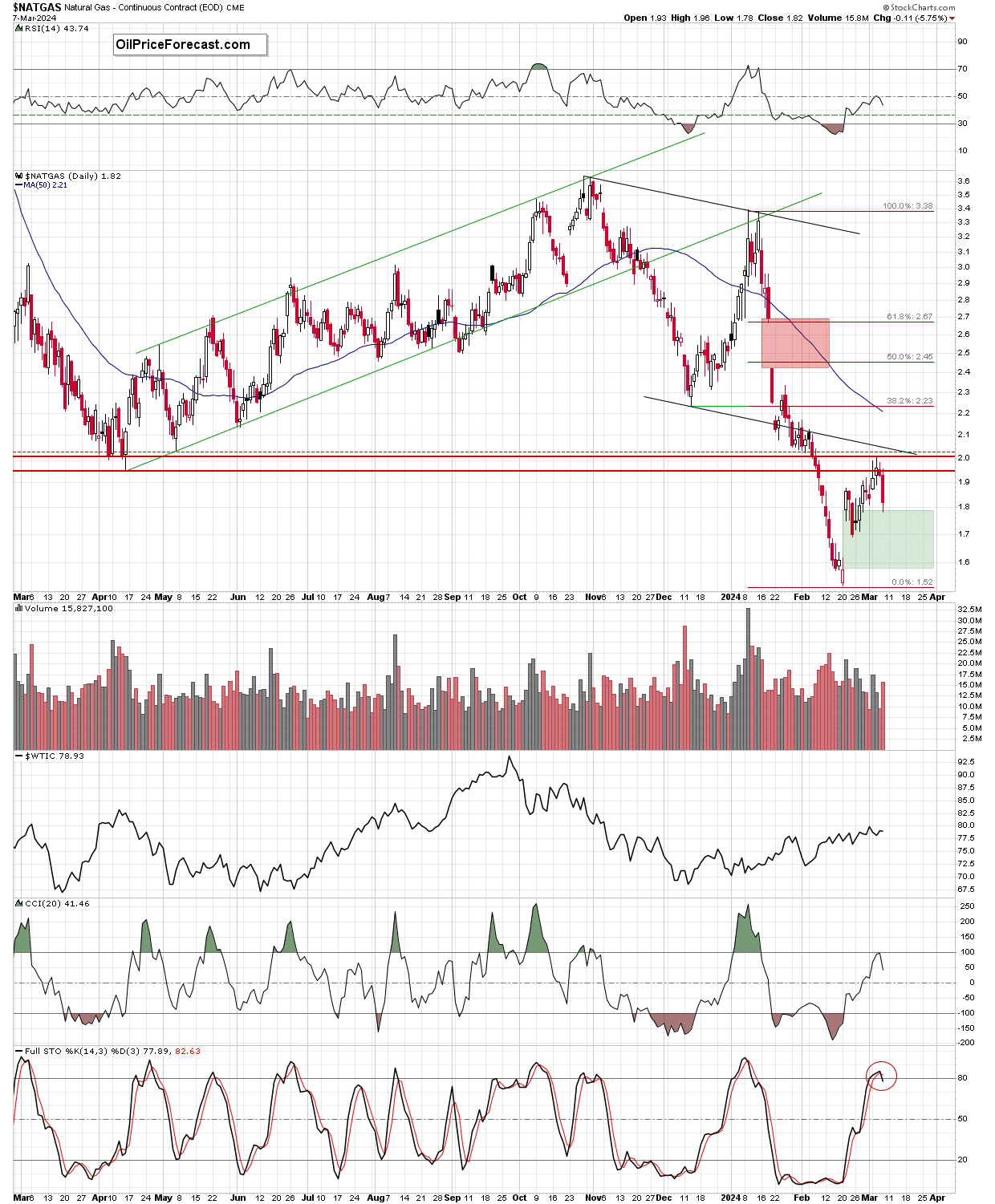

The combination of resistances vs. the gap. What can we expect in the coming week?

In the previous week, crude oil moved higher once again and tested the barrier of $80 and the upper border of the very short-term channel. And what happened at the same time in natural gas?

Were the Bulls also successful? Or have their opponents taken control of the trading floor again? I shared the answers to the questions in Friday’s Oil Trading Alert. Today you will find them in the article below. Have a nice read.

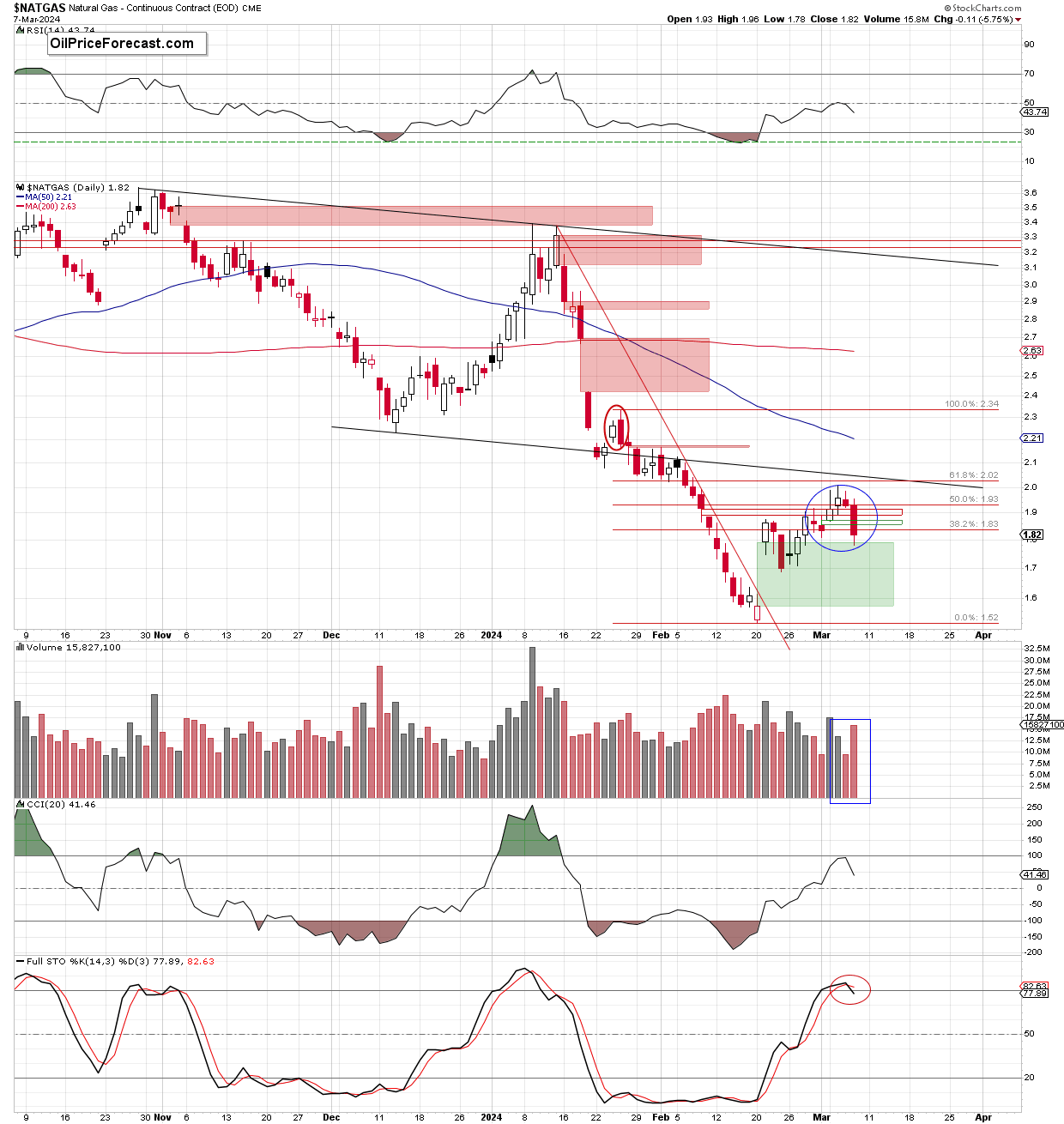

Let's zoom in on the above chart to see more technical details.

From this perspective, we see that the previously broken Apr. 2023 lows (in terms of intraday lows, daily openings, and closures marked with red horizontal lines on the first bigger chart) and the proximity to the previously broken lower border of the black short-term channel and the 61.8% Fibonacci retracement (seen on the second enlarged chart) successfully stopped the bulls and their march north earlier this week.

From today’s point of view, we see that the combination of these resistances lured the bears to the trading floor and encouraged them to show their claws. As a result, the price of natural gas reversed and declined, closing Wednesday’s session under the lower border of the purple rising wedge.

What Were the Consequences of this Negative Event?

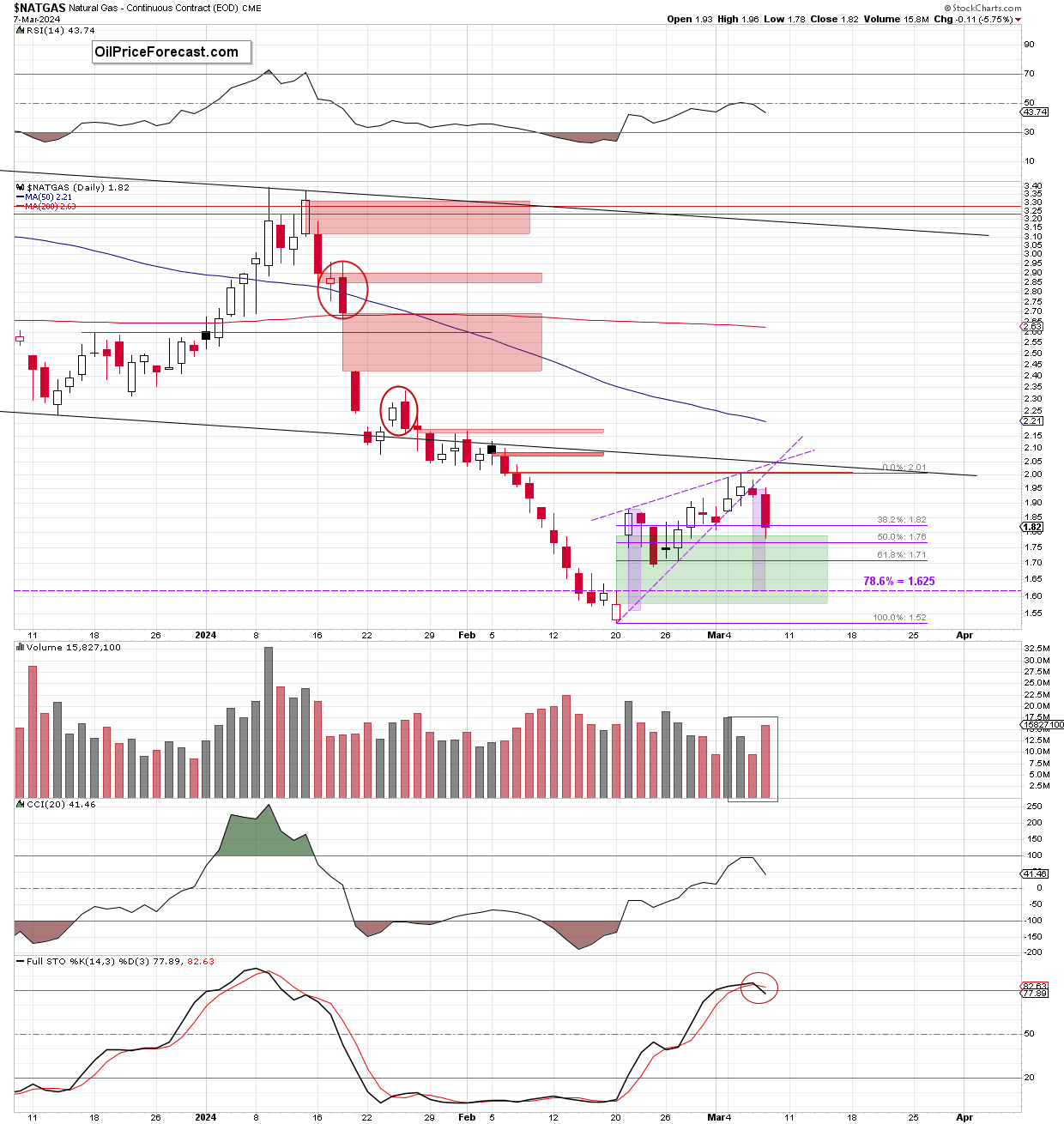

Let’s take a look at the chart below to find out.

Thanks to the mentioned price action, natural gas extended losses during yesterday’s session, losing 5.75% and closing the green supportive gap formed on Mar.4.

Additionally, the sellers tested the upper border of the green gap (1.576-1.792) formed on Feb.21, which caused a tiny rebound before the end of the day. Even though it may look promising, we must remember that the breakdown under the lower border of the purple rising wedge opened the way to around 1,625, where the size of the downward move would correspond to the height of the formation.

As you see on the above chart, in this area is also the 78.6% Fibonacci retracement, which could help the bulls to pause further deterioration in the coming week.

Will We See Further Deterioration in the Near Future?

Looking at the current position of the daily indicators (the CCI turned south after a climb to the overbought area and the Stochastic Oscillator generated a sell signal) and visibly higher volume, which accompanied yesterday’s decline, it seems that this is very likely scenario at the moment of writing these words.

Summing up, although natural gas erased some of earlier losses, the combination of resistances stopped the bulls, triggering a reversal and decline under the lower border of the purple rising wedge. Such price action in combination with yesterday’s increase in volume and the position of the daily indicators suggests that further deterioration in the coming week should not surprise us.

Meanwhile, based on Friday’s move in crude oil profits on my current trading positions have just increased. And it looks like they can increase further in the following days.