Last week's natural gas close at $6.4 has increased the probabilities of repetition of historical moves in different time frames.

The weekly opening levels and follow-up moves on the first trading session will show the further direction of natural gas during the rest of November 2022.

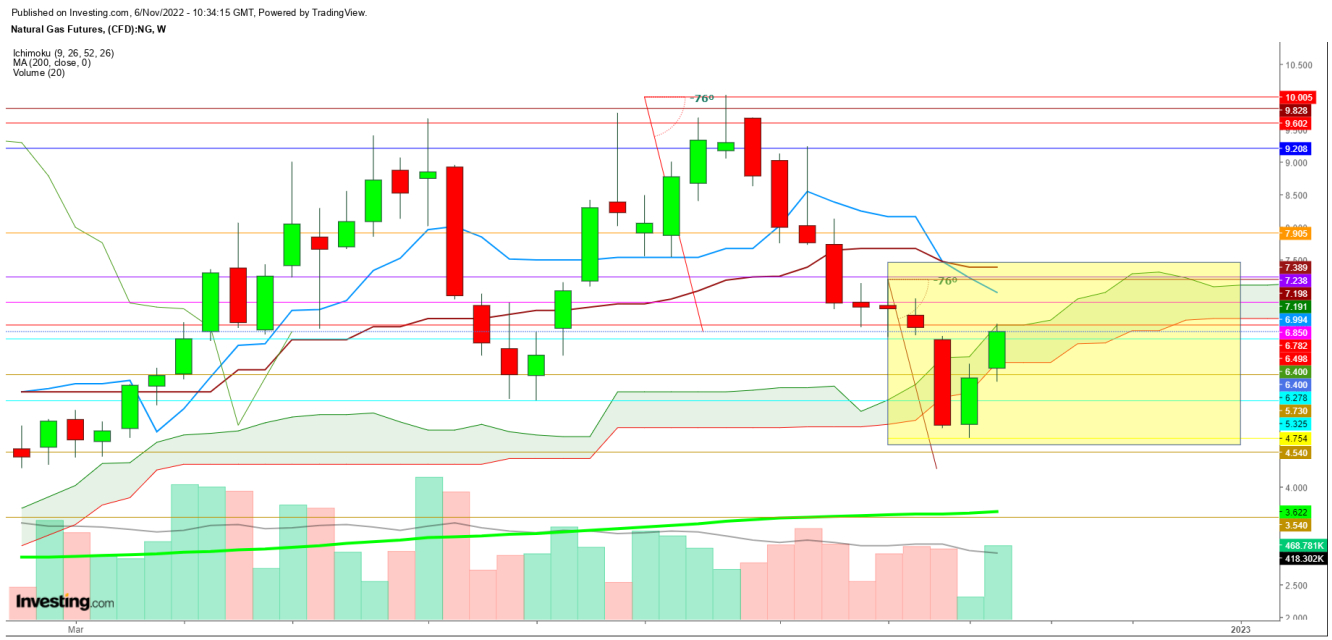

On the monthly chart, natural gas continued to form bearish candles since the recent peak at $10.005 on Aug. 23, 2022.

Natural gas started to slide in September 2022 after facing stiff resistance at $9.208 and continued to slide downward up to $6.569 before closing the month at $7.057. Some reversal was there from the monthly lows, but the overall trend was quite bearish.

October followed this weakness in natural gas prices amid extreme wild price swings as natural gas tested a high at $7.198 and a low at $4.754 before closing the month at $6.331. Undoubtedly, a strong reversal from the month’s low increased hopes among the bulls.

November started amid a sudden surge in the confidence of the natural gas bulls as the price showed a sudden increase in volatility during the first four trading sessions.

Despite the formation of a bullish hammer testing a high at $6.510 and a low at $5.620, closing at $6.400 raises concern about the further direction of the natural gas prices during the rest of November; and the follow-up monthly candles.

Natural gas could repeat this if not sustained above $6.512, with good volumes during the upcoming week.

On the weekly chart, natural gas showed a strong reversal during the last two weeks from the low at $4.574 and remained bullish until the weekly closing at $6.400 after hitting the week’s high of $6.510.

Recent weekly moves could trigger buying spree witnessed during the second week of July 2022 from the week’s low at $6.046.

This rally continued to $9.751 during the last week of July 2022, which resulted in a sharp sell-off during this week of July 2022 when natural gas hit a weekly low at $8.034 before closing that week at $8.247.

On the other hand, despite the formation of a ‘bearish crossover’ in the weekly chart could generate selling sprees. If natural gas doesn't breakout above $6.7 during the upcoming week, there could be a surge in the selling spree below the immediate support at $5.620.

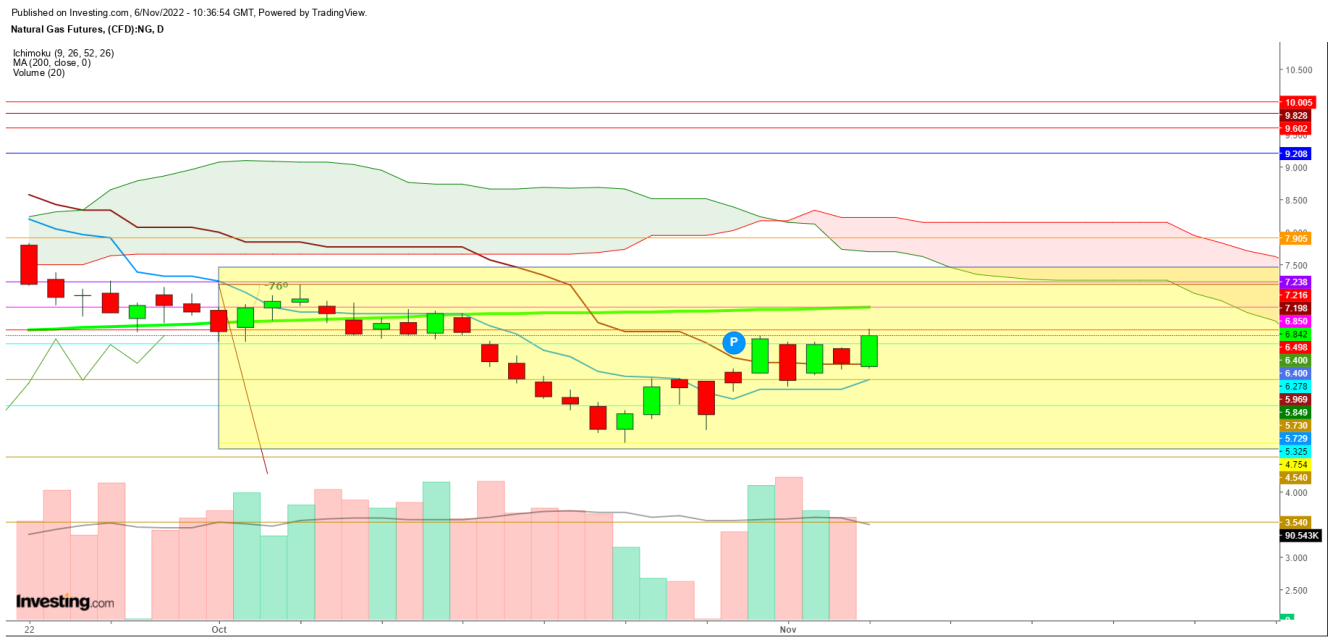

On the daily chart, the price constantly found support at 26 DMA during the last two trading sessions. But not able to find a breakout above the immediate resistance at $6.518 before closing Friday at $6.400, which looks evident enough to increase indecisiveness at this level.

In case of a gap-up opening on the first trading session of the upcoming week, if natural gas sustains above the immediate resistance at $6.518 and finds a breakout above the stiff resistance at 200 DMA, which is currently at $6.841, then only an upside could continue up to $7.512.

On the other hand, if natural gas starts the upcoming week with a gap-down opening below the immediate support at 9 DMA, which is currently at $5.729, a breakdown could follow below the second support at $5.325.

On the other hand, if natural gas could not find a sustainable move above 200 DMA, repetition of natural gas moves from Oct. 10-14, before the advent of a steep slide that pushed the futures up to the low at $4.754.

Overall, a sudden directional change is likely to enhance volatility till the end of this month as a one-sided trend could follow the current uncertainty created at $6.400.

Disclaimer: The author of this analysis does not have any position in Natural Gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.