While observing the movements of natural gas during the last to last week, I could feel the natural gas bulls were looking too eager to be in the driver’s seat and continue to propel natural gas prices approximately 16.5% during last week. This weekly bumpy move indicates the continuity of the current uptrend till the sanction game goes as it started after the Russian invasion of Ukraine.

On Thursday, Russian President Putin said that Russia would work to redirect its energy exports eastward as Europe tries to reduce its reliance on Russian oil and gas. This step by the Russian President could shake the joint move by the European nations to redefine their further steps to avoid an energy crunch despite the promised flow of additional oil and gas from the US strategic reserves.

The U.S. natural gas producers look happy to help the western countries, but this could result in a sharp decrease in domestic shortage, which could be felt through a sudden spike in natural gas prices during the last week.

The steep surge in natural gas prices could continue during the next week as the U.S. President Biden pledged an additional 15 billion cubic meters of natural gas exports to the European Union this year in the form of LNG, while the EU pledged to create the demand for 50 billion cubic meters annually of U.S. LNG "until at least 2030".

The steep surge in natural gas prices looks like a move against all odds, and a sudden tilt in European states could change the whole price equation as Europe is heavily dependent on Russian gas and oil.

While the EU debates whether to slap sanctions on Russian gas and oil and member states seek supplies from elsewhere, the Kremlin has been forging closer ties with China, the world's top energy consumer, and other Asian countries.

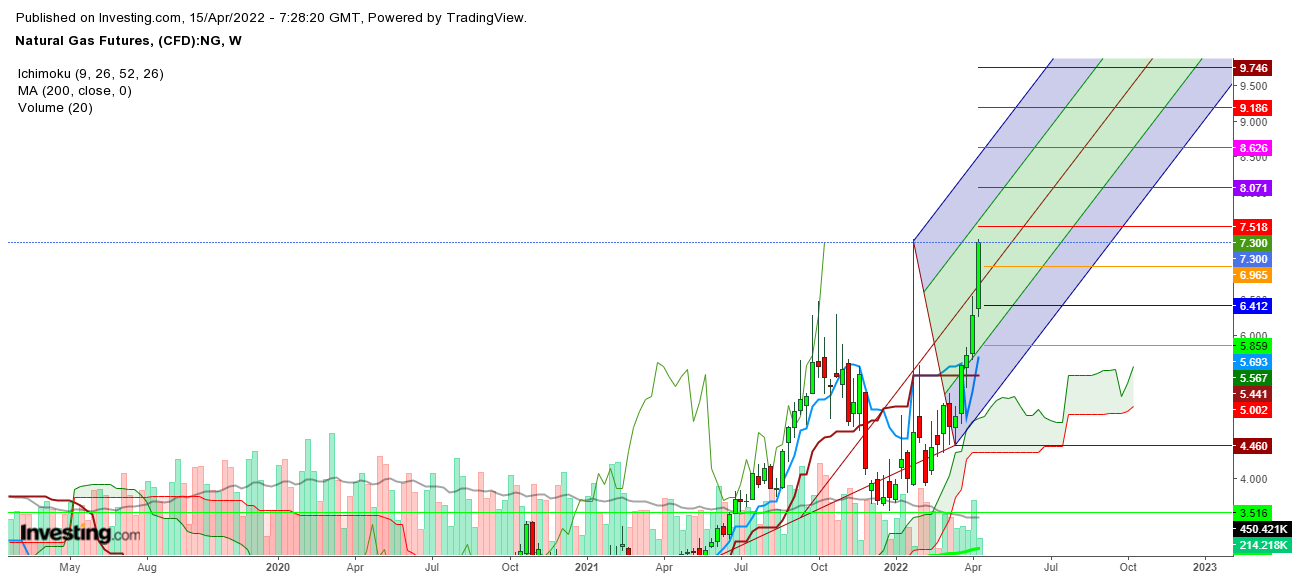

Technically speaking, the natural gas looks ready to continue the current uptrend in the upcoming week as the formation of a bullish crossover in the weekly chart confirms the strength of the current momentum.

Secondly, the opening level will confirm the further directional move. In a weekly chart, immediate support is at $6.965. The immediate resistance at $7.518 confirms that a breakout or a breakdown out of this price range will finally define the further directional move.

In the daily chart, natural gas is constantly maintaining the current uptrend from Mar. 15, 2022, from $4.460. This uptrend is still intact even after a breakout above $7.3, which could turn into the next launching pad for the prices if the energy embargo remains unresolved.

Disclaimer: The author of this analysis does not have any position in natural gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.