On Wednesday, data showed producer prices increased more than expected in September in another hot inflation reading which boosted bets of more jumbo-sized interest rate hikes by the Federal Reserve.

Persistent inflation has sparked worries about the Fed's aggressive monetary action tipping the world's largest economy into a recession. Money markets are pricing in a 92% chance of another 75-basis-point hike in November.

Slowing growth in advanced economies, rising interest rates, climate risks, and continuing high food and energy prices are affecting the global economy.

Last week, the IMF chief said that the global lender would downgrade its forecast for 2.9% global growth in 2023 while releasing its World Economic Outlook on Tuesday, citing the shocks caused by the COVID-19 pandemic, Russia's invasion of Ukraine and climate disasters on all continents.

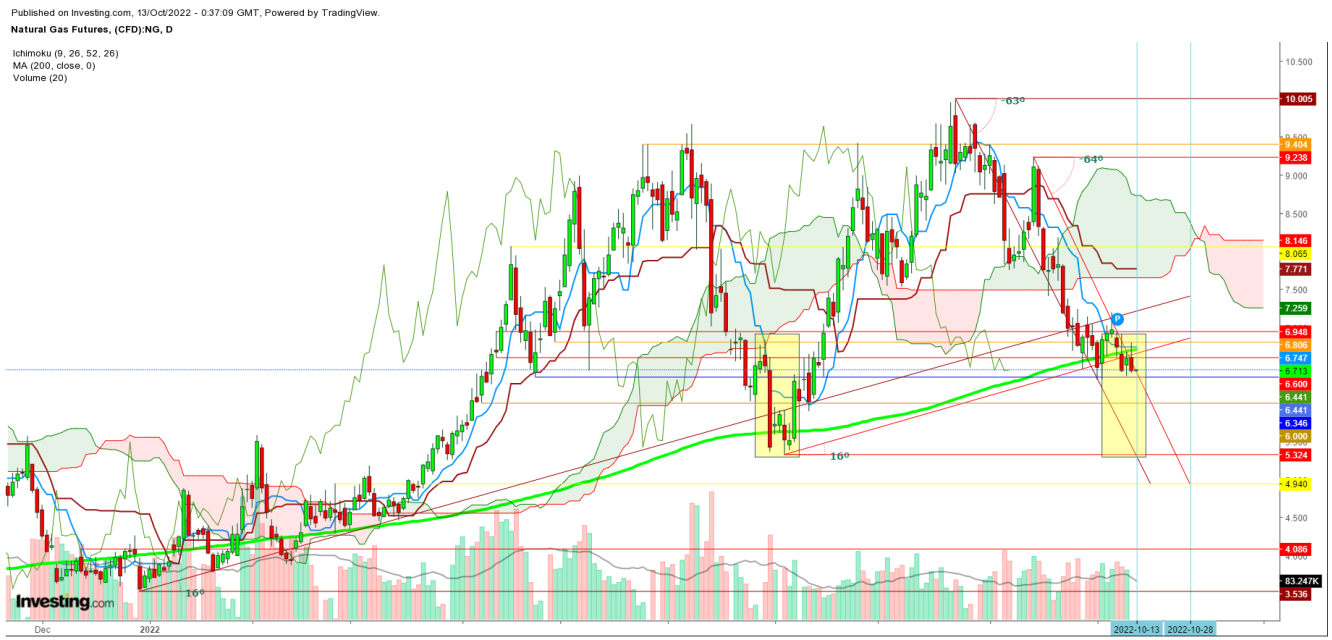

Despite some bouncing moves on Wednesday, natural gas found stiff resistance at $6.806; as was seen on Jun. 29 before a heavy selloff that continued on Jun. 30, resulting in the prices hitting a low at $5.372 on that day.

Technically speaking, in a daily chart, futures formed the same exhaustive candle on Oct. 12 before closing the day. It will be confirmed by a steep fall on Oct. 13 if prices breakdown below the psychological support at $6 after the announcement of weekly inventory.

A sustainable move by the natural gas futures below $5.688 could trigger a selling spree that may continue on Thursday before some bouncing move appears on Friday. If inflationary pressures persist, wild price swings are likely until this week's closing.

If natural gas closes this week below $5.4, it could indicate that the price slide will continue, as the natural gas bears will continue to find supportive weather reports this weekend

Disclaimer: The author of this analysis does not have any position in Natural Gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.