Despite a strong closing last Friday, Natural Gas Futures could start the first trading session of the upcoming week with a gap.

This gap could be a gap-up or a gap-down; still have no idea, but an opening on the first trading session heightens the level of excitement level of the traders. Natural Gas Futures that were maintaining an uptrend since Apr. 22 found a pace on Apr. 30 due to changing demand-supply equation.

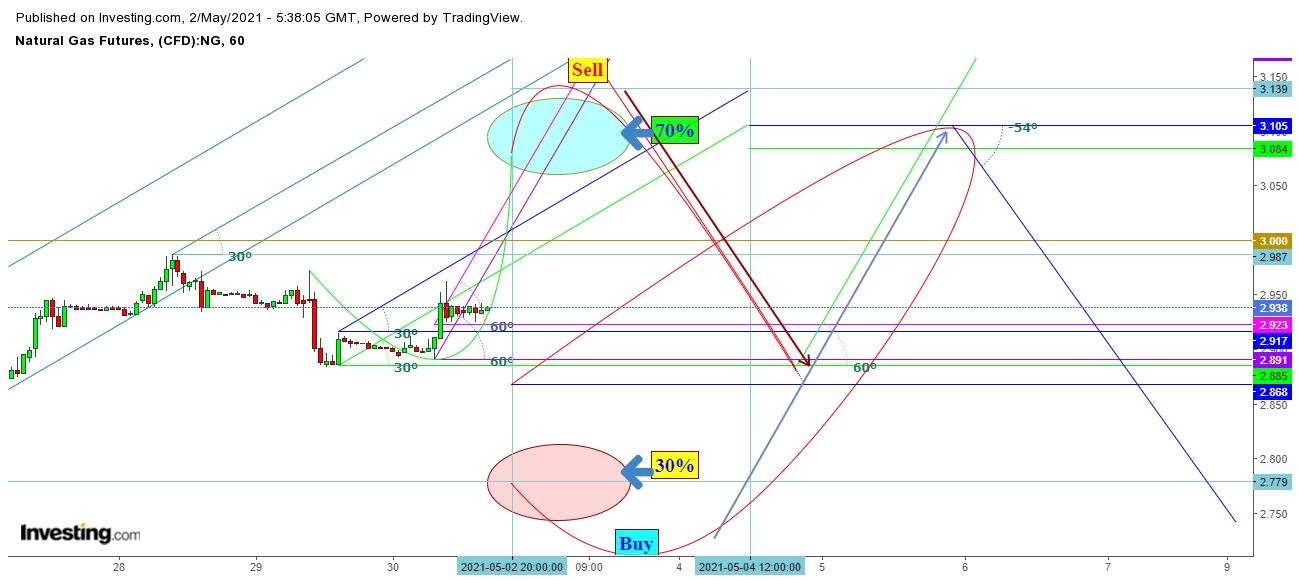

I find that the strength shown by Natural Gas Futures just before the weekly closing looked quite decisive this time. I believe the probabilities of a gap-up could be around 70%, while the gap-down possibilities could be nearly 30%. This could extend volatility to a greater extent.

On the upper side, Natural Gas Futures could test the highs above $3.2. While on the lower side, Natural Gas Futures could go down to $2.888.

Finally, both the bears and the bulls could try to show their full strength during the upcoming week.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities in the world.