Natural gas traded higher as per the last reported expectation. However, heavy profit booking before the rally disturbed the levels of stop loss.

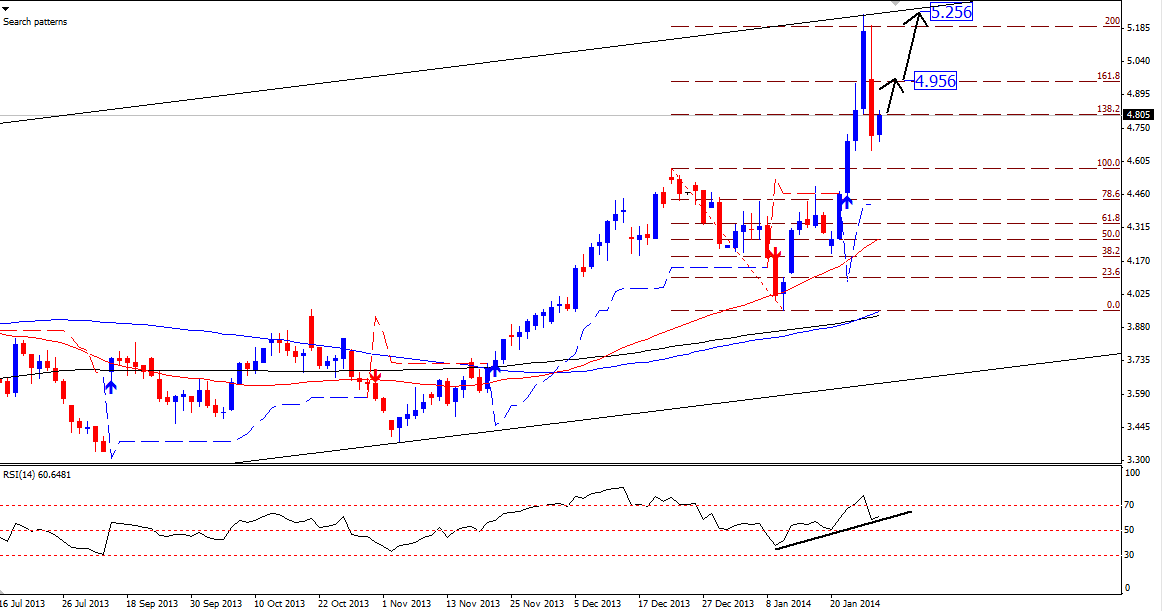

Now natural gas march future is trading around $4.810, and as we can see on charts the over bought indicators added more space after yesterday profit booking session. However, the correction was limited by 38.2% feb area of last rally and also nearing to the parallel support around $4.560. At the same time RSI still staying in positive territory and the candlestick pattern is neutral. This structure indicate for another sharp rally in coming trading session.

On fundamental side, US not coming out of heavy winter season and expecting another snow storm this week. This producing record demand of natural gas and bringing the inventory level to 2423 bcf which is lowest in last 5 years.

Based on above studies, we will prefer to buy natural gas for possible targets around $4.950 and then $5.250. Only a day close below $4.430 will force us to reanalyze the charts.