- Low temperatures in Europe in early December have failed to boost natural gas prices

- Inventories in Europe and the US remain at high levels

- Could this mean natural gas prices are set to plummet even lower?

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Lower-than-expected temperatures in the global north during early December and late November have raised eyebrows. This occurrence is particularly rare, especially in light of the ongoing global warming issues as temperatures this low aren't expected so early in the heating season.

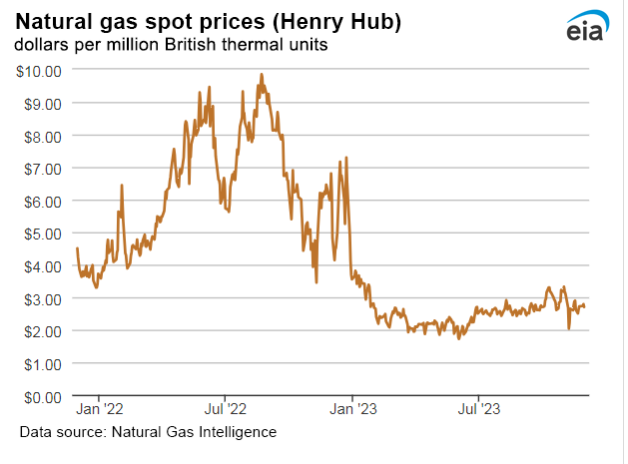

Despite this, prices for one of the key energy commodities natural gas have remained in a downtrend since early November, breaking below $3 for the Henry Hub contract recently.

This shows that Europe in particular, which was heavily dependent on supplies from Russia even before the outbreak of the war, managed to get through the crisis without facing a sharp shortage.

Europe Well Prepared for Heating Season With High Natural Gas Storage Stocks

The last several days have been marked by the onslaught of winter weather, causing temperatures in northern Europe to reach several degrees below zero at night. Fortunately for the economy, this does not have a major impact on natural gas prices.

This is mainly due to the high storage levels in Europe, which are currently filled to an average of 96%, and the efficient organization of supplies from alternative directions to the East.

Additionally favoring the supply side are temperature forecasts that anticipate warming in the second half of December.

Simultaneously, there is a notable decline in economic activity, especially in the eurozone, where GDP is teetering on the brink of recession. The realization of this economic downturn is anticipated in the first quarters of 2024.

The scale of the challenge facing Europe is shown by a chart of Dutch TTF gas prices, which at their peak in August 2022 reached nearly 340 euro and MMBtu (the key storage replenishment period) to fall below 30 euro by the middle of this year.

Asia and Europe Are Also Experiencing Declines in Natural Gas Prices

Declines in natural gas prices are also noticeable in Asia and the United States. Despite the challenges posed by relatively low temperatures in China, Japan, and South Korea, similar to Europe, natural gas prices have demonstrated resilience to significant increases.

This resilience can be attributed to the combination of high storage levels and forecasts predicting a warm winter, creating a scenario that is expected to exert downward pressure on prices.

The current level of U.S. natural gas production at 119.4 billion Bcf at the end of November and the common denominator of high storage stocks are enough to secure the U.S. economy during the heating season.

Natural gas reserves totaled 3836 Bcf in November, which is 9% higher than the average of the past five years.

Source: eia.gov

Dutch TTF Contract: Technical View

As part of the current downward momentum, the valuation of Dutch TTF natural gas contracts remains below EUR 40 MMBtu and is currently testing the demand zone located in the EUR 38 price area.

If sellers manage to break out of the indicated region, the way opens for a renewed attack on the round EUR 30 barrier. The main target for supply, however, is the low forming in the area of EUR 23 from the turn of May and June this year.

The success of this scenario hinges on the accuracy of weather predictions. If the forecasts of a warm winter materialize, there is a good chance of a retest or even a breakdown below this year's lows in natural gas prices.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.