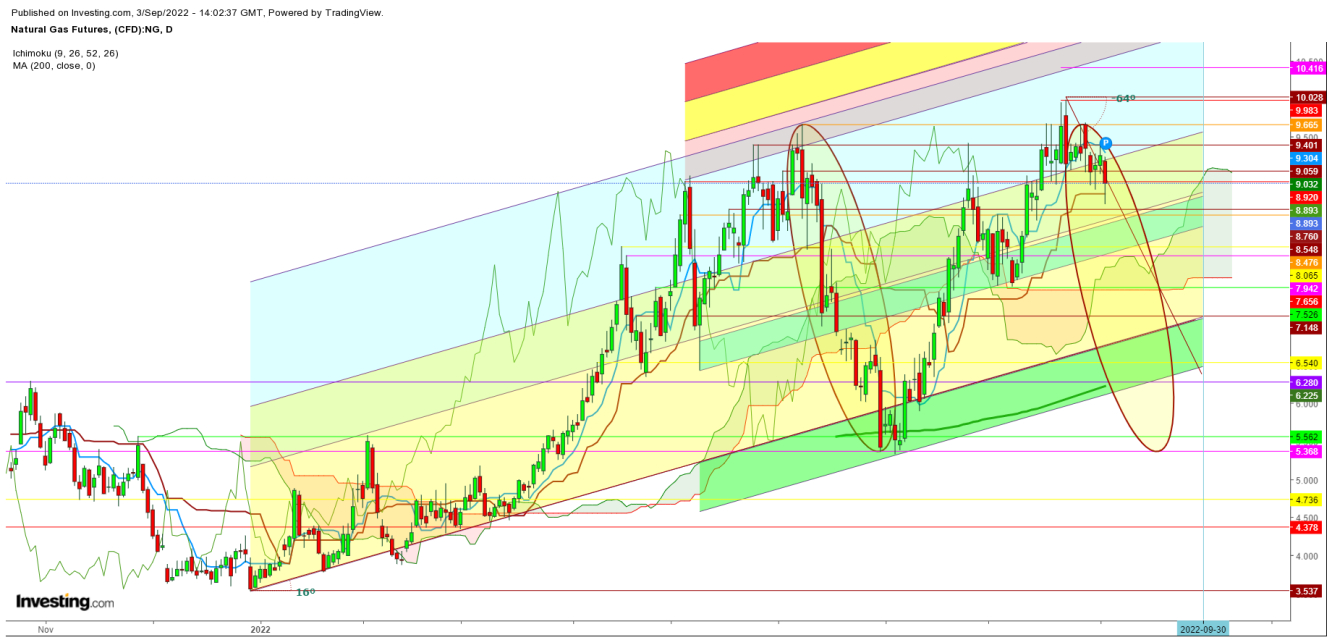

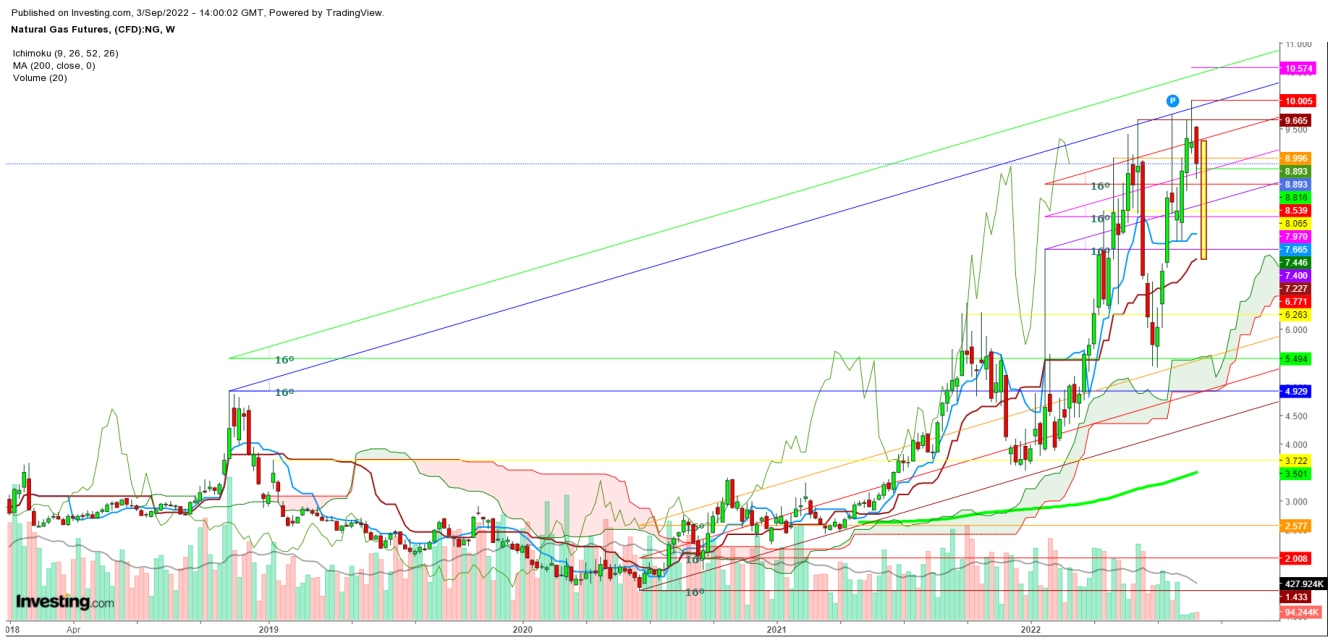

Despite a minor weekly opening gap-up, natural gas capped the upside at $9.547.

Despite several attempts by the natural gas bulls to find a breakout above this capped limit, all breakouts proved false as the bears were more aggressive during the last week.

The natural gas bulls tried to add one more leg on Thursday and Friday. Still, the exhaustion continued to hover on Friday, resulting in a steep fall amid extended volatility.

On Friday, Russia announced to shut Nord Stream 1 pipeline for an undisclosed period as it found leaks during maintenance. This pipeline supplies natural gas to Germany and other countries, hoping to build gas stocks before winter.

Friday’s announcement by Russia could have resulted in a gap-up opening on the first trading session of the week. However, the upside still looks capped as Europe has been trying to shift from coal to meet climate targets, but some plants have been switched back on since mid-2021 because of surging gas prices.

Energy ministers agreed that all EU countries should voluntarily cut gas use by 15% from August to March, compared with their average annual use from 2017 to 2021. They introduced EU-wide targets for refilling gas storage.

Several nations can seek to fill any gap in energy supplies by turning to electricity imports via interconnectors from their neighbors or by boosting power generation from nuclear, renewables, hydropower, or coal.

Nuclear availability is falling in Belgium, Britain, France, and Germany, with plants facing outages as they age, are decommissioned, or phased out. Water levels have been falling this summer due to low rainfall and a heatwave.

On the other hand, strong upper high pressure will bring record-breaking heat to the West with hot to scorching highs of the 90s to the 110s.

Texas, the South, and East US will be warm to hot with highs of the 80s to low 90s, while comfortable over much of the Great Lakes, Ohio Valley, and Northeast with highs of 70s to 80s as weather systems track through with showers.

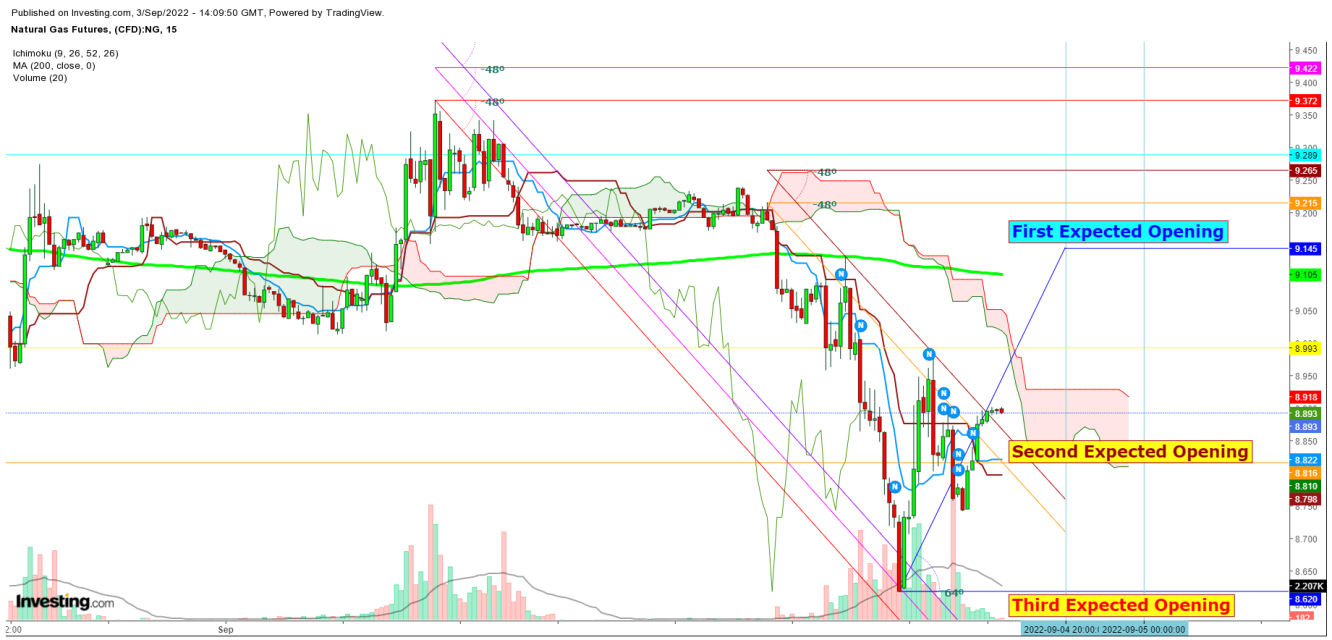

Wild price swings could continue as the trapped bulls could try to bump in the range of $8.5 to $9.5, but the overall trend still favors the natural gas bears as the bulls are ignoring the fundamental realities with support from some deep pocket Hedge Funds.

On the lower side, I find that the natural gas bears could turn more aggressive to drag down natural gas to test new seasonal lows during the upcoming weeks once they find a breakdown below $7.777. The natural gas bears are ready to hit $5.535 this month.

Disclaimer: The author of this analysis does not have any position in natural gas. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.