In late June, the price of natural gas futures fell to a new 25-year low on the expiring July futures contract. The previous low in March was at $1.519, and the energy commodity fell to $1.432. The low in the active month August contract was at $1.517 on June 25 and 26. The double bottom formation gave way to a long-overdue recovery in the futures market.

The August contract had traded to a high of $2.447 on May 5. It was the highest price of 2020 for the contract for delivery during the heart of the summer season. While natural gas tends to reach highs during the early winter, the switch from coal to natural gas-powered electricity production often supports the price as the demand for air conditioning rises in the summer months. In mid-January, the August futures hit $2.3450.

The early high gave way to a low at just over the $1.50 level. As the natural gas market prepared for the latest inventory data from the Energy Information Administration, the price recovered to the $1.85 per MMBtu level. The United States Natural Gas Fund (UNG) moves higher and lower with the NYMEX futures price.

Market Expected 60 bcf Injection

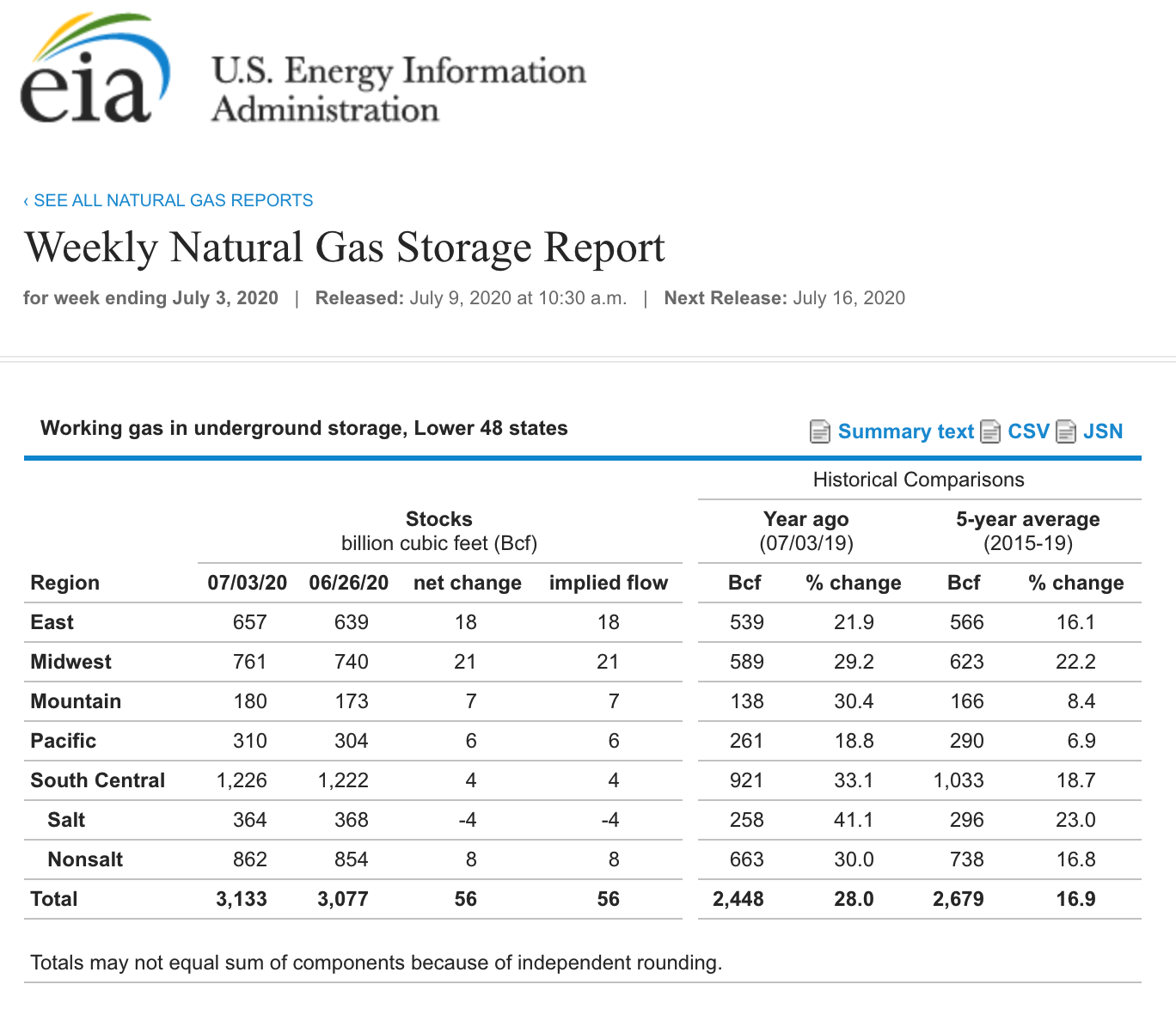

According to Estimize, a crowdsourcing website, the market’s consensus was for a 60-billion-cubic-feet injection into storage for the week ending on July 3, 2020.

Source: EIA

As the chart shows, the inventory data came in at just below the estimates with a 56 bcf injection. Stocks rose to 3.133 trillion cubic feet, 28% above last year’s level, and 16.9% under the five-year average for this time of the year. The data marked the 15th consecutive week where the percentage above last year’s level declined.

(Source: CQG)

As the 10-minute chart illustrates, the price of August natural gas futures rose to a high of $1.891 before the EIA’s latest data release. In the aftermath of the smallest injection into inventories since the week of April 17, the price dropped to the $1.80 per MMBtu level.

Price Rallied Before Latest Data

On June 25 and 26, the price of August futures fell to a low of $1.517 per MMBtu and put in a double bottom formation on the daily chart.

Source: CQG

The daily chart highlights that the price momentum and relative strength indicators fell into oversold territory in late June. The rebound turned the metrics higher with price momentum rising towards an overbought reading and relative strength above neutral territory on Thursday, July 9. During the price recovery, the wider daily trading ranges lifted the measure of daily historical volatility from below 33% on June 24 to over 80% on July 9.

Natural Gas Could Burn Speculative Shorts

Open interest is the total number of open long and short positions in a futures market. In the volatile natural gas market, the metric’s level is often a sign of speculative interest in the market.

Source: CQG

The chart shows that open interest trended higher as the price of the energy commodity fell from early May through late June. As the price declined from $2.447 to $1.517 on the August contract, open interest rose from below 1.2 million to more than 1.33 million contracts. Speculative shorts likely pushed the price lower over the two months. Meanwhile, the metric was at 1.286 million contracts on July 8, which was above the midpoint since early May. Some of the shorts likely covered risk positions during the latest rally that took natural gas to a high of $1.924 on July 7. However, any sign of weakness could cause them to come running back to the market that made two new quarter-century lows in March and June.

The lower the price of the energy commodity, the higher the odds that the natural gas market will burn over aggressive bears. I continue to favor a long position during periods of price weakness in the natural gas futures market. Last year at this time, the price was over 50 cents per MMBtu higher at the $2.40 level. The heart of the summer season is likely to continue to cause the demand for natural gas to rise as air conditioners run overtime. Natural gas replaced coal as the primary ingredient in power generations in the U.S. According to Baker Hughes, 76 natural gas rigs were operating in the U.S. as of July 2, 98 lower than last year at the same time. Falling production and rising demand led to the smallest injection into storage since mid-April this week. The EIA’s latest data was supportive of the price of the energy commodity, and I continue to favor buying on dips. My target remains the $2.10 to $2.15 level on August futures.