While Texas residents are still grappling with the aftermath of winter storm Uri, which resulted in extreme cold and a catastrophic blackout, a new winter storm named Viola could add one more leg in the adverse weather conditions. Viola could dump between 6 to 12 inches of snow from West Virginia to Massachusetts, along with freezing rain and sleet.

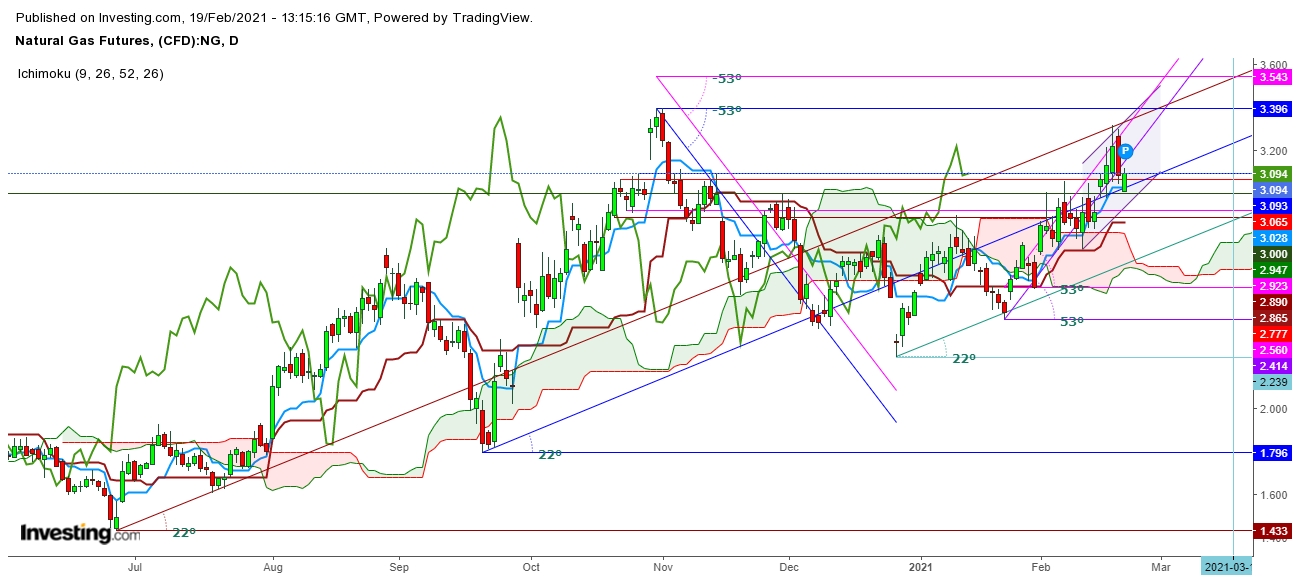

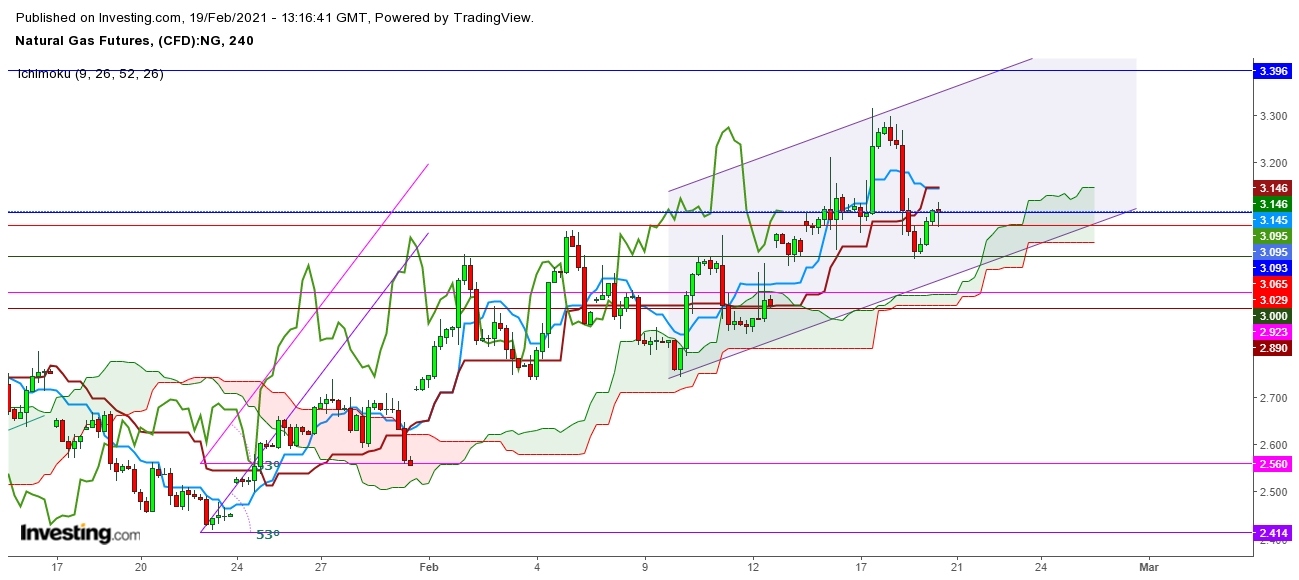

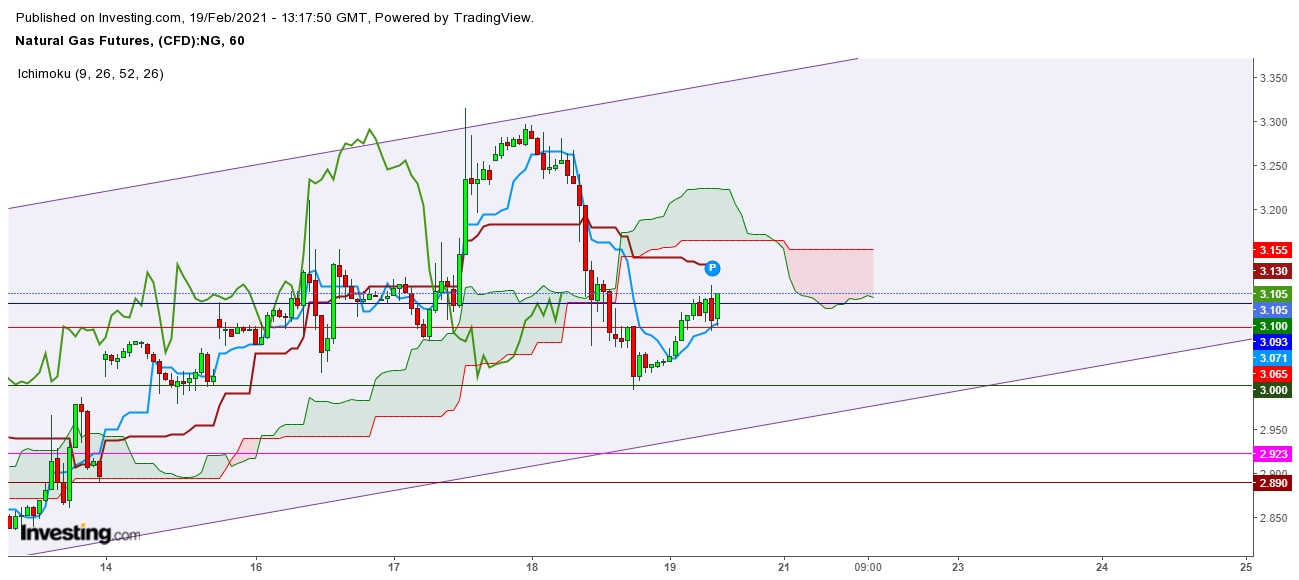

I find that the currently prevailing weather conditions could continue to encourage natural gas bulls during the upcoming week. I find that the winter storm Viola could support natural gas bulls to remain aggressive till this weekly closing but could continue to test new high during the upcoming week amid growing volatility.

Today, I find that the weekly closing levels of the natural gas futures will provide initial signals for directional moves during the upcoming week; that could start with a gap-up opening. But, if the natural Gas futures do not close this week above $3.155, bears could try to hold the command due to supply disruption of natural gas amid extreme freezing conditions.

There are no liquefied natural gas tankers docked and loading at any of the six U.S. export terminals. Moreover, this situation could result in an unusual position for the world’s third-largest shipper of the LNG, as the recent freeze could extend this supply disruption for a longer time.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.