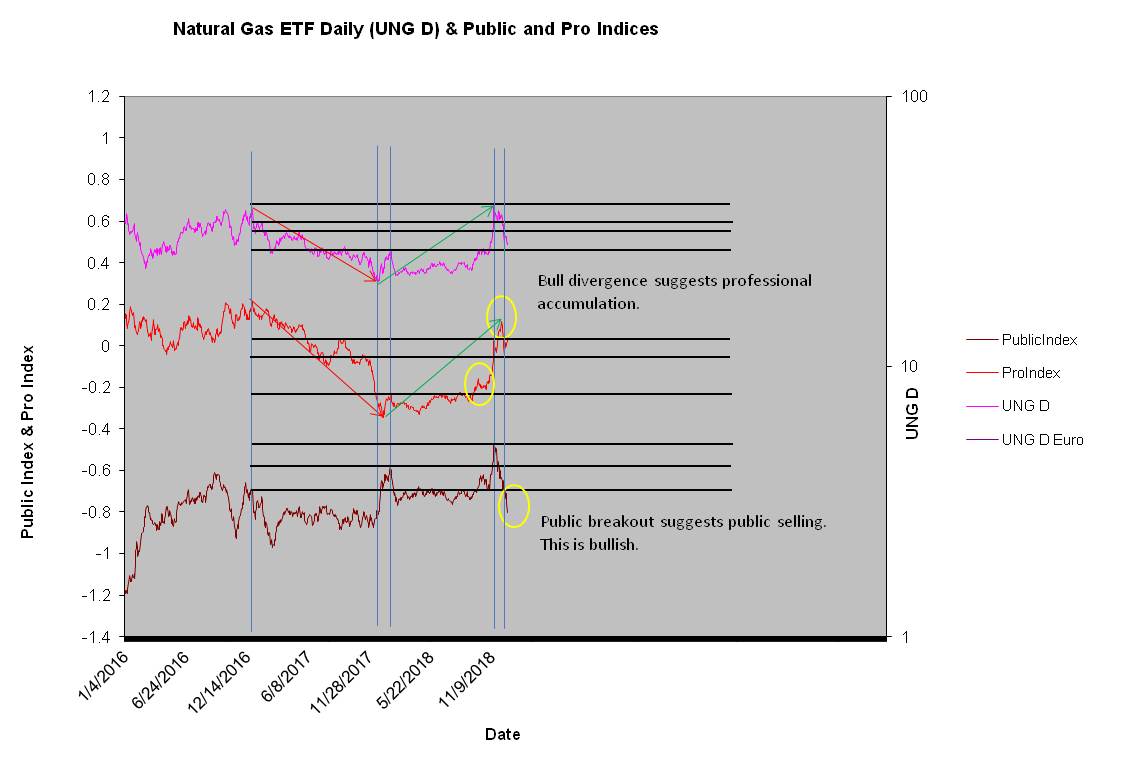

The complete smash down of natural gas, an operation directed towards the 3% of the net long position held by retail investors, gained strength during the light volume of the holiday sessions. I've seen these types of operations in gold and silver. They're not conspiracies, but rather trading moves set up by uneven distributions in the futures and options markets. Trading operation materializes with the light of markets for those that know how to look. United States Natural Gas (NYSE:UNG)'s pro and public indices tell us who's buying and selling. Pro are buying, the public is selling. In fact, the selling from the public has been a ski slope decline from the high.

It's highly probable that the public will come out of this decline bearish and screaming sell. The computer still defines NG's trend as CONSOL, UP, and UP. Expectations, however, go easily go from one of the coldest falls in decades and a potential shortage of NG to global warming that will help Disney World move to Chicago in a few years. That's how sentiment works.