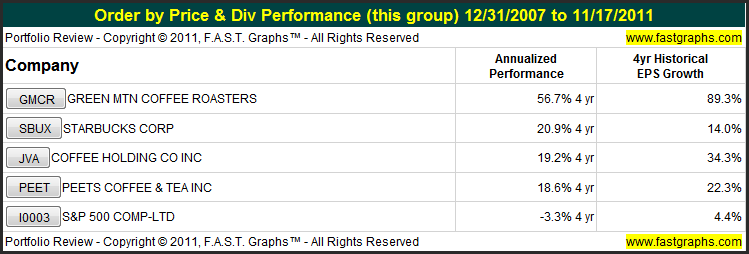

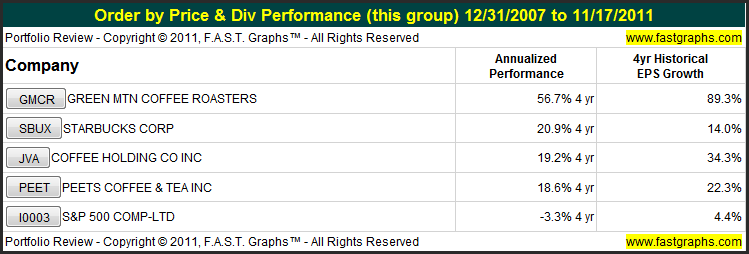

Up until very recently, specialty coffee stocks were among the best performing stocks in the market since the great recession of 2008. The following performance table comparing four of the leading specialty coffee companies against the S&P 500 (the average company) illustrate just how extraordinary their performance has been. Even more amazingly, these performance results reflect precipitous percentage drops in the stock prices of Green Mountain Coffee Roasters (GMCR) and Coffee Holding Co. Inc. (JVA) where each saw their stock prices essentially cut in half.

Historical Performance Since the Great Recession of 2008

Estimated Performance Next Five Years

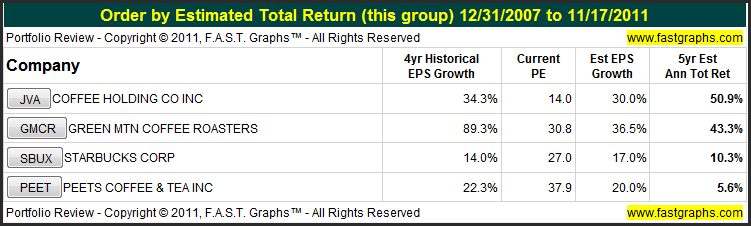

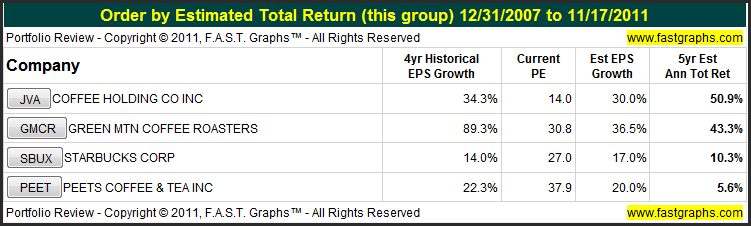

When turning our attention to the future, as prudent long-term investors must always do, we discover that Coffee Holding Co. (JVA) and Green Mountain Coffee Roasters (GMCR) are, based on fundamentals, expected to offer the best future five-year performance, just as they did over the past four years. We believe there are two primary reasons for this. First of all, these two companies are expected to achieve the fastest future earnings growth rates of the group. Second, both of these companies were overvalued prior to their stock prices crashing, but now can be bought with PE ratios that are lower than their expected future earnings growth.

In contrast, both Starbucks Corp. (SBUX) and Peets Coffee & Tea Inc. (PEET) are currently trading at PE ratios that are almost double their expected earnings growth rates. This is a reliable indication that current fundamentals do not support today’s valuations on either Starbucks Corp. (SBUX) or Peets Coffee &Tea Inc. (PEET). Therefore, current holders and prospective buyers of these quality businesses should take caution based on current valuations that are not supported by earnings and cash flows. In other words, the risk of owning these stocks is currently higher than the potential rewards would justify based on fundamentals.

The following table lists each of our specialty coffee companies in order of highest five-year estimated annual total return to lowest. The table shows each respective company’s four-year historical EPS growth rate, followed by its current PE ratio, followed by the consensus five-year estimated EPS growth, and finally, a five-year estimated annual total return based on these fundamental relationships. The most important takeaway that we believe this table illustrates is how the combination of attractive valuation coupled with strong earnings growth leads to high potential return expectations.

The first two companies with the best return expectations have PE ratios significantly below expected earnings growth. Conversely, the last two companies with the lowest return expectations have PE ratios that are significantly higher than their expected EPS growth. The first two companies on the list, thanks to low relative valuation, have return expectations significantly higher than earnings growth. On the other hand, the last two companies, due to overvaluation, have return expectations significantly below expected earnings growth.

Essential Fundamentals at a Glance

The following fundamental analysis provides a comprehensive look at the important dynamics of the relationships between earnings growth and valuation. Successful long-term investing requires a firm grip on and understanding of how these relationships intertwine to produce shareholder returns, and perhaps even more importantly, the amount of risk taken to achieve any given return. Of course, the investor’s goal should be to achieve the highest possible return while simultaneously taking the lowest possible amount of risk to achieve it.

Conclusions

The specialty coffee industry has been a great source of shareholder returns since the great recession of 2008. However, the strong returns did not go unnoticed by investors which therefore culminated in extended valuations for each of the four companies highlighted in this article. Two of these companies, Green Mountain Coffee Roasters (GMCR) and Coffee Holding Co. Inc. (JVA) at one point experienced stock price valuations that far exceeded their earnings justified levels. In both cases, Mr. Market, as he inevitably will, brought the stock prices of both companies back to more rational levels. Consequently, both of these companies may represent better and safer opportunities for above-average future returns than they have in a long time.

In contrast, both Starbucks Corp. (SBUX) and Peets Coffee & Tea Inc. (PEET) have also achieved stock price valuations that exceed their expected operating potential. Therefore, we would caution investors that the risk of owning these quality specialty coffee companies are high and the long-term return potential lower than it should be. Although these are both superb businesses with excellent fundamentals and solid prospects for future growth, there is a rational limit that prospective investors should be willing to pay. Overvaluation needs to be recognized and respected for successful long-term investing to be achieved.

Disclosure: No positions at the time of writing.

Below You May Find The Video.

Historical Performance Since the Great Recession of 2008

Estimated Performance Next Five Years

When turning our attention to the future, as prudent long-term investors must always do, we discover that Coffee Holding Co. (JVA) and Green Mountain Coffee Roasters (GMCR) are, based on fundamentals, expected to offer the best future five-year performance, just as they did over the past four years. We believe there are two primary reasons for this. First of all, these two companies are expected to achieve the fastest future earnings growth rates of the group. Second, both of these companies were overvalued prior to their stock prices crashing, but now can be bought with PE ratios that are lower than their expected future earnings growth.

In contrast, both Starbucks Corp. (SBUX) and Peets Coffee & Tea Inc. (PEET) are currently trading at PE ratios that are almost double their expected earnings growth rates. This is a reliable indication that current fundamentals do not support today’s valuations on either Starbucks Corp. (SBUX) or Peets Coffee &Tea Inc. (PEET). Therefore, current holders and prospective buyers of these quality businesses should take caution based on current valuations that are not supported by earnings and cash flows. In other words, the risk of owning these stocks is currently higher than the potential rewards would justify based on fundamentals.

The following table lists each of our specialty coffee companies in order of highest five-year estimated annual total return to lowest. The table shows each respective company’s four-year historical EPS growth rate, followed by its current PE ratio, followed by the consensus five-year estimated EPS growth, and finally, a five-year estimated annual total return based on these fundamental relationships. The most important takeaway that we believe this table illustrates is how the combination of attractive valuation coupled with strong earnings growth leads to high potential return expectations.

The first two companies with the best return expectations have PE ratios significantly below expected earnings growth. Conversely, the last two companies with the lowest return expectations have PE ratios that are significantly higher than their expected EPS growth. The first two companies on the list, thanks to low relative valuation, have return expectations significantly higher than earnings growth. On the other hand, the last two companies, due to overvaluation, have return expectations significantly below expected earnings growth.

Essential Fundamentals at a Glance

The following fundamental analysis provides a comprehensive look at the important dynamics of the relationships between earnings growth and valuation. Successful long-term investing requires a firm grip on and understanding of how these relationships intertwine to produce shareholder returns, and perhaps even more importantly, the amount of risk taken to achieve any given return. Of course, the investor’s goal should be to achieve the highest possible return while simultaneously taking the lowest possible amount of risk to achieve it.

Conclusions

The specialty coffee industry has been a great source of shareholder returns since the great recession of 2008. However, the strong returns did not go unnoticed by investors which therefore culminated in extended valuations for each of the four companies highlighted in this article. Two of these companies, Green Mountain Coffee Roasters (GMCR) and Coffee Holding Co. Inc. (JVA) at one point experienced stock price valuations that far exceeded their earnings justified levels. In both cases, Mr. Market, as he inevitably will, brought the stock prices of both companies back to more rational levels. Consequently, both of these companies may represent better and safer opportunities for above-average future returns than they have in a long time.

In contrast, both Starbucks Corp. (SBUX) and Peets Coffee & Tea Inc. (PEET) have also achieved stock price valuations that exceed their expected operating potential. Therefore, we would caution investors that the risk of owning these quality specialty coffee companies are high and the long-term return potential lower than it should be. Although these are both superb businesses with excellent fundamentals and solid prospects for future growth, there is a rational limit that prospective investors should be willing to pay. Overvaluation needs to be recognized and respected for successful long-term investing to be achieved.

Disclosure: No positions at the time of writing.

Below You May Find The Video.