- Soon-to-expire March gas hits $1.967 after frenzy over break of $2 support

- Next question is what will April gas do after Wednesday’s positive close

- Both weather and technicals look mixed to assure any direction

- Storage draws expected to be weak but closer to norm

The much-anticipated snap of the $2 support in natural gas has happened, at least in the soon-to-expire March front-month contract in Wednesday’s post-settlement trade.

The question now is what happens to the April contract, which officially becomes the benchmark from Friday, with trading volumes already four times higher than the March contract.

Gas prices have virtually been a one-way story for the past two months: Down.

From a 14-year high of $10 per mmBtu, or million metric British thermal units, in August, futures of the heating fuel on the New York Mercantile Exchange’s Henry Hub went to $7 by December on signs that the 2022/23 winter could have a warm start.

Wednesday’s sub-$2 low for the March contract — $1.967 to be precise — was reached after two months of one of the least cold winters in history. It was a bottom gas prices had not seen since Sept. 24, 2020, or in 2-½ years.

The question is whether that bottom is really the bottom of this selloff.

The response from analysts tracking the market wavered between a cautious yes and a too-soon-to-tell.

Those in the positive camp said the fact that April gas finished Wednesday's session higher, at almost $2.30, was in itself encouraging as there was a decent gap now between the contract and $1 territory.

Technical indicators are showing “momentum to the upside in the short term”, said Gelber & Associates, the Houston-based energy markets service, which for weeks had stuck to a bearish forecast for gas. “Traders appear to be targeting the $2 per mmBtu price level as a key support level,” Gelber added in a note.

In terms of fundamentals, the market could be nearing a “short-term bottom” as closer-to-normal heating demand was expected over the two weeks, EBW Analytics Group analyst Eli Rubin said in comments carried by naturalgasintel.com.

Weather forecasters explained that closer-to-normal meant conditions closer to historical norms — which at this time of year, wouldn’t normally be as cold as early February or January. To be sure, there are just over three weeks officially left to the 2022/23 winter before spring is ushered in.

NatGasWeather summed it up in an outlook, saying:

“Timing-wise, national demand will be moderate through Thursday as very cold air and areas of snow impact the West and Midwest, although not enough to counter much warmer than normal conditions over the South and East”.

The forecaster added that stronger demand will follow from Thursday through Saturday “as frosty air over the Northern Plains spreads eastward to include the Great Lakes and Northeast with chilly lows” from the negative teen Fahrenheit to the 30s.

“However, mild to nice temperatures will follow over much of the South and East” from Sunday through March 3, with some of the overnight data trending warmer for this period, the firm added.

The Climate Prediction Center, meanwhile, said its outlook indicates the highest probability of below-normal temperatures will come from the Pacific Coast to New England, along the northern third of the country. The Pacific Northwest through the Central Plains, in particular, are at risk for unusually chilly weather, the CPC said.

CPC forecasters said a tilt toward below-normal temperatures is likely over the eastern Great Lakes through parts of New England, though probabilities are lower given that some models showed above-normal temperatures reaching northward. Above-normal temperatures are likely over much of the U.S. Southeast. There are equal chances of above- and below-normal temperatures stretching across the country’s midsection to the Mid-Atlantic, according to the CPC.

Aside from the closer-to-normal weather conditions, feed demand for liquefied natural gas was also picking up from a steady recovery in volumes going into the Freeport LNG terminal in Texas, which has been slowly getting back to normal operations after a fire in June. Freeport had been a rock-solid base of 2 bcf, or billion cubic feet, of gas demand a day until it was knocked out. The terminal has lately been processing just about 10% of its previous capacity.

LNG feed gas demand is poised to “reach new highs over the next 30-45 days” and could “begin flattening the ballooning natural gas storage surpluses of the past 10 weeks”, said EBW analyst Rubin.

Potentially helping demand as well will be the 65% collapse in natural gas prices since December. The current market level of $2 per mmBtu is a serious incentive for U.S. utilities to consider using as much gas and as little coal as possible for power and heat generation, said analysts. Rubin himself anticipates that “more than 4 bcf per day of price-induced coal-to-gas switching” could occur.

That’s all for the positive side. For the not-so-bullish theme, there are ample technical signals that gas isn’t entirely out of the woods yet, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

Dixit described Wednesday’s bounceback from the lows as a technical one caused by the divergence of gas futures’ RSI, or Relative Strength Index, on the daily chart — a development that bucked lower lows for prices.

“The current bullish momentum may be short lived unless we see a sustained break above the Daily Middle Bollinger Band of $2.51 and above, and a further recovery challenging $2.68.”

“Weakness below $2.16 will, however, put gas futures back into a bearish channel, with enough room to dig deeper into the $1.75 and $1.43 levels.”

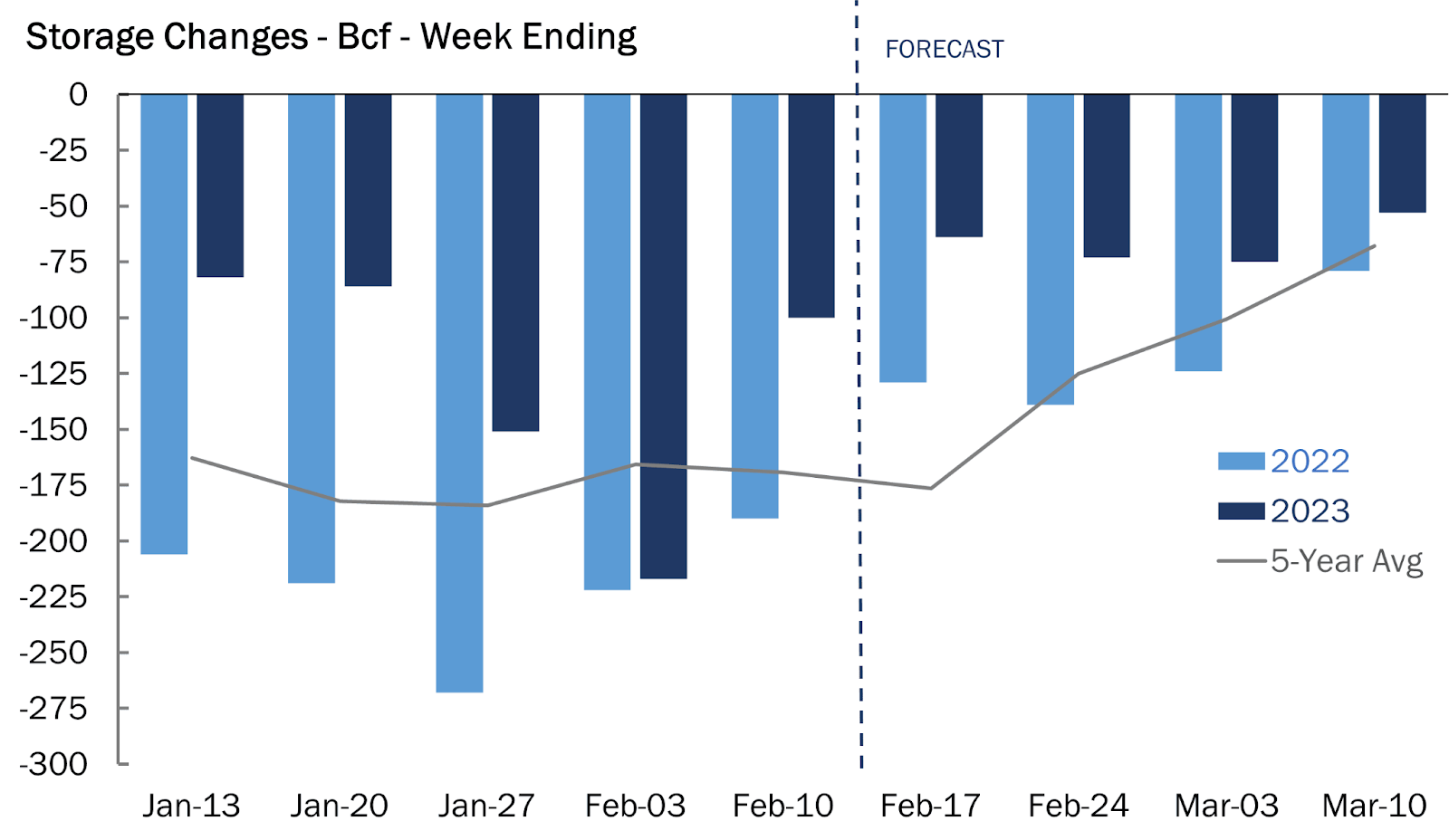

Source: Gelber & Associates

Thursday’s market in natural gas will also feature traders’ reaction to weekly U.S. storage numbers for gas, released by the EIA, or Energy Information Administration.

According to analysts tracked by Investing.com, utilities probably pulled an average of 67 bcf from storage during the week ended Feb. 17, versus the 100 bcf drawdown during the previous week to Feb. 10.

For comparison, the EIA recorded a 138 bcf withdrawal in the same week last year and the five-year average pull is 177 bcf.

Total working gas in storage as of Feb. 17 stood at 2,266 bcf, which is 328 bcf higher than year-earlier levels and 183 bcf higher than the five-year average, according to EIA.

With neither weather nor storage draws being bullish enough to carry the market, it was not surprising that many market participants see Freeport as the greatest factor for upside pricing in gas, Rystad analyst Ade Allen said. He added:

“Even with the addition of structural volumes coming online from Freeport LNG as early as March, a price rebound is nothing more than a pipe dream.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.