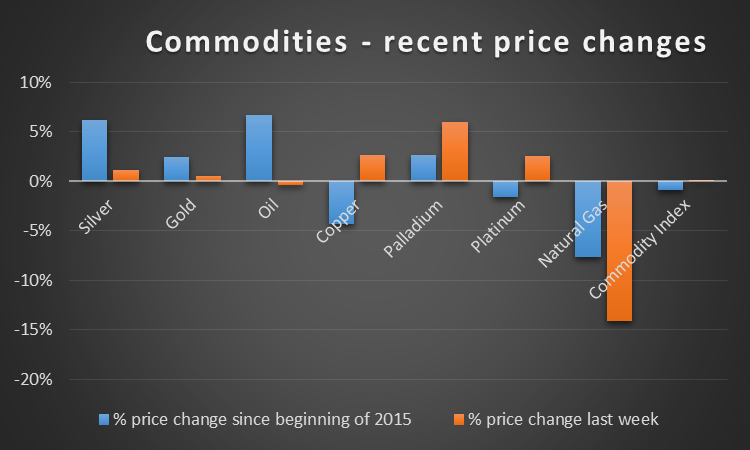

Natural gas has been among the weakest performing commodities this year, as shown in the graph below. This is on the heels of a 30% price fall in 2014.

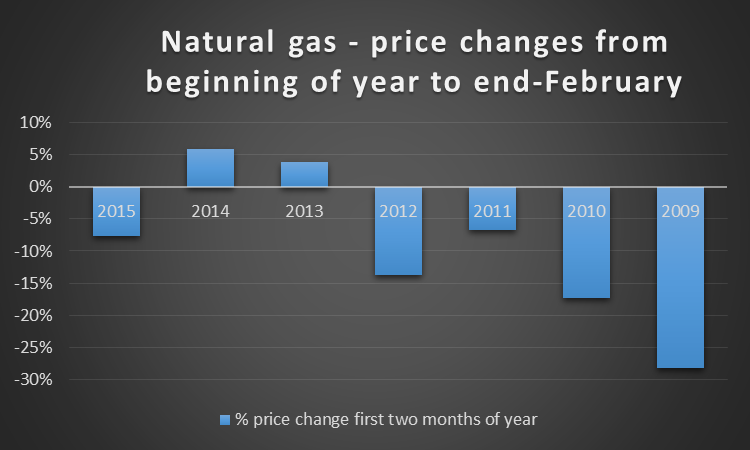

Weakness in the first two months of the year is not unprecedented, as can be seen from the graph below:

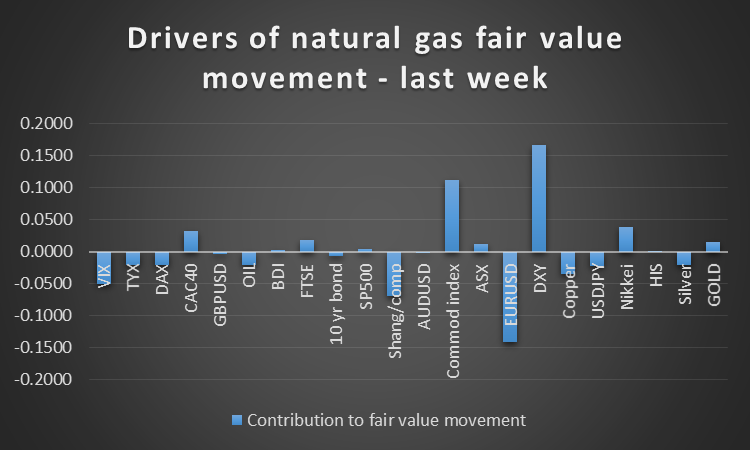

Last week saw continued weakness (price down 14%), a move well in excess of the decline in fair value of 3.2%. The fair value is assessed using a multiple regression analysis of the natural gas price on 22 driver variables including interest rates, stock indices, other commodities and exchange rates. The database is six years of daily prices.

The contribution of each driver variable to the decrease in natural gas’ fair value last week is shown in the graph below. A significant factor mitigating the fall was the strength in the US dollar index (up 1% over the week), to which natural gas’ fair value is positively correlated. The strength of other commodities also supported the fair value.

An excess of price decrease over fair value decrease would normally be a signal to go long natural gas.Taking positions based on disparities between price and fair value change over the last 90 days would have yielded an annualized gain of 49% with volatility of 69%.

Our assessment of natural gas’ fair value using the multiple regression model lies well above the current price, suggesting that the commodity is undervalued on fundamentals. However, taking positions in natural gas based on this signal of under/over valuation would have generated negative returns over the last 90 days – hence we are inclined to use caution when relying on this indicator.

We have also developed a signal based on the lead given by the change in the Baltic Dry Index (BDI) of raw material shipping freight rates. This index is widely seen as a leading indicator of world economic growth, with increases viewed as bullish and decreases conversely. Based on the relationship between the BDI and oil price over the last six years and the 11% drop in the BDI over the last month, a short term increase in the natural gas price can be seen as likely.

Trading this signal would have yielded a 27% per annum gain with volatility of 59% over the last six years.

Relationship to USD and volatility

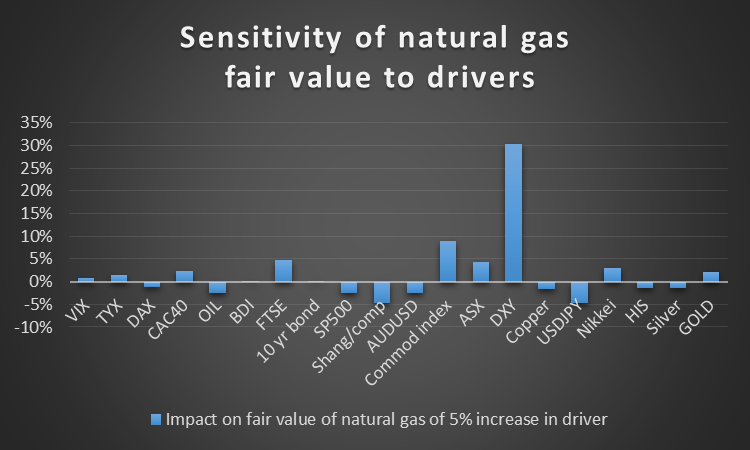

The graph below shows the sensitivity of natural gas’ fair value to the drivers on which the fair value is based:

As can be seen, natural gas is positively correlated to the US dollar. Our fair value indicators suggest some short term upside in the US dollar index which would augur well for natural gas.

The USD may undergo some volatility this week if the PMIs and/or jobs data come in some distance from consensus. Given the high sensitivity of oil to the USD evident in the above graph, this could translate into volatility in the natural gas price.

The above discussion has touched on the volatility of natural gas prices and observations on future price direction, and position sizing, must be tempered by this volatility which is far higher than for most other commodities.

This week has historically been of above average volatility - looking back over the last three years at natural gas’ price changes for the four days leading up to the nonfarm payrolls print, we find a volatility of 68% vs volatility for all weeks over the period of 62%.