the Zacks Consensus Estimate of $1.44 by 21.5%.

Total Revenue

In the quarter under review, Natural Resource Partners’ total revenue of $94.9 million surpassed the Zacks Consensus Estimate of $93 million by 2.1%.

Segment Details

Coal Royalty and Other segment’s revenues and other income (excluding gains on asset sales) in the first half of 2017 decreased 13.8% to $100.7 million from $116.9 million in the year-ago period.

Soda Ash segment’s revenues were $18.7 million in the first half, down 6% from the year-ago period.

Construction Aggregates segment’s revenues in the first half were $60.8 million, up nearly 8.0%.

Highlights of the Release

In the second quarter, coal produced from the company’s leased asset amounted to 6.47 million tons, up 0.3% from 6.45 million tons in the year-ago quarter. Thanks to the improvement in metallurgical coal prices, coal royalty revenues improved from the last-year period.

Total operating expenses in the reported quarter were down 6.3% to $44.5 million from $47.5 million in the prior-year quarter.

Interest expenses dropped 7.7% to $20.4 million from $22.1 million in the year-ago quarter.

Financial Condition

Natural Resource Partners had cash and cash equivalents of $40.7 million as of Jun 30, 2017, up marginally from $40.4 million as of Dec 31, 2016.

The partnership continues to lower outstanding debt levels. Long-term debt was $700.2 million as of Jun 30, 2017, down from $987.4 million as of Dec 31, 2016.

In the quarter, cash from operating activities was $34.8 million, up 95.5% from $17.8 million in the prior-year period.

Zacks Rank

Natural Resource Partners currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of the Peers

Other operators in the industry like CONSOL Energy (NYSE:CNX) , Alliance Resource Partners LP (NASDAQ:ARLP) and SunCoke Energy (NYSE:SXC) surpassed their respective Zacks Consensus Estimate in second-quarter earnings.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

CONSOL Energy Inc. (CNX): Free Stock Analysis Report

Natural Resource Partners LP (NRP): Free Stock Analysis Report

SunCoke Energy, Inc. (SXC): Free Stock Analysis Report

Alliance Resource Partners, L.P. (ARLP): Free Stock Analysis Report

Original post

Zacks Investment Research