Is the rally for Natural Gas over? Even though current levels are the highest since 2008, it seems that bullish momentum has stalled, with prices shedding more than 10% since the peak on 30th Jan. The start of the rally stretches all the way to April 2012, but prices really shot up the most in the past couple of weeks on concern of the extraordinary chilly weather experienced in the US. With Spring coming, the demand for Natural Gas as a heating energy source is bound to decline, and we should be able to see prices falling deeper.

As market is forward looking, it is no surprise that sentiment may have already changed. Yesterday's statements from 2nd largest Nat Gas producer Chesapeake Energy Corp showed that output of natural gas in US is actually falling, while California has warned that their Nat Gas supplies are running short. However, market remained unmoved with prices actually ended lower by the time US session ended yesterday.

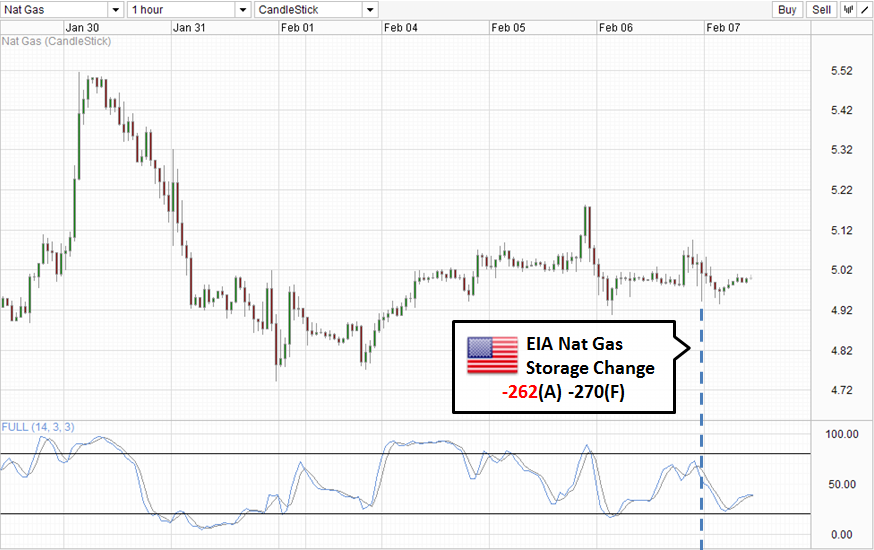

Certainly the lesser than expected decline in EIA's weekly report added more bearish pressure. But it should be noted that the difference is just 8B cubit feet. Since the beginning of 2014 we've seen larger disappointments (e.g. 16th Jan by 9B, 3rd Jan by 28B) but prices continue to climb steadily higher instead during these period. Hence, it is clear that sentiment in Nat Gas is no longer bullish, or at least not bullish enough to overcome the data disappointment, which still lead to the conclusion that the bullish momentum may be stalling/reversing.

This reverse in sentiment can be reflected on technicals if 5.00 holds in conjunction with Stochastic readings push lower below 80.0 and preferably below 75.0 in order to give us a strong bearish cycle signal. Obvious bearish target should that happen will be the 3.80 support or the lower wedge depending on whichever comes first. However, should 5.00 is broken to the upside, we could see yet another push towards upper wedge but sustained bullish push is unlikely given that Spring is coming soon and production will be expected to increase while demand is bound to fall. Furthermore, given that US Government has incentives to drive Nat Gas prices lower to encourage utilization and provides subsidies/tax grants to producers to encourage more production all in the bid to achieve energy independence, Nat Gas has added political pressure to remain cheap in the future.