In our analysis, we'll take a look at the extended trading range experienced by natural gas futures last week, as growing noise was flowing in about the impact of the Freeport blast. The impact of the blast could result in supply disruption for a extended time to Asia and Europe, particularly as a steep surge in demand continues.

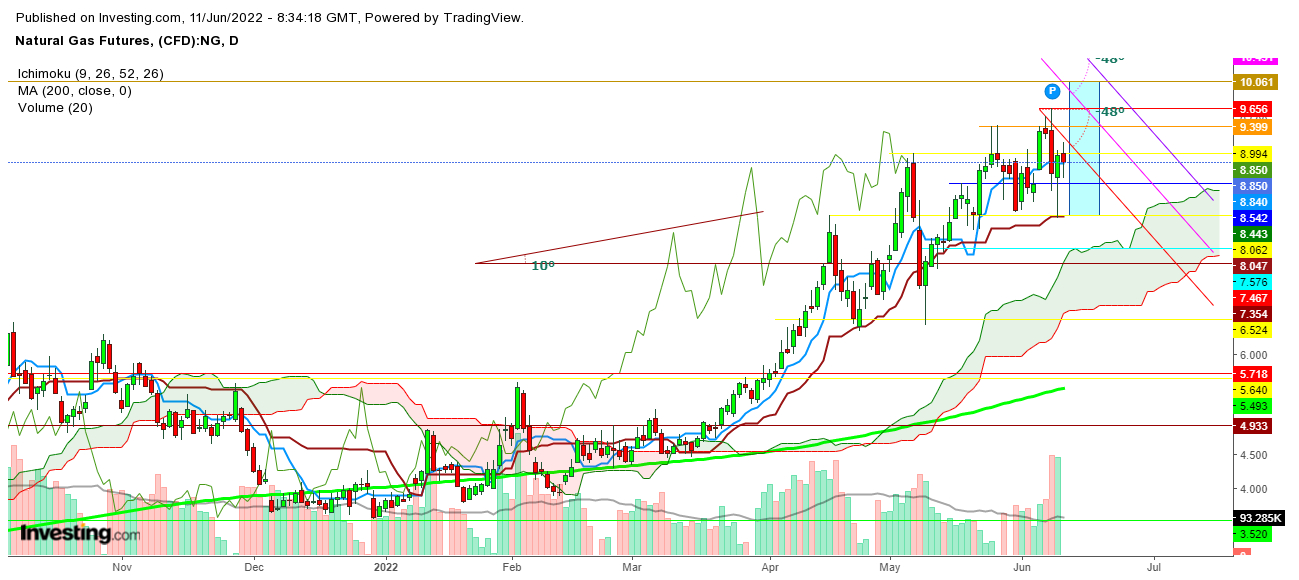

US natural gas prices tumbled after a fire broke out at the Texas export terminal at Freeport, threatening to leave the supply of the fuel stranded in shale basins despite surging overseas demand. NG tested a low at $8.024 and a high at $9.656 before closing the week at $8.850.

Undoubtedly, the duration of the supply outage matters significantly as this could continue to impact power production as hot weather conditions continue from California to Texas with highs in the mid-90s to 110°F, resulting in regionally strong demand.

In addition, growing inflation could add one more leg to the sharp surge during the upcoming weeks as the national average price for regular unleaded gasoline increased to $5.004 a gallon on June 11, up from $4.986 one day previous.

This sudden surge in regular unleaded gasoline could encourage natural gas bulls to start the first trading session of the upcoming week with a gap-up opening.

In the weekly chart, we see NG possibly experiencing an overstretched trading range of about $2, raising the price from $8.061 to $10.062. The final weekly closing of the coming week could remain above $9.767 since the moving averages still indicate an uptrend.

Despite a lot of selling pressure, NG's daily chart on Friday found its closing point well above the 9 DMA, which is currently at $8.440. This could result in a gap-up opening on the first trading session of the upcoming week with bulls turning more aggressive once they find a sustainable move above $9.4.

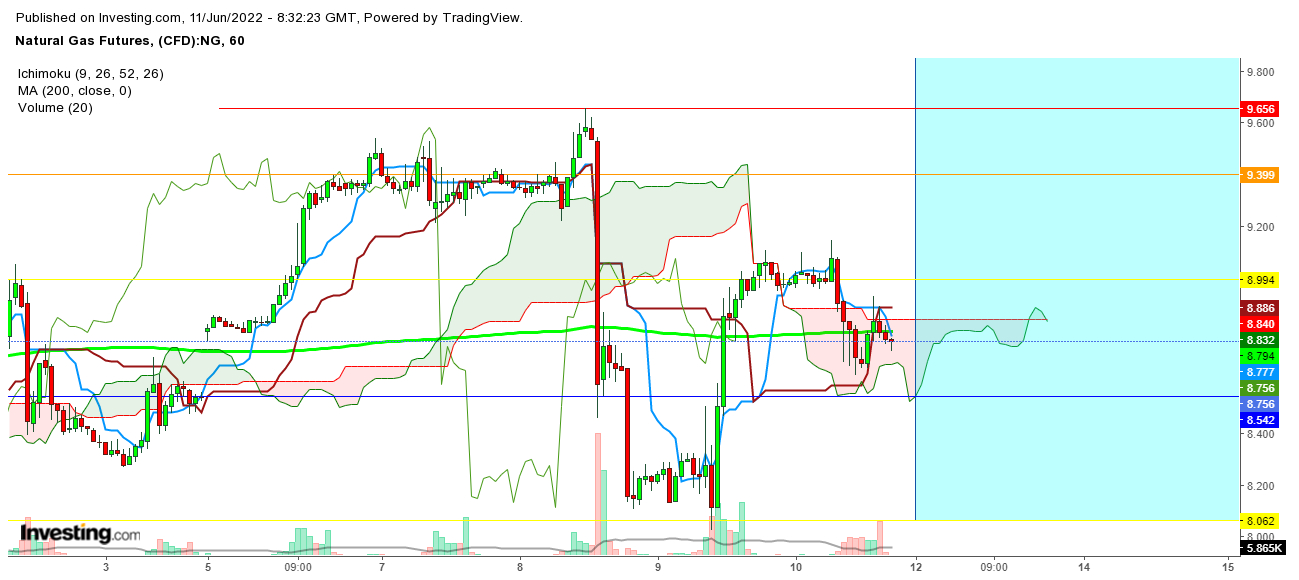

On the hourly chart, the overall situation looks favorable for natural gas bears as NG closed the week well below the 200 DMA. This may lead to extreme volatility during the first two trading sessions of the upcoming week.

Wednesday could finally define the final direction of the commodity as the overall supply outage situation and duration could finally be clarified.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Natural Gas: Trading Range Could Stretch Up By $2

Published 06/11/2022, 12:53 PM

Updated 07/09/2023, 06:31 AM

Natural Gas: Trading Range Could Stretch Up By $2

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.