After Tuesday’s turn, natural gas rebounded again after finding support at the initial base at $6.064 as EIA's latest projections for 2022 were higher than its October forecasts of 97.56 bcfd for supply and 87.89 bcfd for demand.

On Tuesday, the U.S. Energy Information Administration (EIA) presented its Short-Term Energy Outlook, which indicates U.S. demand and production will rise to record highs in 2022.

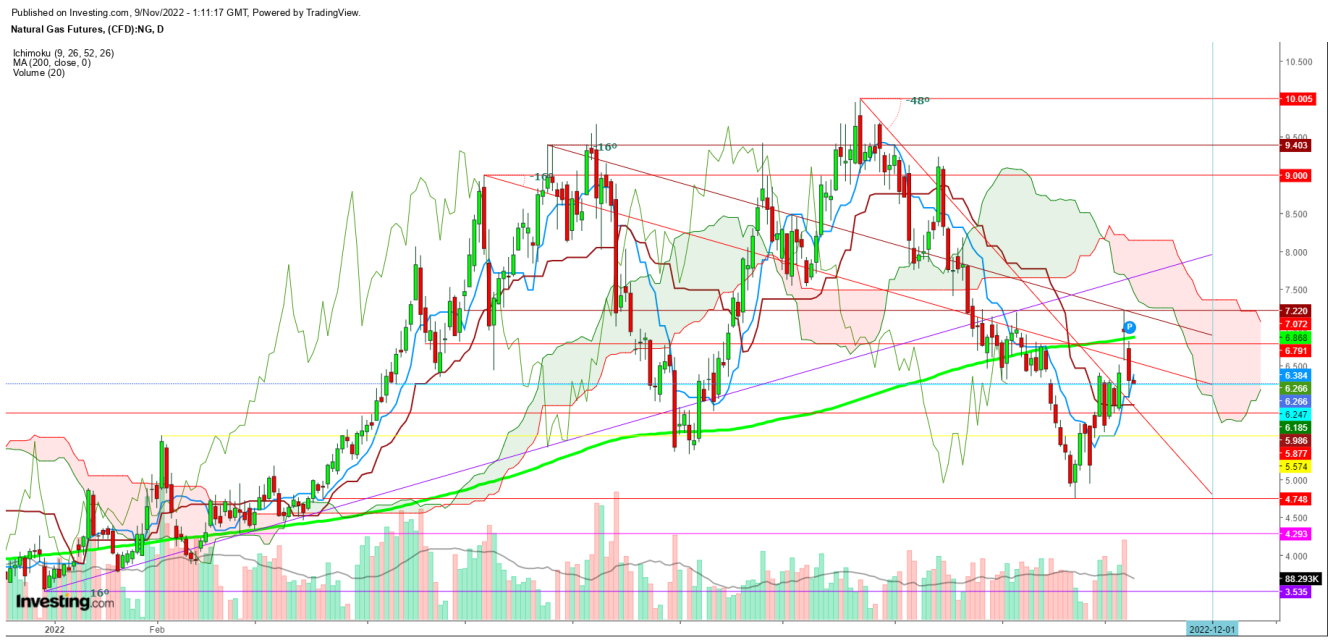

In the daily chart, natural gas tested a day’s low at $6.064, which is the long-term support, before starting a reversal on Wednesday.

If this support maintains for some time, the first breakout above the immediate resistance at $6.248 will confirm an upward trend.

The next confirmation will be with the next sustainable move above $6.512 before proceeding toward 200 DMA, which is currently at $6.686.

The bulls could attempt to stay above this before proceeding more upward, but still, the fear of sudden slide continues to hover as the weather still looks to favor the bears.

The pre-winter season could cause a surge in demand, but supply and storage concerns could result in selling sprees if production rises in the short term.

On the other hand, changing climate patterns could disrupt the demand-supply equation, resulting in wild price swings until this year's end.

In the daily chart, natural gas is currently trading below the 9 DMA, which is currently at $6.384, indicating weakness.

Despite forming a ‘bullish crossover’ in the daily chart, weakness could persist if prices fail to hold the 26 DMA, which is the next significant support at $5.986.

A breakdown below $5.676 could push prices to hit the next significant support at $5.048.

Disclaimer: The author of this analysis does not have any position in Natural Gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.