The first report on the impact to natural gas storage from the Freeport LNG blast of three weeks ago has told us what we already suspected: That it won’t be pretty—just like the June market loss for natty.

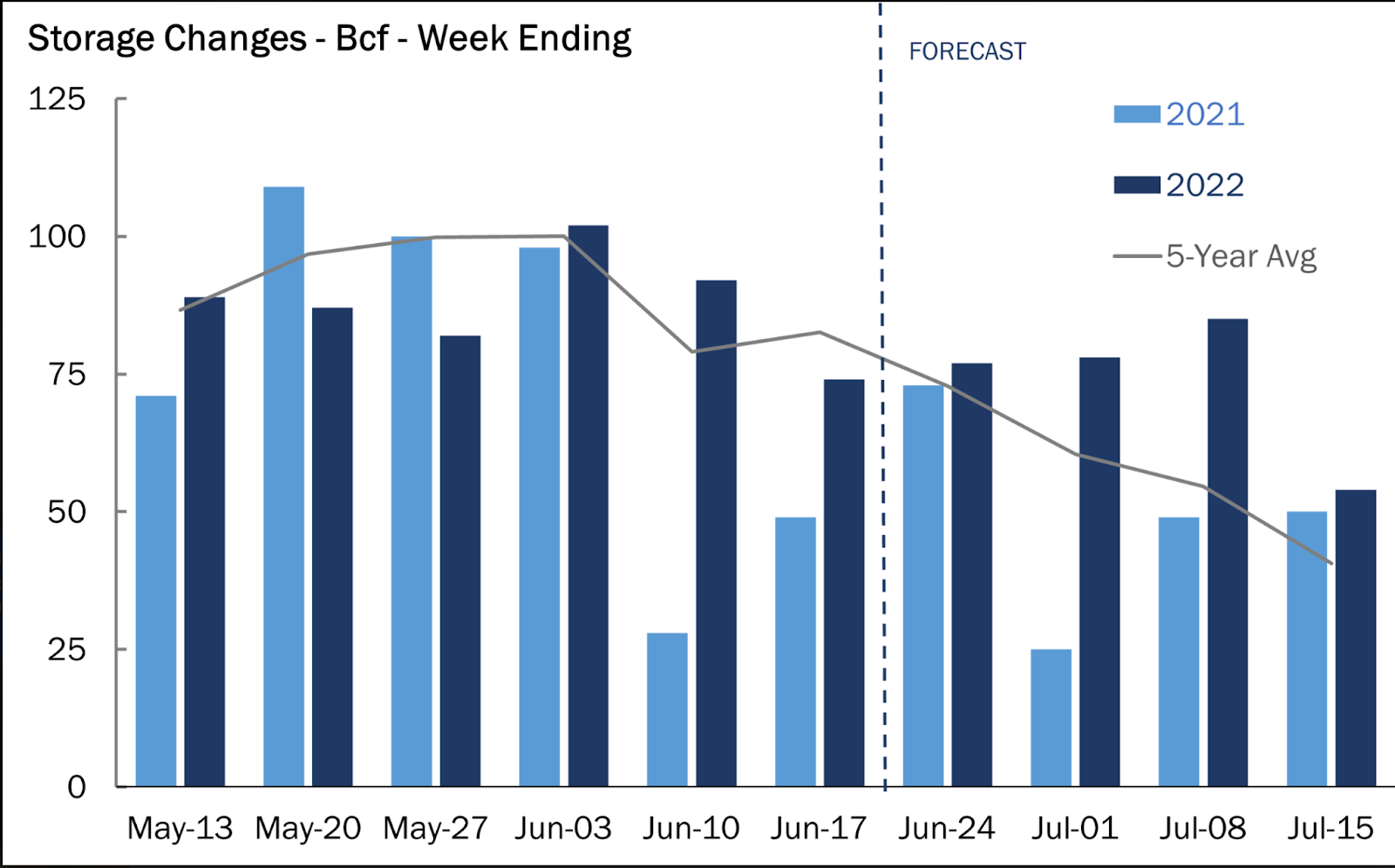

The Energy Information Administration said gas storage for the week ended June 17 rose by 74 billion cubic feet (bcf) versus market expectations for a build in the 60s.

As the trade awaits the storage update for the June 24 week—due today from the EIA at 10:30 AM ET—price screens show the front-month gas contract on New York’s Henry Hub down by around 20% for June. It’s the first monthly loss in four for longs in natural gas and the biggest since January.

The loss on the Henry Hub is unlikely to cost bulls in the game much sleep, given the near-term forecasts for gas demand.

Neither is there expected to be too much worry over gas storage—or, more importantly, its deficit—as a sizable portion that goes unliquefied due to the outage at Freeport is likely to be burnt for cooling from a spike in heat this summer. In other words, the storage burden from Freeport might be more manageable than thought.

Forecaster NatGasWeather said weather models for the first half of July maintained a hot pattern over most of the southern two-thirds of the United States, with peaks forecast in the 90F to lower 100F.

“It’s still a bullish pattern July 10-13, just not quite as hot as July 1-9,” NatGasWeather said in comments carried by industry portal naturalgasintel.com.

“Overall, the coming 15 days are plenty hot enough to be considered bullish since it will prevent deficits from improving.”

But some think the summer heat might not make so much of a dent on storage.

“In the long-term, the storage deficit to the five-year average is expected to decrease as the impacts of Freeport (and higher production down the line) will alleviate tightness in the market,” analysts at Houston-based gas markets consultancy Gelber & Associates said on an email to their clients on Wednesday, that was also seen by Investing.com.

Adds the Gelber email:

“Within the next four weeks, the storage deficit (which is sitting above 300+ bcf) is anticipated to sink to under 280 bcf based on current weather patterns.”

The widely anticipated deficit of 300 bcf or more in the five-year average of gas storage is one of the reasons for the commodity being priced at almost 75% more now than a year ago. Europe’s ban of Russian gas in the aftermath of Moscow’s invasion of Ukraine has also led to unprecedented demand for liquefied natural gas from Europe.

Guessing how gas demand for cooling in the summer would fare and how much of that would be offset by what Freeport will not be liquefying has been a challenge to the market.

Freeport used to account for around 20% of all US LNG processing, liquefying up to 2.1 billion cubic feet of natural gas per day.

Initially, after the June 9 shutdown of the plant on the Texas Gulf Coast, it was estimated that the outage would take just about a million tonnes of LNG exports off the market. But later, it was estimated that the disruption could last as long as three months, impacting at least 180 bcf of gas in total.

Analysts say that would be equivalent to around 55% of the current storage deficit, with the final number decided by how hot a summer the United States and Europe would have and how much domestic cooling and European LNG demand that would result in.

Prior to the Freeport incident, gas was coasting at around 14-year highs of above $9 per million metric British thermal units (mmBtu). At the time of writing, it hovered at just under $6.50 per mmBtu, after nearly breaking below $6 on Friday. Almost all of June’s 20% plunge on the Henry Hub is due to the so-called Freeport effect.

Source: Gelber & Associates

In the guessing game for today’s storage report that would cover the week ended June 24, forecasters tracked by Investing.com estimate that another 74 bcf was injected last week, similar to that in the previous week.

If that’s accurate, it would be just a notch above the 73 bcf build seen during the same week a year ago and the five-year (2017-2021) average for storage injections, which also stand at 73 bcf.

Such an injection would also lift gas stockpiles to 2.243 trillion cubic feet (tcf), about 12.8% below the five-year average and 11.9% below the same week a year ago.

Reuters-associated data provider Refinitiv said there were around 81 cooling degree days last week, versus the 30-year normal of 71 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.