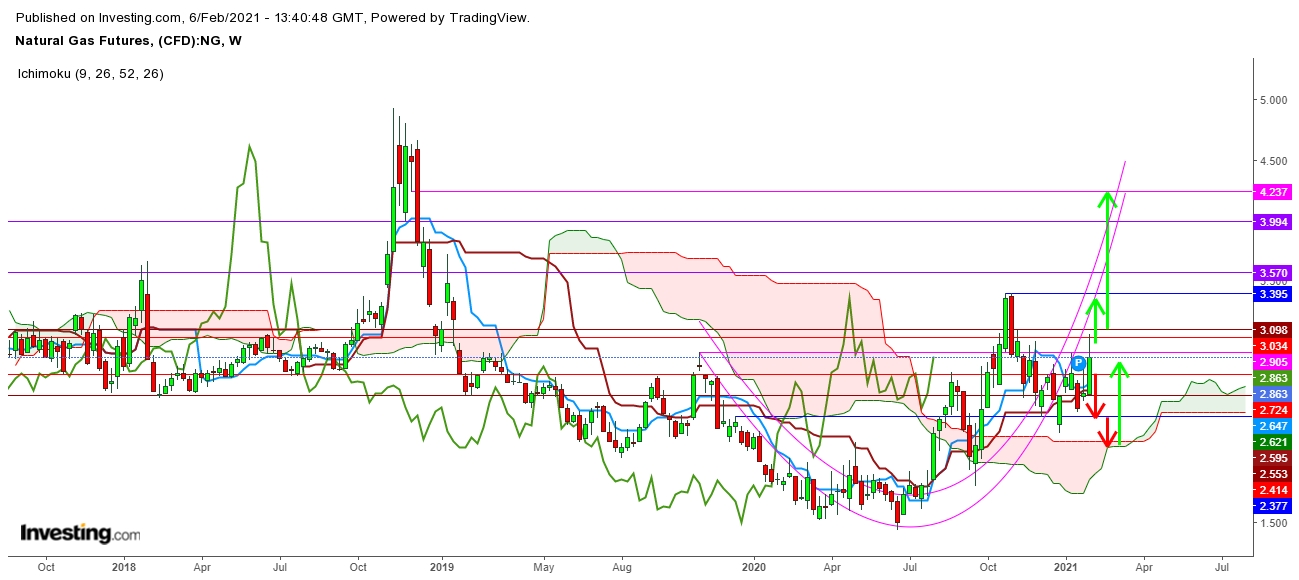

Natural Gas looks ready for a decisive move with a breakout from the range from $2.731 to $2.961. After repeated attempts, Natural Gas futures finally break the psychological resistance at $3 during the first week of February 2021. I find that the Natural Gas Futures look ready to cross the immediate resistance zone between the levels of $3.040 - $3.098 as Arctic air to blanket much of the U.S. and extend toward the Gulf Coast by next Friday. There is no doubt that this February could be one of the coldest months, which could push the weekly withdrawals up to 300 Bcf.

I find that the Natural Gas Futures could take a decisive move only below the immediate supports at $2.793 and $2.731, where bears could try to hold the command. But a breakout above $3.166 could push the Natural Gas Futures towards the next resistance at $3.290. I find that the last two weekly withdrawals of 192 Bcf look evident enough to see the upcoming weekly inventory could remain above 220 Bcf. I find that the rest of the days of this month could see highly volatile moves, but the trend could be one-sided during the last two weeks of February 2021. I find that natural gas bulls could find massive support from the weather and the withdrawals.

I find the Natural Gas Futures could form a new base above the level of $3.166 to test the next target at $4. I find that the oversupply issue, natural gas bulls look ready to break all the barriers above $3; to achieve their next target. There is no doubt that if the Natural Gas Futures start the upcoming week with a gap-up opening above the $2.956 and breaks the psychological resistance of $3 during the first two trading sessions of the next week, the uptrend could continue up to $3.348. But, the need of the hour is to remain extremely cautious during the upcoming week.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Natural Gas: Weather And Withdrawals Could Support Bulls

Published 02/07/2021, 08:12 AM

Updated 07/09/2023, 06:31 AM

Natural Gas: Weather And Withdrawals Could Support Bulls

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.