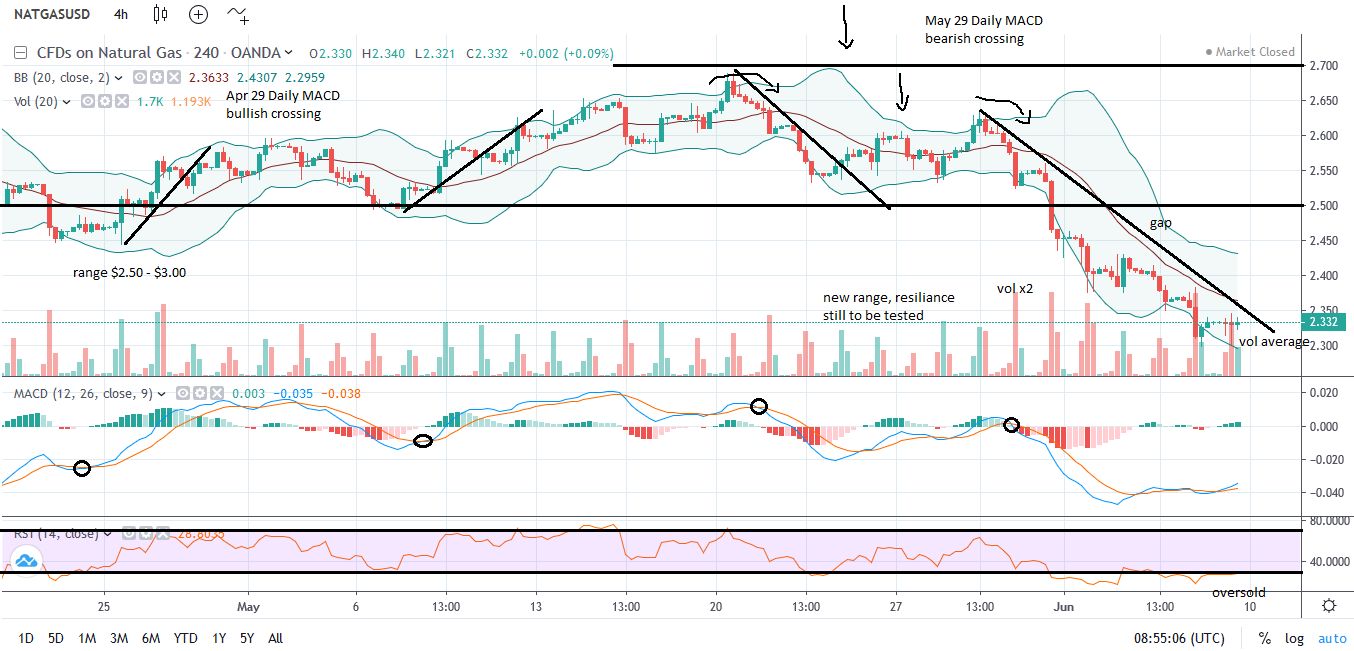

Natural Gas futures market on the Nymex faced another negative week as price slipped further to produce new 3-year lows. Friday’s session closed 4.50% lower than a week ago at $2.33. Recent Daily MACD bearish crossing, following 5-year record weekly builds in working underground stocks, repeatedly in the last couple of months of the refill season, putting fresh pressure on producers and most of market participants as fundamentals remain bearish in the last few years. Thursday’s EIA storage report confirmed a 114 Bcf build for the week ended May 31, as three digit figures keep on coming. We like to sell rallies on shorter term charts. A bounce at this level is very welcome to offer fresh opportunity, we don’t like to go against the market nor becoming too greedy about this highly anticipated fall. Demand still low as the weather is looking mild and only an increase in demand for electricity generation for cooling, later in the dog days, will offer support while new export agreements are yet to buffet the domestic industry. New range bound movements on lower trading volumes are usual as Summer progresses so we have to keep an eye on it routinely, to find out about a potential new range that is still shaping. Monitoring also the U.S. macro figures, industrial output, domestic demand and the U.S. Dollar Index . Trading volumes, Daily, 4hour, 15min MACD and RSI are offering precision to our entry decisions.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.