Natural gas looks set to face immediate resistance at $6.278, and the bears could turn aggressive above this level.

The bulls showed some strength from the opening levels after finding significant support at $6.064 on Monday but still look skeptical after a steep fall on Friday during the last trading hours.

Undoubtedly, yesterday’s move could play a decisive role this week. However, today’s economic data still could be a game changer as China is to release October data on retail sales, industrial production, investment, and employment, with economists expecting the figures to reflect the ongoing impact of the government's zero-COVID policy.

It looks as if both the natural gas and crude oil futures could continue to simmer at the current levels as the traders are waiting for today’s announcements by China as Beijing said Friday it was easing some of its COVID restrictions, including shortening quarantines by two days for close contacts of infected people and inbound travelers.

This comes despite cases on the mainland at 6-month highs and some big cities under fresh lockdowns. Recent data showed exports and imports unexpectedly contracting, inflation slowing, new bank lending tumbling, and property sales in an extended decline.

On the other hand, Ukraine's Zelenskiy, due to address G20 on Tuesday, could provide a significant indication of the trend in gas and oil prices.

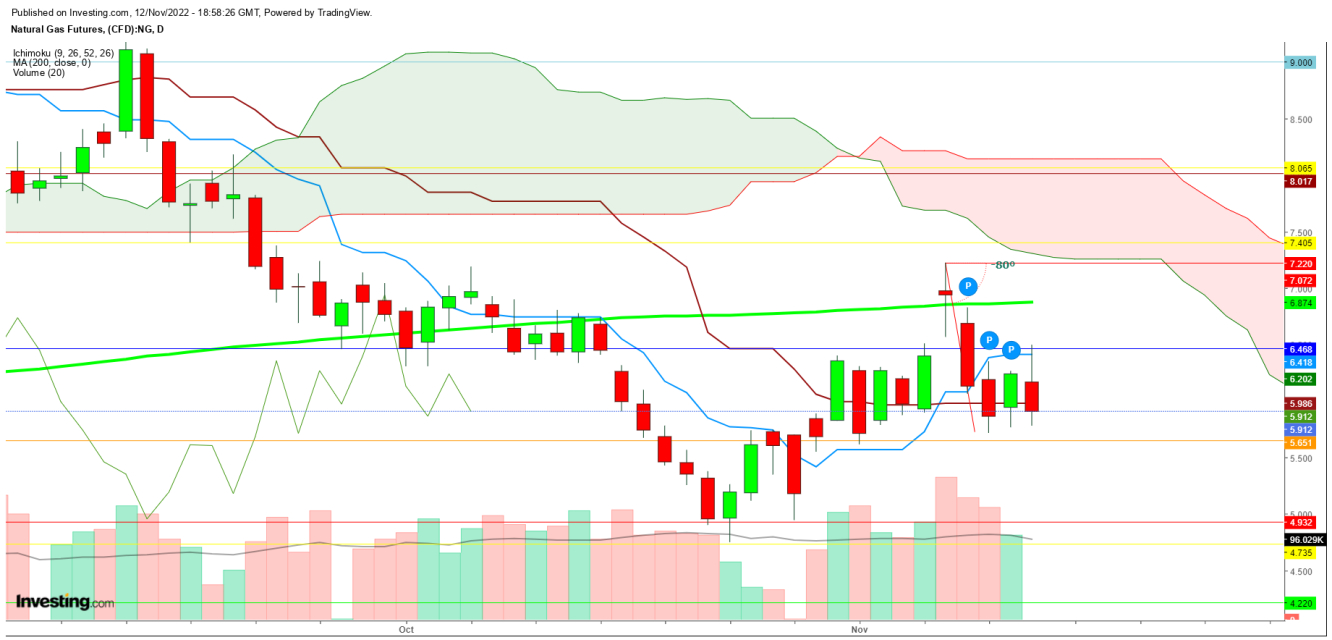

Technical Outlook - Natural Gas

In the weekly chart, natural gas has shown some exhaustion during the last week after forming a ‘Bearish Crossover.’

This week has witnessed the formation of an ‘Exhaustive Candle’ facing stiff resistance at the upper end of the Ichimoku Cloud. Support at its lower end confirms weakness could follow as the bears will sell rallies above $6.445.

In the daily chart, natural gas could continue to feel Friday’s Fear as the bears turned aggressive yesterday above $6.4 and tested the lows at $5.896, confirming that every upward move will attract big bears to command the scenario during this week.

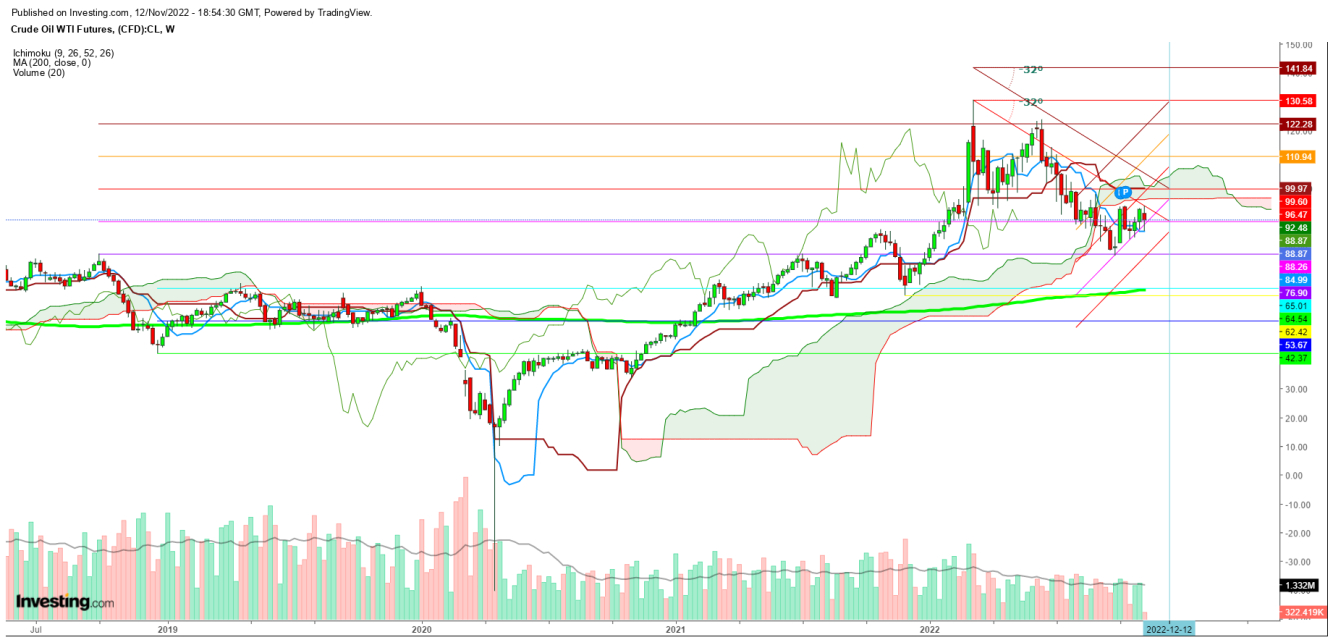

WTI Crude Oil

In the weekly chart, WTI crude oil is trying to sustain above the 9 DMA, which is currently at $84.995, confirming a rally to try and find a breakout above the 26 DMA, immediate resistance, which is currently at $99.965.

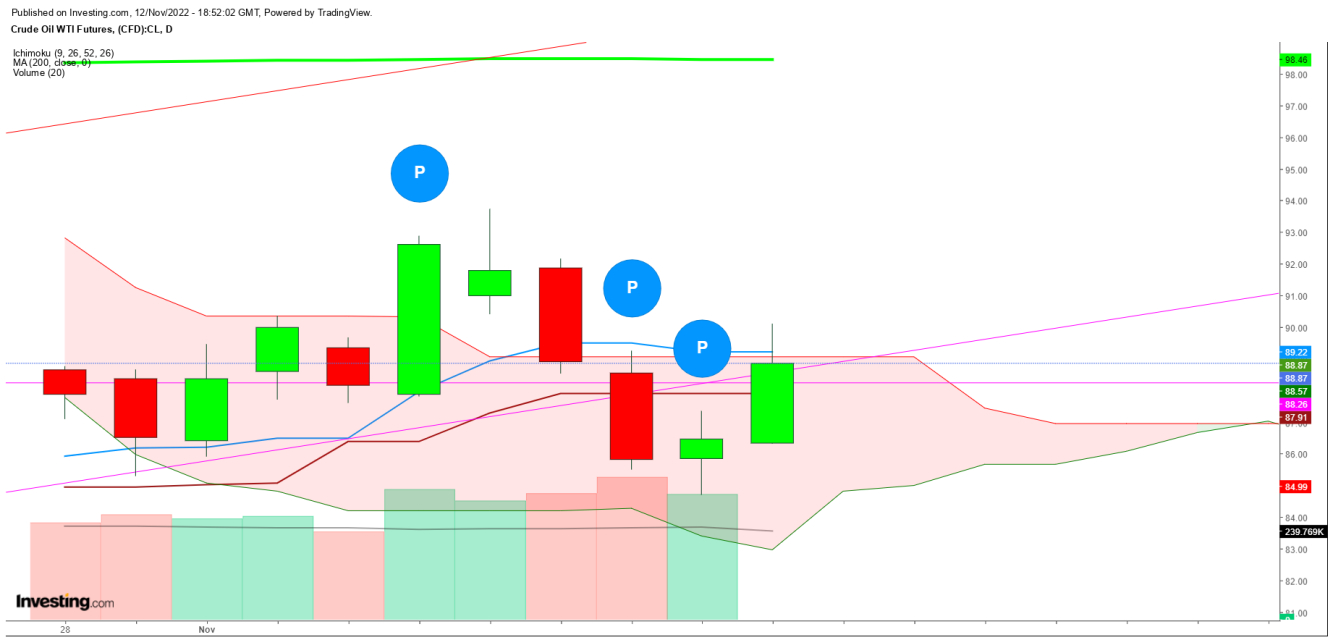

In the daily chart, the prices could make a decisive move with a breakout or a breakdown above the Ichimoku Clouds. They are currently hovering at the lower end of the Ichimoku Clouds.

Disclaimer: The author of this analysis does not have any position in Natural Gas and WTI Crude Oil. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.