The traders who horribly misread weather extremities since spring and this year’s underwhelming natural gas production have paid dearly for their indiscretion over the past five months.

Like a broken record, they keep hearing that the rally will snap soon, that gas prices will retreat from the high $4 levels to the lower $3s.

But with less than four weeks to the fall season, summer cooling demand isn’t evaporating in the United States. And gas futures keep being bought on the dip like tech and growth stocks on Wall Street.

With the EIA, or Energy Information Administration, likely to report today another subpar injection of gas into storage for last week, chances are that market bears may have to wait a few more weeks for any trend reversal.

Dan Myers, analyst at Houston-based gas markets consultancy Gelber & Associates, broke it down for the firm’s clients in an email circulated on Wednesday and shared with Investing.com:

“A decrease in wind generation … led to a higher reliance on natural gas on the week of storage, which should result in a smaller injection than the previous week despite milder temperatures overall.”

“The coming weeks are expected to follow a somewhat similar pattern in the near term, with storage injections continuing to lag 5-year average increases into at least the first full week of September.”

According to a consensus of analysts tracked by Investing.com, some 40 billion cubic feet on average were added to inventories last week, from what was left over from new production not burned for power generation and cooling.

That would be below the 46 bcf injected into storage during the previous week to Aug. 13. It would also be lower than the five-year average (2016-2020) injection of 44 bcf.

If accurate, the injection during the week ended Aug. 20 would take stockpiles to 2.862 tcf, or trillion cubic feet—about 5.9% below the five-year average and 16.2% below the same week a year ago.

Below average gas production and inventory additions for most of this year have resulted in a phenomenal run-up in prices of the fuel.

At Wednesday’s session on the New York Mercantile Exchange, front-month gas on the Henry Hub settled little changed at $3.925 per mmBtu, or million metric British thermal units.

If gas maintains its present trajectory, it could end the week about 1.5% higher, the fourth week in five that it would be settling in positive territory. On a monthly basis, Henry Hub futures have risen without stop since the end of March, gaining just over 51% in that span.

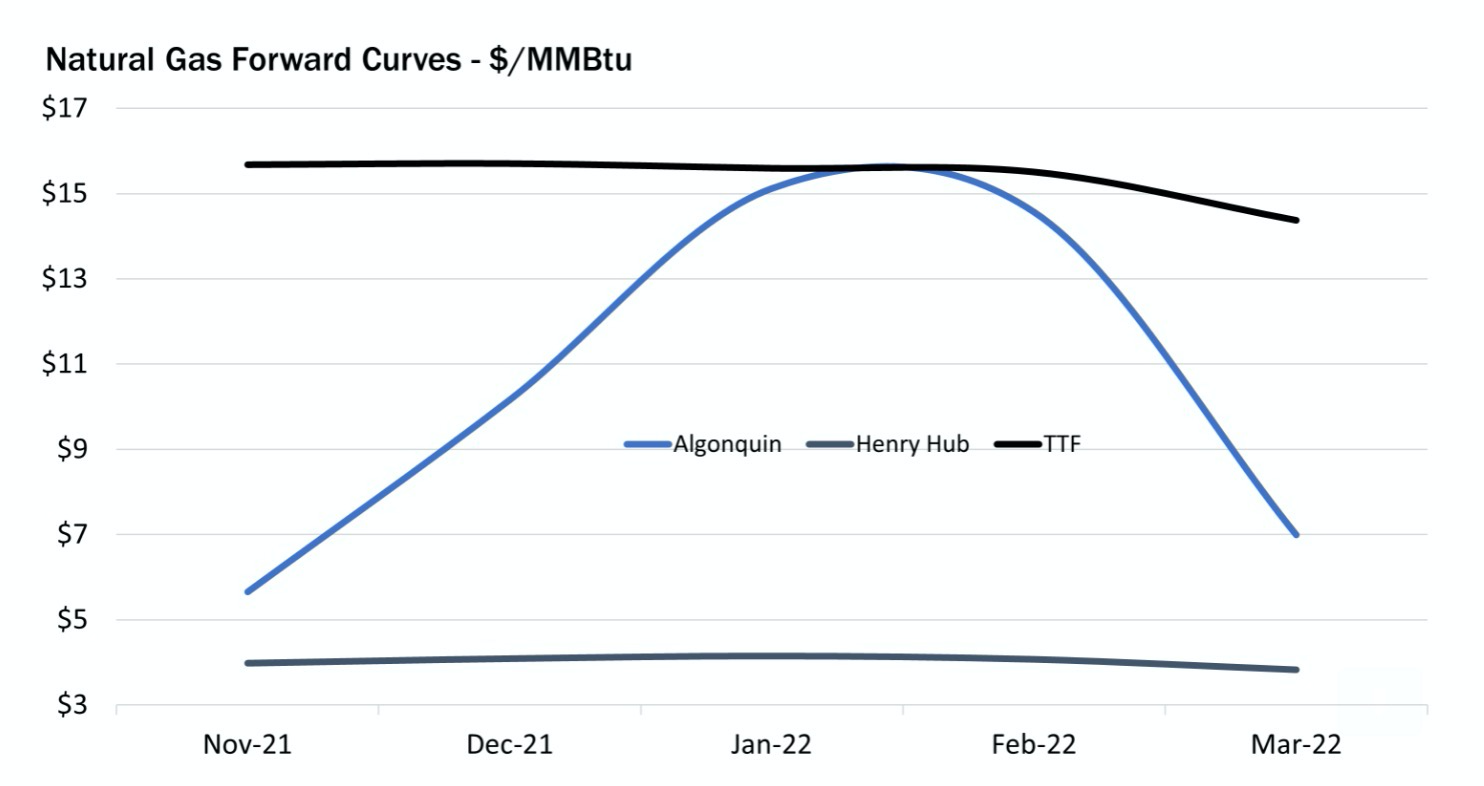

Source: Gelber & Associates

This week’s run-up in gas came after temperature readings for last week turned out to be slightly warmer than normal for this time of year, with 88 CDDs, or cooling degree days, compared with a 30-year average of 83 CDDs.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit (18 degrees Celsius).

Early analysts' estimates for storage injection in the current week to Aug. 27 ranged from 23 bcf to 44 bcf, with a mean increase of 31 bcf.

That compares with an injection of 36 bcf during the same week last year and a five-year average build of 53 bcf.

The National Hurricane Center, meanwhile, said on Wednesday that a low-pressure system in the Caribbean would likely evolve into a tropical depression or tropical storm by this weekend and may become a hurricane next week.

The NHC said it presented potential concern from Mexico to the Gulf Coast.

The storm could bring chilly winds and dampen cooling demand, offsetting production interruptions, weather forecaster Bespoke said in an analysis by the naturalgasintel.com portal.

Bespoke also noted that forecasts for next week showed a shift toward cooler temperatures in early September, the portal said.

“We do still see a decline back toward normal, or even below the five-year normal, as we move beyond the opening of September,” the forecaster said.

It, however, added that “a temporary cool down” was likely and that overall September weather was expected to prove relatively warm.

Adding to the uncertainty, Wood Mackenzie said Wednesday its latest daily pipe production estimate showed a daily decline of 1.8 bcf. It estimated dry gas production in the Lower 48 US states at 91.2 bcf per day, well below output highs around 93 Bcf/d reached earlier this summer.

The declines were focused in Texas, New Mexico and Wyoming, and they coincided with pipeline notices indicating capacity restrictions, Wood Mackenzie analyst Laura Munder said. She noted a series of locations on the El Paso Natural Gas (EPNG) system showing signs of impact following a force majeure on the pipeline’s Line 2000 earlier this month.

In the meantime, summer temperatures were soaring Wednesday and were expected to remain elevated across much of the Lower 48 through the end of the trading week. Such conditions have prevailed most of the summer.

With temperatures lofty and cooling demand strong, the EIA has throughout the summer reported relatively modest storage injections. Ahead of Thursday’s report—covering the week ended Aug. 20—estimates were running below historical averages again, naturalgasintel.com noted.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.