December saw natural gas futures continue to consolidate in a range-bound trading zone between $3.632 and $4.040 which started on Dec. 5, 2021. On Dec. 5, 2021, NG started the week with a gap-down opening at $3.815 after closing the previous week at $4.099. Undoubtedly, this $0.284 gap was the resultant impact of growing voices raising the belief that a warm winter was in forecast and that continued to keep the bears in command during this period.

But shifting atmospheric conditions confirmed that winter could actually be extremely cold from mid-January to mid-February 2022, which may once again create a gap of more than $0.284 to continue the reversal of the current trend.

Some analysts predict the possibilities of a polar vortex appearing in mountainous regions in January, February, and early March of 2022. This change in the weather outlook is in stark contrast to the range-bound trading natural gas futures experienced during the whole month of December 2021.

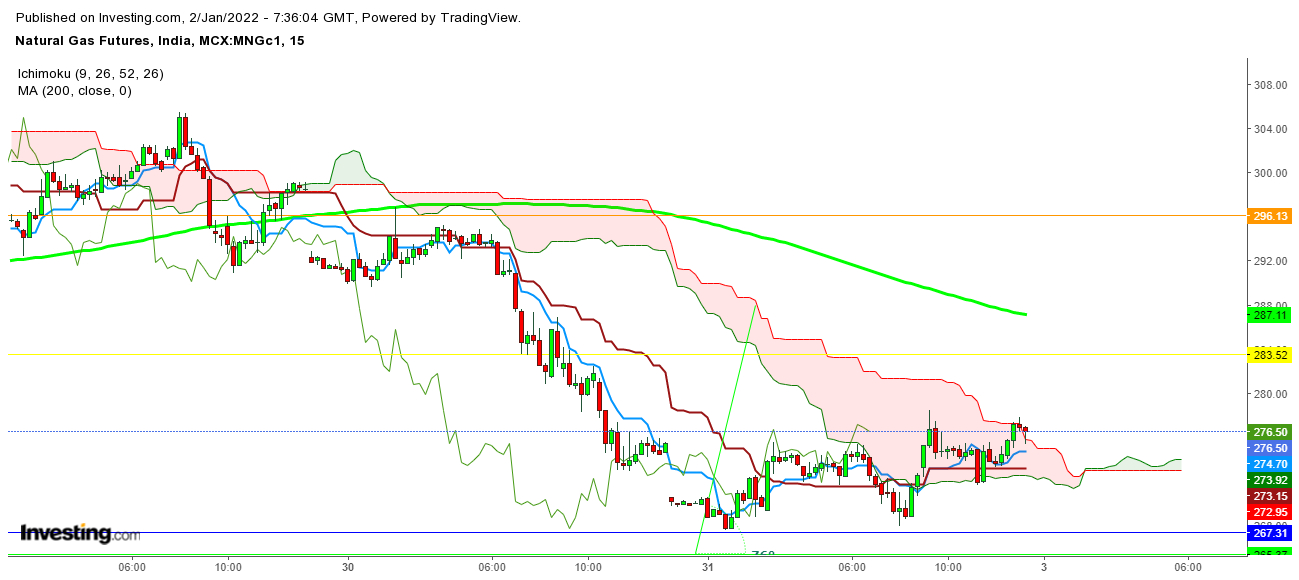

The EOY technicals point to a gap-up opening on Jan. 3, 2022, which will be an initial clue about the forthcoming directional trend of the commodity. The 15 minute chart shows NG finally finding a breakout above the 200 DMA that ensures a gap-up opening of more than $0.284 that will push NG to reflect the updated weather front.

If NG finds sustainable moves well above $4.099 on the first two trading sessions of the upcoming week, we could see the advent of a renewed uptrend voyage that may continue during the first 8 – 9 weeks of 2022.

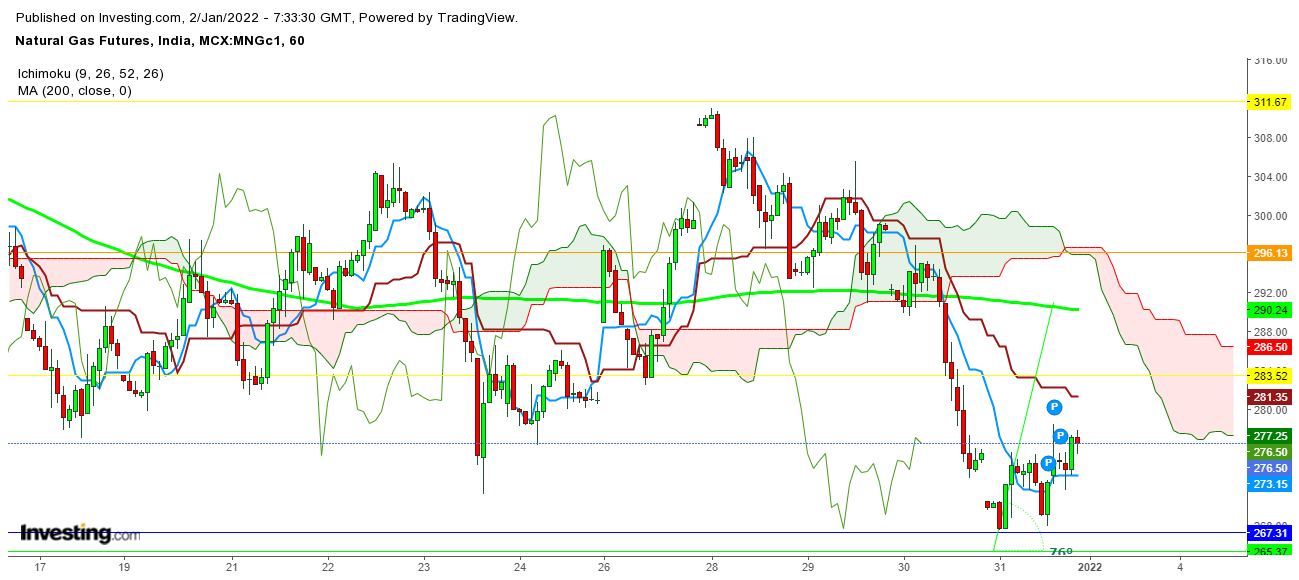

The hourly chart showed a strong pullback during the last few hours before the weekly closing on Dec. 31, 2021. NG closed the week below the ‘Ichimoku Clouds’ in the hourly chart but, the strong pullback showed a strong current in the last hour that may continue during the upcoming week if it finds a big gap-up opening.

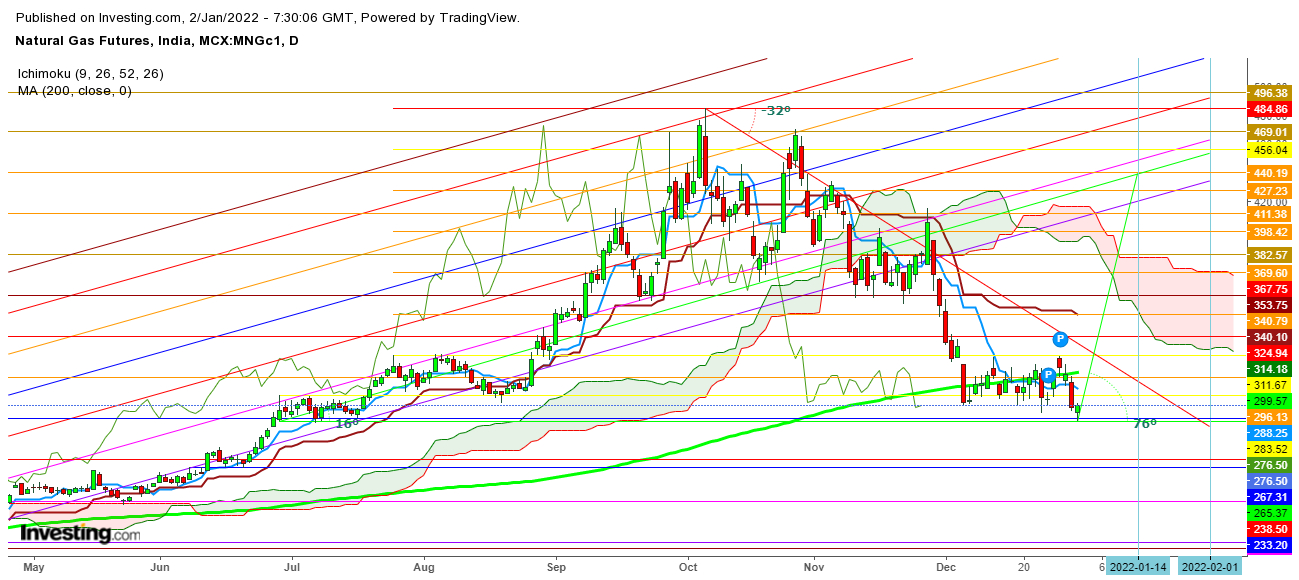

On the daily chart, the appearance of a green candle on Dec. 31 showed the confidence of bulls to find a breakout above 200 DMA, which is currently at $4.014. That could encourage natural gas bulls to go with the shifting weather outlook that may prevail between mid-January to mid-February 2022. In a daily chart, the immediate target for the bulls could be $4.440. Undoubtedly, a breakout above this level could keep the bull's heading towards the next psychological resistance above $5.

Natural gas futures could make extremely volatile moves between the two psychological resistances points at $4 and $5 during the first two weeks of January 2022, before a decisive breakout, until we find sudden stratospheric warming in January.

If the current tight trading range of December 2021 finds the breakout above $4.099 in the first week of January 2022, it will confirm that natural gas traders see the advent of winter's moves; same as those seen during January, February, and March of 2013.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk as Natural Gas is one of the most liquid commodities of the world.